The president’s action, according to ESG critics, will help undermine asset managers’ fiduciary duty

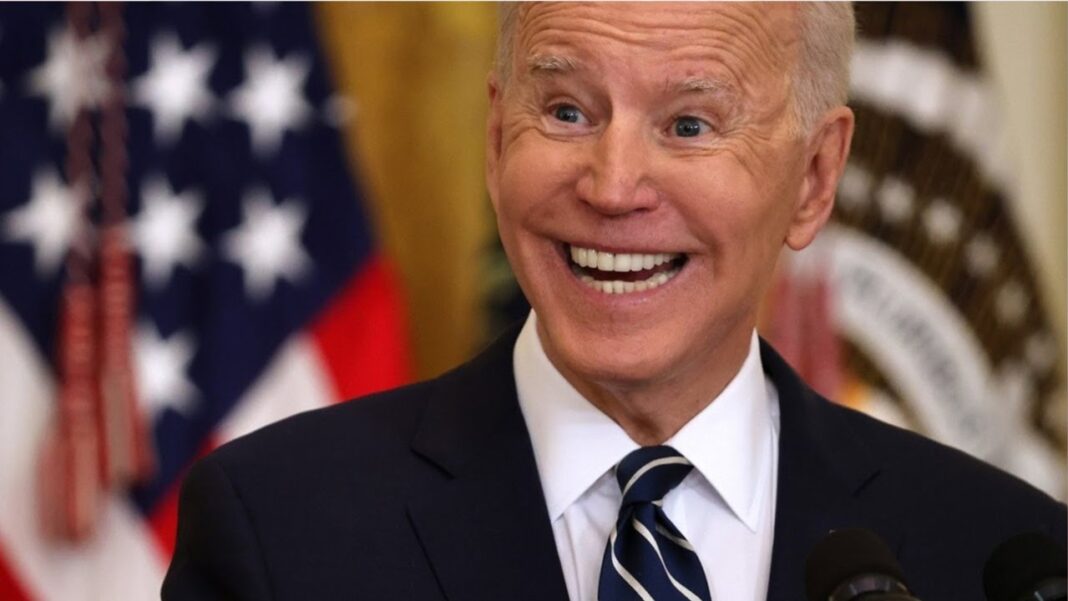

President Joe Biden issued his first veto on March 20, rejecting a bipartisan measure that would have blocked a Labor Department rule that allows pension fund managers to consider social factors and climate change in investment decisions—a rule that Republicans say is a “woke” policy that will harm retirees’ pocketbooks.

The president posted a video to Twitter defending his veto, saying it “made sense” because Congress’s resolution would “put at risk the retirement savings of individuals across the country.”

“There is extensive evidence showing that environmental, social, and governance factors can have a material impact on markets, industries, and businesses,” he said in a White House statement.

“But the Republican-led resolution would force retirement managers to ignore these relevant risk factors, disregarding the principles of free markets and jeopardizing the life savings of working families and retirees.”

The resolution was approved by the House on a 216–204 vote, while the Senate voted 50 to 46 to overturn the rule, with Sens. Joe Manchin (D-W.Va.) and Jon Tester (D-Mont.) crossing party lines to vote with Republicans. A two-thirds majority is needed in each chamber to override a veto.

The measure targeted Biden’s “Final Rule on Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights,” which became effective at the end of January.

That rule involved the Employee Retirement Income Security Act of 1974 (ERISA), a key pension reform measure.

ERISA and Why It Matters

According to critics, the president’s move is likely to have an impact on many Americans’ financial security in their retirement years.

ERISA was enacted to ensure that, among other things, those who manage company pension funds are held to the highest legal standard of fiduciary care, and that they act solely to maximize the financial returns for pensioners.

That law was enacted because companies weren’t honoring their pension obligations to employees and because pension managers were misappropriating retirement funds, in extreme cases using them as their own personal banks.

One of the goals of ERISA was to prevent asset tunneling, which occurs when those in control of corporate assets use them for their own purposes or personal benefit. ERISA set strict standards of fiduciary care.

By Savannah Hulsey Pointer, Nathan Worcester and Kevin Stocklin