The president’s budget for fiscal year 2025 increases taxes on corporations and the rich to reduce the deficit by $3 trillion over 10 years.

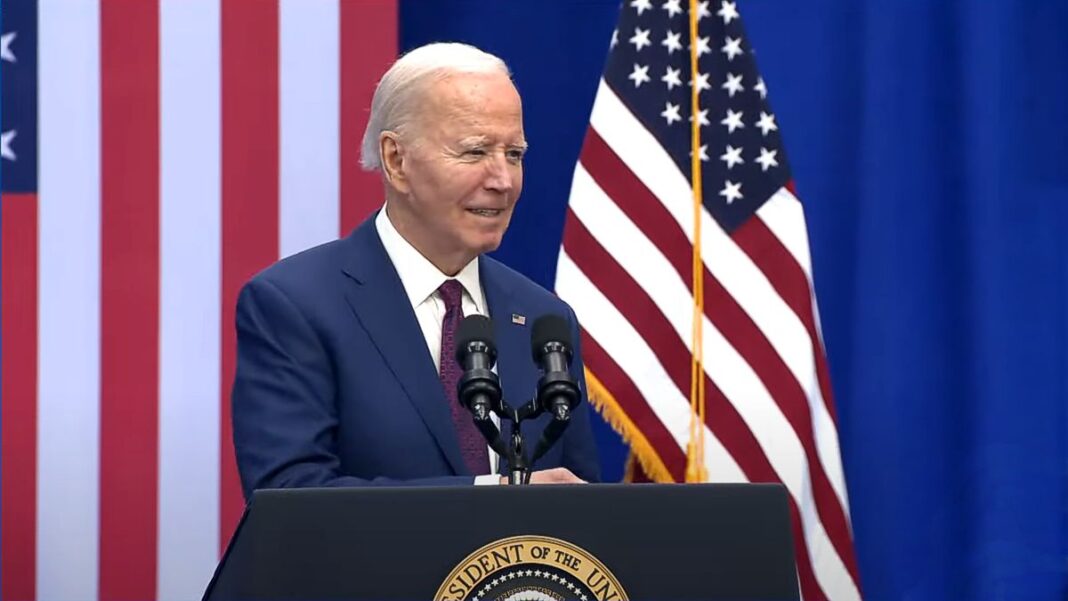

WASHINGTON—President Joe Biden on March 11 released his $7.3 trillion budget for fiscal year 2025 that calls for significant tax increases for the wealthy and corporations.

The request features cost-cutting measures for families, building affordable housing, and investing in American manufacturing in line with previous years. It also includes funding for the administration’s equity initiatives across the U.S. government.

President Biden’s budget proposal would reduce the federal deficit by nearly $3 trillion over the next decade, in line with the deficit reduction proposed by the president last year.

The $7.3 trillion budget for the fiscal year 2025 is a 4.7 percent increase over the current year’s budget. It proposes to increase defense spending by 1.8 percent and non-defense discretionary spending by 2.8 percent.

President Biden’s plan was sent to Congress, which has “power of the purse.” However, it is widely seen as a political messaging document and is unlikely to become law.

Here are a few highlights from the budget proposal for the fiscal year that starts in October:

Progressive Tax Hikes

The president emphasizes higher taxes on the ultra-rich and corporations to help pay for his spending proposals, as in 2024. He calls for a 25 percent minimum tax on households earning more than $100 million. In addition, the plan seeks to partly repeal former President Donald Trump’s tax cuts, raising the top individual tax rate to 39.6 percent from 37 percent and the corporate tax rate to 28 percent from 21 percent.

He also proposes increasing the corporate minimum tax rate to 21 percent from 15 percent. The minimum tax enacted as part of the Inflation Reduction Act in 2023 currently requires corporations with more than $1 billion in revenue to pay federal tax of at least 15 percent of their profits.

The budget also proposes “reforming the international tax system” by raising the tax rate on U.S. multinational firms’ foreign earnings to 21 percent from 10.5 percent. The president states that he wants to “reduce the incentives to book profits in low-tax jurisdictions, stopping corporate inversions to tax havens.”