Collections to Restart May 5th, Struggling Borrowers Urged to Act Now

The U.S. Department of Education today announced its Office of Federal Student Aid (FSA) will resume collections of its defaulted federal student loan portfolio on Monday, May 5th. The Department has not collected on defaulted loans since March 2020. Resuming collections protects taxpayers from shouldering the cost of federal student loans that borrowers willingly undertook to finance their postsecondary education. This initiative will be paired with a comprehensive communications and outreach campaign to ensure borrowers understand how to return to repayment or get out of default.

While Congress mandated that student and parent borrowers begin to repay their student loans in October 2023, the Biden-Harris Administration refused to lift the collections pause and kept borrowers in a confusing limbo. The previous Administration failed to process applications for borrowers who applied for income-driven repayment and continued to push misguided “on-ramps” and illegal loan forgiveness schemes to win points with borrowers and mask rising delinquency and default rates.

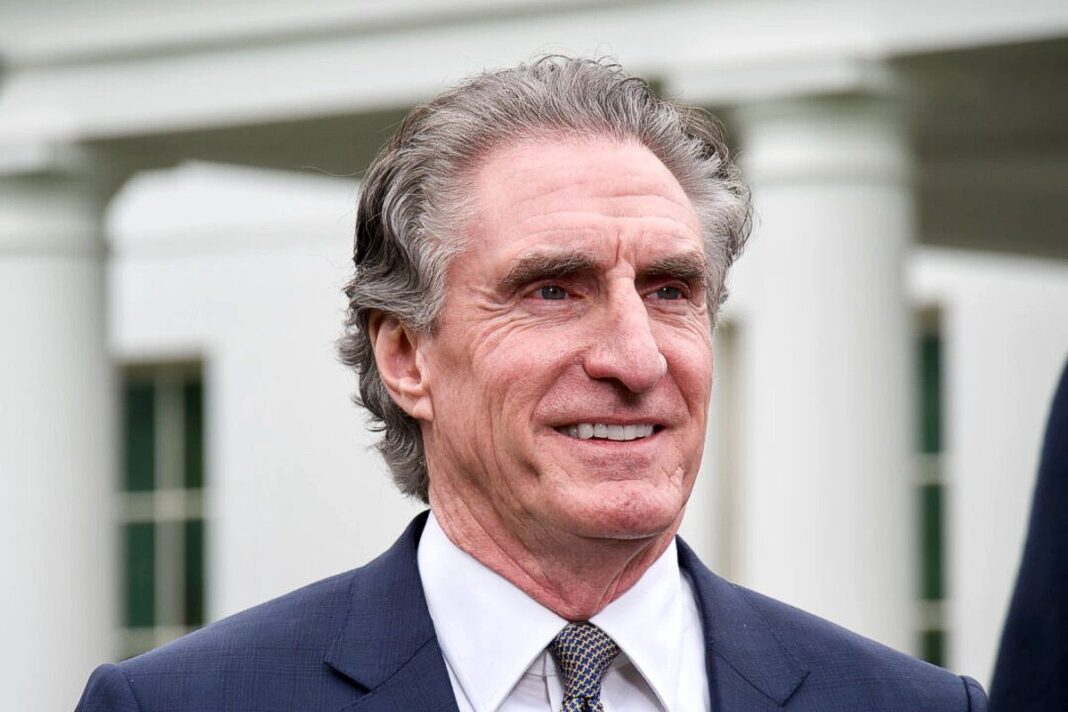

“American taxpayers will no longer be forced to serve as collateral for irresponsible student loan policies,” said U.S. Secretary of Education Linda McMahon. “The Biden Administration misled borrowers: the executive branch does not have the constitutional authority to wipe debt away, nor do the loan balances simply disappear. Hundreds of billions have already been transferred to taxpayers. Going forward, the Department of Education, in conjunction with the Department of Treasury, will shepherd the student loan program responsibly and according to the law, which means helping borrowers return to repayment—both for the sake of their own financial health and our nation’s economic outlook.”

Federal student loans are financed by the American people. Instead of protecting responsible taxpayers, the Biden-Harris Administration put them on the hook for irresponsible lending, pushing the federal student loan portfolio toward a fiscal cliff:

- Today, 42.7 million borrowers owe more than $1.6 trillion in student debt.

- More than 5 million borrowers have not made a monthly payment in over 360 days and sit in default—many for more than 7 years—and 4 million borrowers are in late-stage delinquency (91-180 days). As a result, there could be almost 10 million borrowers in default in a few months. When this happens, almost 25 percent of the federal student loan portfolio will be in default.

- Only 38 percent of borrowers are in repayment and current on their student loans. Most of the remaining borrowers are either delinquent on their payments, in an interest-free forbearance, or in an interest-free deferment. A small percentage of borrowers are in a 6-month grace period or in-school.

- Currently, almost 1.9 million borrowers have been unable to even begin repayment because of a processing pause put in place by the previous administration. Since August 2024, the Department has not processed applications for enrollment in any repayment plan such as Income-Based Repayment, Income-Contingent Repayment, or PAYE. The Department is currently working with its federal student loan servicers and anticipates processing to begin next month.

Involuntary Collections for Defaulted Borrowers

FSA will restart the Treasury Offset Program, administered by the U.S. Department of Treasury, on Monday, May 5, 2025. All borrowers in default will receive email communications from FSA over the next 2 weeks making them aware of these developments and urging them to contact the Default Resolution Group to make a monthly payment, enroll in an income-driven repayment plan, or sign up for loan rehabilitation. Later this summer, FSA will send required notices beginning administrative wage garnishment.

The Department will also authorize guaranty agencies that they may begin involuntary collections activities on loans under the Federal Family Education Loan Program. All FSA collection activities are required under the Higher Education Act and conducted only after student and parent borrowers have been provided sufficient notice and opportunity to repay their loans under the law.

Support for Current and Struggling Borrowers

FSA is committed to keeping borrowers updated with clear information about their payment options to put them on a productive path toward repaying their federal student loans. Over the next two months, FSA will conduct a robust communications campaign to engage all borrowers on the importance of repayment. FSA will conduct outreach to borrowers through emails and social media reminding them of their obligations and providing resources and support to assist them in selecting the best repayment plan, like the new Loan Simulator, AI Assistant (Aiden), and extended servicers call times. FSA will also launch an enhanced Income-Driven Repayment (IDR) process, simplifying the time that it will take borrowers to enroll in IDR plans and eliminating the need for borrowers to recertify their income every year. More information will be posted on StudentAid.gov next week.

FSA intends to enlist its partners – states, institutions of higher education, financial aid administrators, college access and success organizations, third-party servicers, and other stakeholders – to assist in this campaign to restore commonsense and fairness with the message: student and parent borrowers – not taxpayers – must repay their student loans. There will not be any mass loan forgiveness. Together, these actions will move the federal student loan portfolio back into repayment, which benefits borrowers and taxpayers alike.

Detailed information to help borrowers get out of default is also available at StudentAid.gov/end-default.