The tally was 16–21 as five Republicans joined all Democrats in voting against it.

Five Republicans joined Democrats on the House Budget Committee on May 16 to reject a sweeping policy bill to enact President Donald Trump’s agenda.

The vote tally was 16–21. Republicans could not afford to lose the votes of more than two of their own members on the committee. On the House floor, Republicans cannot afford to lose the votes of more than three of their own members.

The no vote by the panel marks a setback for House Republican leadership, who hope to pass the bill by Memorial Day. They are still negotiating with both fiscal hawks and blue-state Republicans who want changes to various provisions of the package.

The bill would make income tax cuts enacted in 2017 permanent and would implement measures to secure the border and unleash American energy. It would increase the cap on the State and Local Tax, or SALT, deduction from $10,000 per household to $30,000.

The SALT deduction allows taxpayers who itemize deductions, especially in high-tax states such as New York and California, to claim a deduction on their federal income tax return for certain state and local taxes.

The SALT cap has been a point of contention with members of New York’s congressional delegation, including Reps. Mike Lawler (R-N.Y.) and Nick LaLota (R-N.Y.), who are calling for the cap to be lifted.

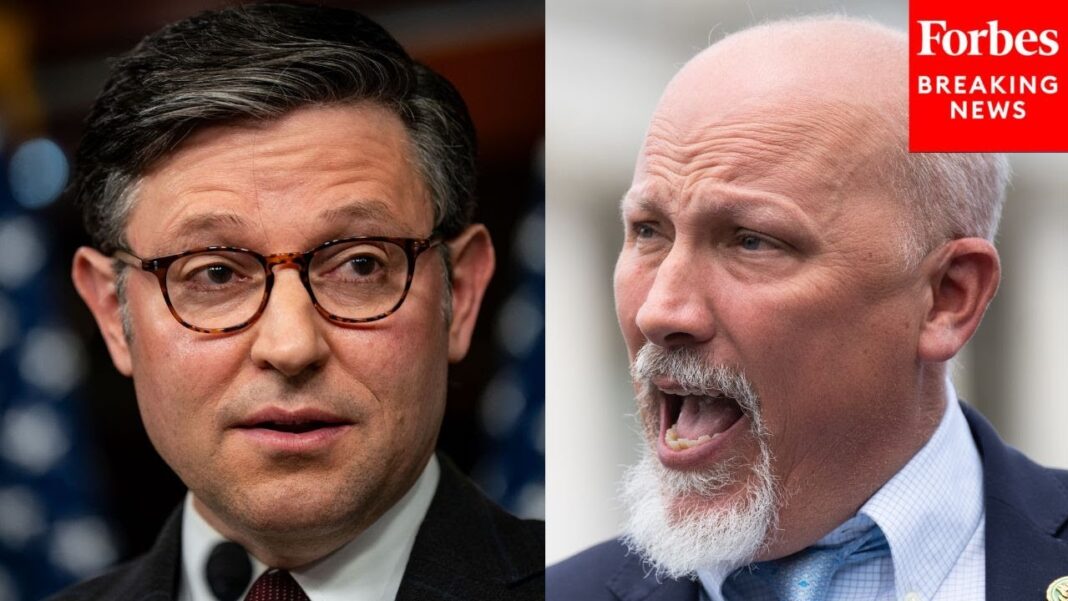

Five Republicans on the committee, Reps. Chip Roy (R-Texas), Ralph Norman (R-S.C.), Josh Brecheen (R-Okla.), Lloyd Smucker (R-Pa.), and Andrew Clyde (R-Ga.) joined all Democrats in voting against the bill.

Smucker, who has been outspoken in saying the bill cannot add to the deficit, changed his vote from yes to no.

“Sadly, I’m a hard no until we get this ironed out,” Norman said.

Norman later told reporters that it is problematic that the bill’s reforms and cuts to Medicaid would not take effect until 2029.

“This bill falls profoundly short. It does not do what we say it does with respect to deficits,” Roy said.

“I am a no on this bill unless serious reforms are made today, tomorrow, Sunday.”

By Jackson Richman and Nathan Worcester