The agency will propose cutting upfront and annual mortgage insurance premiums to 25 basis points across all multifamily program categories.

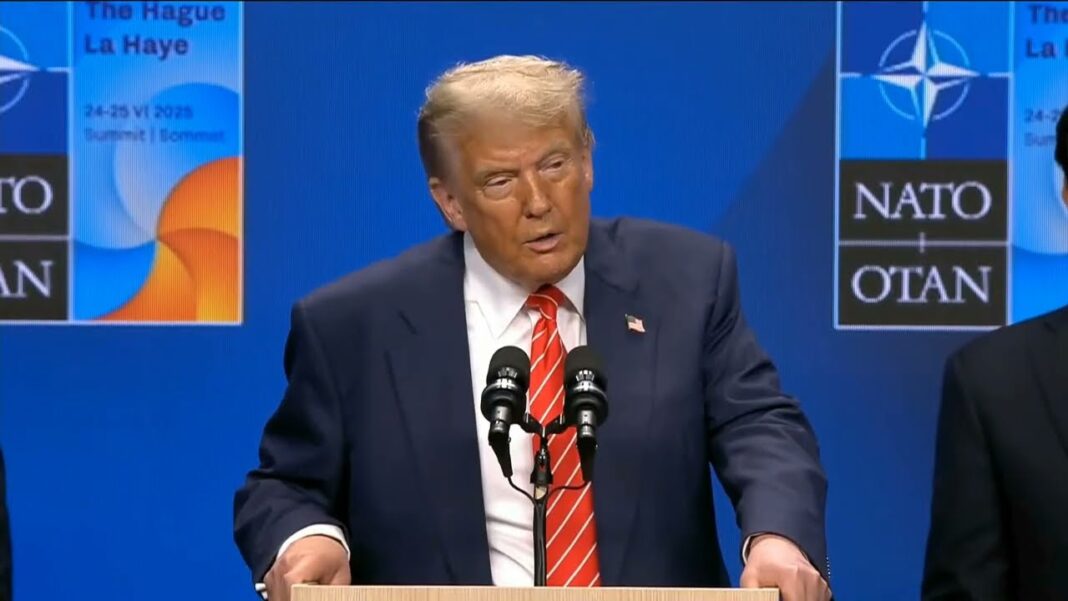

In line with President Donald Trump’s promise to eliminate Biden-era “green energy” programs across the federal government, Housing and Urban Development (HUD) Secretary Scott Turner on June 24 announced that his department will overhaul Biden-era mortgage programs that it considers “misguided and inefficient.”

According to Turner, the Federal Housing Administration (FHA) will propose a uniform reduction of its upfront capitalized and annual mortgage insurance premiums (MIPs) to 25 basis points across all HUD multifamily program categories. The upfront MIP, a critical requirement for FHA loans, is 1.75 percent of the loan amount and can be paid in cash at closing or rolled into the loan. The annual MIP ranges from 0.15 percent to 0.75 percent of the loan and is collected in monthly installments.

Turner stated that this initial step is the first move toward eliminating what he called the “ideologically motivated” green energy category, which will reduce costs for lenders and developers and help speed up the availability of affordable housing for Americans. After the June 24 announcement, HUD will seek public comments for 30 days.

“At HUD, we’re mission-minded and focused on helping to put affordable housing within reach for hardworking Americans,” said Turner.

“By leveling MIPs and cutting cost-inflating regulations, we’re unlocking competitive financing and driving down costs across the board to spur development.

“For too long, access to housing has been tied to obsolete, ideological mandates. Under President Trump’s leadership, Americans are no longer forced to subsidize misguided and inefficient green energy crusades at the expense of real housing solutions.”

In addition, Turner said HUD’s Multifamily Green and Energy Efficient Mortgage category is burdensome and costly for lenders and developers and has proven ineffective in encouraging widespread affordable housing development. In 2016, HUD introduced a reduced mortgage insurance initiative, called Green Housing MIP, to promote the adoption of more energy-efficient and sustainable standards for construction, rehabilitation, repairs, maintenance, and property operations.

Owners who had an outstanding loan with a reduced MIP under this program were obligated to various reporting requirements to ensure compliance.

By Wesley Brown