The White House has suggested that increases in economic growth from the tax cuts will offset any increases to the deficit from a reduction in tax revenue.

The latest version of the budget bill that the Senate is considering will add trillions to the national debt, the Congressional Budget Office (CBO) said in an analysis posted on June 29.

The CBO estimates that the Senate version of the Republican-led One Big Beautiful Bill Act will increase the deficit by almost $3.3 trillion from 2025 to 2034.

This is a nearly $1 trillion increase from the House-passed version of the bill, which the CBO had initially estimated would add $2.4 trillion to the national debt by 2034, before raising that projection to $2.8 trillion just two weeks later.

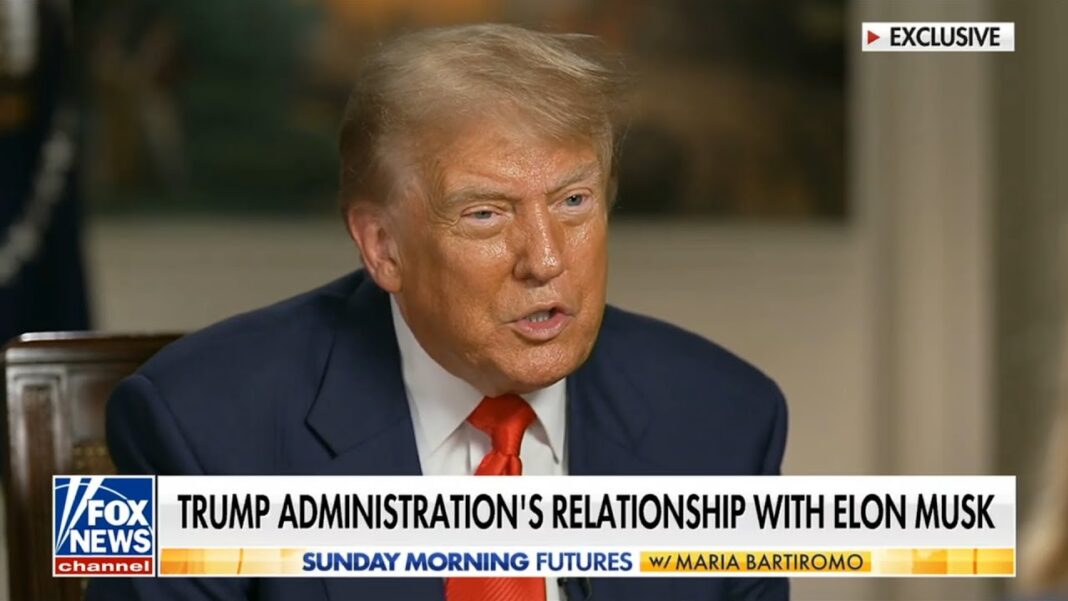

The increased estimate reflects some of the changes to the bill as Senate Republicans look to pass the legislation—a critical effort to advance President Donald Trump’s agenda—ahead of his July 4 deadline.

In addition to the increase in the impacts on the national debt, CBO’s latest analysis found that 11.8 million more Americans would lose their medical insurance by 2034 if the bill becomes law. This is an increase from the 10.9 million who were projected to lose their health coverage in the House-passed version of the bill.

White House spokeswoman Abigail Jackson criticized the CBO’s new report in an emailed statement to The Epoch Times.

“Democrats and the media love to tout the CBO’s historically incorrect scoring—look no further than their doomcasting of President Trump’s tax cuts during his first term, which helped usher in the first decline in wealth inequality in decades,” she said. “Last week’s [Council of Economic Advisors] report made clear that The One, Big, Beautiful Bill will reduce the federal deficit by more than $2 trillion over the next decade, thanks to tax-cut driven economic growth.”

Jackson did not comment on the projected impact on millions of Americans’ health insurance coverage.

When the CBO released its previous analysis on the House-passed version of the bill, White House spokesperson Kush Desai said that the CBO provides incomplete information.

“Reporting that takes CBO scoring about the One Big Beautiful Bill at face value should also take the CBO’s tariff revenue estimate of $2.8 trillion at face value, which together cancel out to no change to the deficit,” Desai told The Epoch Times.

However, the CBO is not the only group raising alarm about the potential negative fiscal impacts from Trump’s sweeping tax cut legislation.

By Jacob Burg