Key to countering China’s dominance is to make mining and refining profitable again in the United States.

The United States recognized decades ago that the Chinese Communist Party was subsidizing a vast expansion of Chinese mining and processing capacities to manipulate mineral and metal markets and dominate global manufacturing supply chains.

As early as 1980, with the adoption of the National Materials and Minerals Policy, Research, and Development Act, Congress declared an urgent priority “to strengthen materials research, development, production capability, and performance of the United States.”

Yet, in the past half-century, domestic manufacturers—including in the nation’s defense industry—have only become more reliant on imported minerals and processed metals, beholden to CCP market manipulation, as documented by the U.S. Geological Survey in January.

This vulnerability is longstanding. It was made glaringly apparent during 2010’s “rare earths crisis” when China restricted global exports of rare earths; in 2023, when it restricted gallium, germanium, and graphite to the United States; and in April, when it expanded restrictions to include gadolinium, dysprosium, lutetium, samarium, scandium, terbium, and yttrium.

The United States is 100 percent import-reliant for all these rare earths, among 30 key minerals for which China controls at least 75 percent of global processing capacity, according to New York-based Exiger, which has developed a proprietary AI platform that uses “predictive signal intelligence” to identify supply chain risks.

When the CCP added seven rare earths to its export restrictions in April, this long-unresolved urgency became an existential threat, according to Derek Lemke, senior vice president at Exiger.

“The reality is, this is no longer a hypothetical risk. It’s a real, quantifiable supply chain chokepoint right now,” he told The Epoch Times. “We’re seeing the weaponization of the periodic table.”

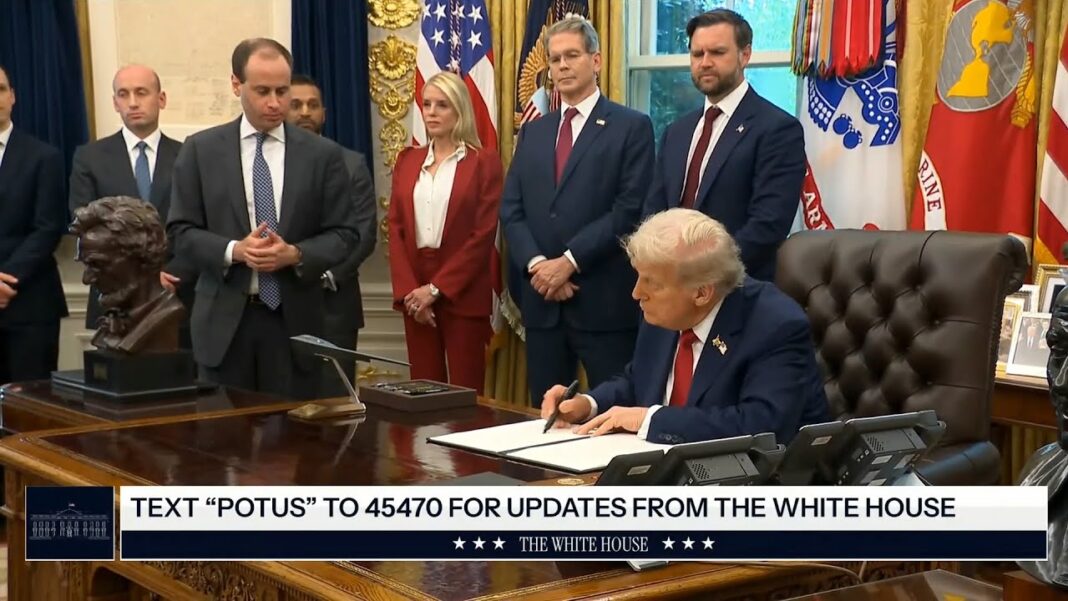

In his second administration, President Donald Trump is countering this decades-long slide the old-fashioned American way: making mining and refining profitable again.

“In the last few years, it’s been this gradual build but in the last seven, eight months, President Trump has taken on critical minerals and made it a priority,” said Steve Christensen, executive director of the Responsible Battery Coalition.

The Washington-based coalition, whose members include Honda, FedEx, battery makers such as Clarios and Entek, and auto parts retailers, has been raising the alarm about reliance on China for minerals since it was founded in 2017.

“The president understands this issue, I think, probably better than any president in recent history,” Christensen told The Epoch Times.

However, it will take years, maybe decades, to revive the nation’s mining industry and reshore metal processing capacities for U.S. industries to access resources resilient to CCP market-meddling.

In the interim, it will require coordination with allied nations, according to Rahman Butts, who owns Bullion Hub, a gold and precious metals brokerage based in Melbourne, Australia.

“The direction is clear. Washington is striking deals with Canada, Australia, and parts of South America to spread supply risk,” he told The Epoch Times. “The problem is speed. New refineries take years to plan, finance, and build, so China’s lead in processing metals is not going to vanish in the short term.”

By John Haughey