‘The risk profile of the index increasingly reflects the fortunes of those companies rather than the broader U.S. economy,’ one economist said.

Many investors opt for index funds in the belief that, by doing so, they are diversifying their risk across a broad segment of companies and industries. Increasingly, however, that is no longer the case.

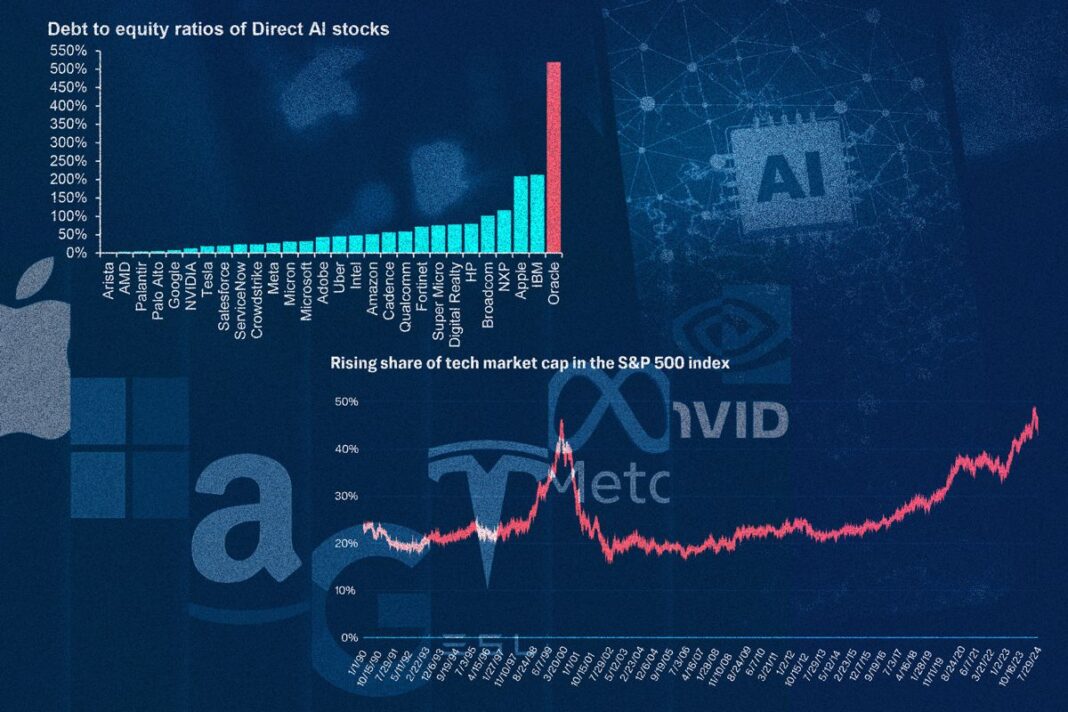

Companies involved in information technology or communication services now comprise about 43 percent of the S&P 500 index by market capitalization, according to a September report by U.S. Bank Wealth Management. Seven tech companies alone—the so-called “Magnificent Seven” of Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—now represent about 36 percent of the total market cap of the index, up from a 12 percent share in 2015.

“The risk profile of the index increasingly reflects the fortunes of those companies rather than the broader U.S. economy,” Peter Earle, senior economist at the American Institute for Economic Research, told The Epoch Times. “In practice, investors may not be receiving the same level of diversification that such [index] funds are traditionally assumed to provide.”

In addition to the concentration in these few companies, much of the recent appreciation in U.S. shares has been driven by one technology—artificial intelligence (AI).

AI-affiliated stocks have comprised 75 percent of all returns in the S&P 500, as well as 80 percent of earnings growth and 90 percent of capital spending growth, since the launch of ChatGPT in 2022, according to a Sept. 24 analysis by Michael Cembalest, chair of JP Morgan’s Investment Strategy Group.

AI technology is having ripple effects on the wider economy. The construction of new data centers for AI and cloud computing now exceeds spending on office construction across the United States.

The last time markets were so highly concentrated was during the apex of the dot-com bubble in 2000, when the top 10 companies comprised 27 percent of the index, and tech companies represented 47 percent of the index, again by market capitalization. When that bubble burst, the S&P 500 fell 49 percent from its peak, wiping out approximately $5 trillion in market value.