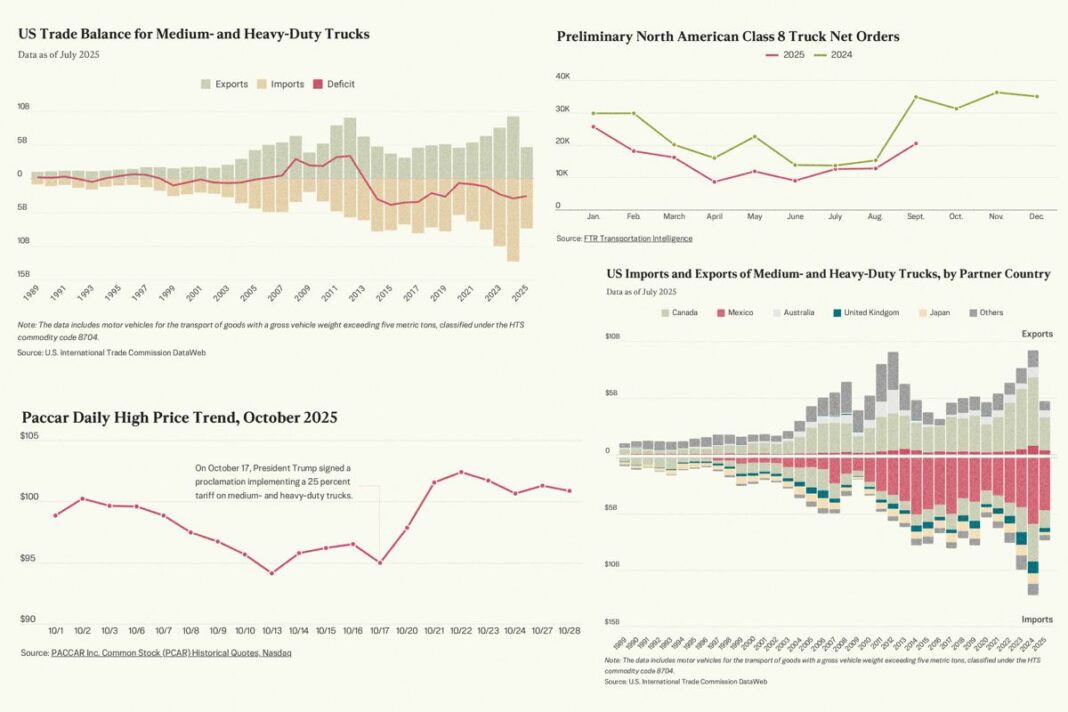

The U.S. trade deficit with Mexico for medium- and heavy-duty trucks soared above $5.1 billion in 2024.

Starting Nov. 1, the United States will impose a 25 percent tariff on imports of medium- and heavy-duty trucks, impacting billions in imports from Mexico and Canada.

Of the $12 billion in U.S. imports of medium- and heavy-duty trucks in 2024, Mexico ($5.9 billion) and Canada ($3.3 billion) led the way and accounted for 48 percent and 27 percent of total imports, respectively.

The United Kingdom and Japan each contributed 8 percent to the overall import share, according to official trade data.

The new truck tariff is “good for Paccar’s customers, as it will reduce tariff costs and bring clarity to the market,” Preston Feight, CEO of U.S. truck manufacturer Paccar, said at a recent earnings call.

“American-made heavy-duty trucks have been up to a $10,000 or more per truck cost disadvantage compared to trucks assembled in Mexico,” Paccar said in May in response to a Secretary of Commerce truck imports investigation.

“Mexican-built trucks that incorporate non-tariffed Chinese parts and foreign steel and aluminum can be imported into the U.S. tariff-free if they meet the U.S.-Mexico-Canada Agreement (USMCA) rules of origin for finished vehicles,” Paccar said.

Paccar, an American Fortune 150 company with a 120-year history, controls more than 30 percent of the U.S. heavy-duty truck market. The company manufactures more than 98 percent of its heavy-duty trucks for the United States in Ohio, Texas, and Washington.

The United States posted a $2.7 billion truck trade surplus with Canada in 2024. In contrast, the truck trade deficit with Mexico surged past $5.1 billion—the largest gap recorded in the past 35 years. Nearly $3 billion of that deficit was attributed to Class 8 heavy-duty trucks, which typically weigh more than 33,000 pounds, according to The Epoch Times’ analysis of international trade data.

Under the new tariff, trucks traded under the USMCA will incur a 25 percent tariff on non-American components, according to a White House fact sheet released on Oct. 17. For medium- and heavy-duty trucks that do not qualify for preferential tariff treatment under the USMCA, the tariff will apply to the full value of the vehicle.

To boost domestic production, manufacturers assembling trucks in the United States with imported parts may offset tariffs by an amount equal to 3.75 percent of the total value of all trucks built domestically between 2025 and 2030.

The new truck tariffs are meant to boost the volume of Class 8 units assembled in the United States, according to Dan Moyer, senior analyst for commercial vehicles at FTR Transportation Intelligence.

“By targeting non-USMCA content and rewarding domestic assembly, they push [original equipment manufacturers] and suppliers toward more North American sourcing,” Moyer told The Epoch Times via email.

“The transition will take time, given current capital and labor limits,” he added.

“The policy also avoids stacking with other steel, aluminum, or reciprocal tariffs, preventing double penalties on U.S. producers.”

In August, the Commerce Department imposed 50 percent tariffs on hundreds of steel and aluminum derivative products imported to the United States.

“[Paccar’s third-quarter] margins were affected by the August steel and aluminum tariff increases and the tariff costs on trucks that were built in the United States,” Feight told analysts during the company’s earnings call on Oct. 21.

Paccar’s chief financial officer, Brice J. Poplawski, also believes the One Big Beautiful Bill Act, signed into law on July 4, will provide incentives for next quarter.

“We have programs around encouraging our customers to take advantage of that 100 percent bonus depreciation. We think that will help spur some demand here in the fourth quarter,” he said.

The 100 percent bonus depreciation is a tax benefit that allows businesses to immediately deduct the entire cost of qualifying property—that which has a useful life of 20 years or less, such as trucks—rather than spreading it over several years.

“I think it gives us a competitive leg up from where we’ve been,” Feight said.

After Trump signed the truck tariff proclamation on Oct. 17, Paccar’s stock rose by 3 percent and continued to climb, reaching a monthly high in the following days.

By Sylvia Xu