President Trump claims a Supreme Court ruling that the worldwide tariffs are illegal, would place the country on “the brink of economic catastrophe.” Yes, Trump would suffer a blow to his ego, and his trade policy. The real cost of the catastrophe, however, would be imposed directly on the American people. First, Americans today pay for the tariffs in higher prices. And, with an adverse decision, Trump’s Treasury Department would likely send the bill to the Judgment Fund. In direct terms, Congress has already agreed to pay any and all judgments against the U.S. Therefore, the taxpayer would get hit with the second bill in the form of higher taxes or an increase in the national debt.

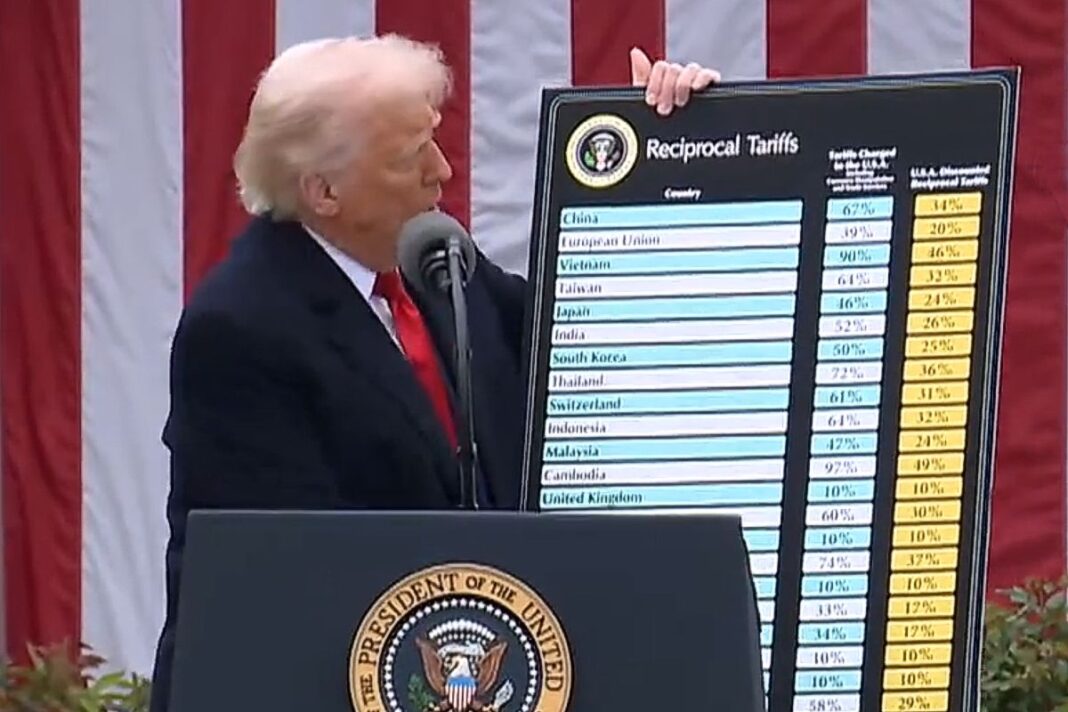

Trump’s tariffs have been a source of pride, with daily boasts about the substantial money they raise. The current figure stands at $175 billion through September, with a monthly collection of $31 billion. The amounts collected could exceed a trillion dollars during his term. However, the more pressing concern is the financial burden if the U.S. Supreme Court upholds the lower courts’ decisions, finding the tariffs illegal or unconstitutional. The question then becomes, how will the money collected be repaid?

Has the President kept the money in a lockbox pending a court decision? Doubtful! If not, where will a financially strained federal government find an extra several hundred billion. It will be the taxpayer, they always pays for the government’s mismanagement.

The federal government is currently grappling with a monthly deficit of $145 billion, with annual interest payments on its national debt expected to reach nearly $1 trillion in 2025. This deficit necessitates borrowing to cover bills that federal revenues cannot meet. If the federal government is ordered to return the funds collected from the tariffs, it will further exacerbate the deficit, provided the debt ceiling allows it. Or the President could attempt to repurpose other funds, if it can comply with the Impoundment Control Act. The fundamental hurdle is Article I, Section 9 of the Constitution, which bars the President from spending money that Congress has not appropriated.

Any repayment resulting from a court order is paid by the agency collecting the funds if it has the resources to repay them. That process is workable for small judgments. In this instance, the Executive Branch does not have the money. So, in its cavalier manner, it will send the bill to Congress. Congress pays the bill by appropriating money that it obtains through taxation or by imposing more debt on our children. Congress, for decades, has paid for the mistakes of the Executive Branch through the Judgment Fund.

The Judgement Fund.

The Judgment Fund, 31 U.S.C. sec. 1301, is often referred to as the “mother of all slush funds.” It is a permanent, indefinite, and unlimited congressional appropriation that is continuously available to pay money judgments entered against the United States, as well as settlements for cases that are either in litigation or likely to be in litigation. The U.S. Congress has established the fund to cover “whatever amount is necessary” to pay for qualifying judgments and settlements. It established this fund so it would not have to concern itself with the tedious paperwork of paying the nation’s bills, even big bills.

Because it is a permanent, unlimited, and indefinite appropriation, the specifics of the amounts being allocated are not debated in Congress. The Department of the Treasury pays these claims as soon as the necessary paperwork is received. Notably, in 2016, President Obama used the fund to deliver $1.7 billion in cash to Iran, the return of $400 million in Iranian assets, and $1.3 billion in interest on those funds.

Over the years, the Judgment Fund has been used to pay for thousands of claims arising from the federal government’s illegal or negligent conduct. Among them were a $1.25 billion discrimination settlement with Black farmers and a $760 million settlement with Native American farmers and ranchers who alleged lending discrimination.

The bizarre aspect of the fund is that it isnot publicly accessible, and there is no comprehensive ledger. Moreover, because many records are heavily redacted under the guise of privacy, the public has no clear picture of how much money has been paid out, or to whom. Until 2018, the Judgment Fund even paidharassment settlements for members of Congress,shielding them from personal financial responsibility for their actions.

Now the President will ask Congress to pay the “Mother of all Judgments.”

The ‘mother of all potential judgment’ cases, S.O.V. Solutions v. Trump, was argued in the Supreme Court on November 5, 2025. This case challenges the legality of the President’s ‘Liberation Day’ tariffs, which were imposed on nearly every nation. The lower courts held that the International Emergency Economic Powers Act (IEEPA) does not authorize the Presidentto impose tariffs, as tariffs are a form of taxation. The IEEPA permits the President only to ‘regulate’ imports during national emergencies—a term legally distinct from ‘tariff,’ ‘duty,’ or ‘tax.’ The power to tax belongs exclusively to Congress, which may delegate such power only if it clearly defines its scope and provides guiding principles for its use. In this case, Congress provided no such guidance, making any delegation of tariff authority constitutionally suspect.

The court will also examine the imposition of the tariffs under its Major Questions Doctrine, which holds that if Congress intends to delegate authority to the President to make decisions concerning matters of “vast economic and political significance,” it must provide explicit congressional authorization.

The potential political implications of this case are significant, as they concern the balance of power between the President and Congress. The financial implications are monumental. The federal government will have to return hundreds of billions of dollars. But it is how the money is returned if the tariff collecting agency does not have the money.

Must the Congress pay?

Federal courts can issue judgments against the government; however, they cannot compel Congress to pay those judgments. The principle of separation of powers prevents the judicial Branch from directly forcing Congress to appropriate funds. While the Executive Branch can submit judgments against it to Congress for payment under the Judgment Fund, it cannot compel Congress to appropriate more money, unless Congress honors the Judgment Fund Act and finds more money.

What are the potential consequences of leaving these judgments unpaid?

If Congress pays, it directly adds hundreds of billions in debt to taxpayers to cover the costs associated with a president’s unconstitutional actions. If Congress refuses to pay, it leaves importers with an uncollectible judgment against a country whose bond ratings have been downgraded several times this year. The most troubling aspect of the Judgment Fund is that it protects government officials from accountability, while shifting all costs to the taxpayer.

More troubling is that the Judgment Fund obscures the full cost of executive overreach.

Unless Congress restructures the operation of the Judgment Fund to demand transparency and accountability, taxpayers will continue to bear the financial burden of the government’s illegality and mismanagement.