Analysts have said gold’s surge signals more than a fleeting flight to safety.

Gold prices surged to a fresh all-time high above $5,300 an ounce on Jan. 28, extending a powerful rally fueled by a weaker U.S. dollar, rising geopolitical risk, and growing expectations that U.S. interest rates will move lower in the months ahead.

Spot gold climbed more than 1.5 percent to $5,260.28 an ounce by 7:14 a.m. EST, according to TradingView, after touching a record $5,311.31 earlier in the session. Prices had already gained more than 3 percent in the previous trading day.

U.S. gold futures for February delivery rose by more than 3 percent to $5,253.10 an ounce.

Analysts have said gold’s surge signals more than a fleeting flight to safety, pointing to a wider reappraisal of global monetary and fiscal policy dynamics.

“Gold is rising not merely due to market anxiety, but because confidence in the global monetary–fiscal order is shifting toward a more cautious stance,” XS.com Senior Market Analyst Linh Tran said.

Dollar Weakness Underpins Rally

The U.S. dollar slid to a four-year low on Jan. 27, pressured by expectations of continued Federal Reserve easing, uncertainty surrounding U.S. tariff policy, concerns over fiscal deficits, and investor unease over policy volatility.

Losses in the dollar index, which tracks the greenback against six major currencies, came despite comments from President Donald Trump that appeared to play down the currency’s recent declines.

When asked on Jan. 27 whether he was concerned about the dollar’s weakness, Trump told reporters in Iowa that its value was great, adding that he wanted it to “just seek its own level.”

A weaker dollar tends to support gold by making the metal cheaper for holders of other currencies, while also reinforcing its appeal as a store of value when confidence in fiat currencies erodes.

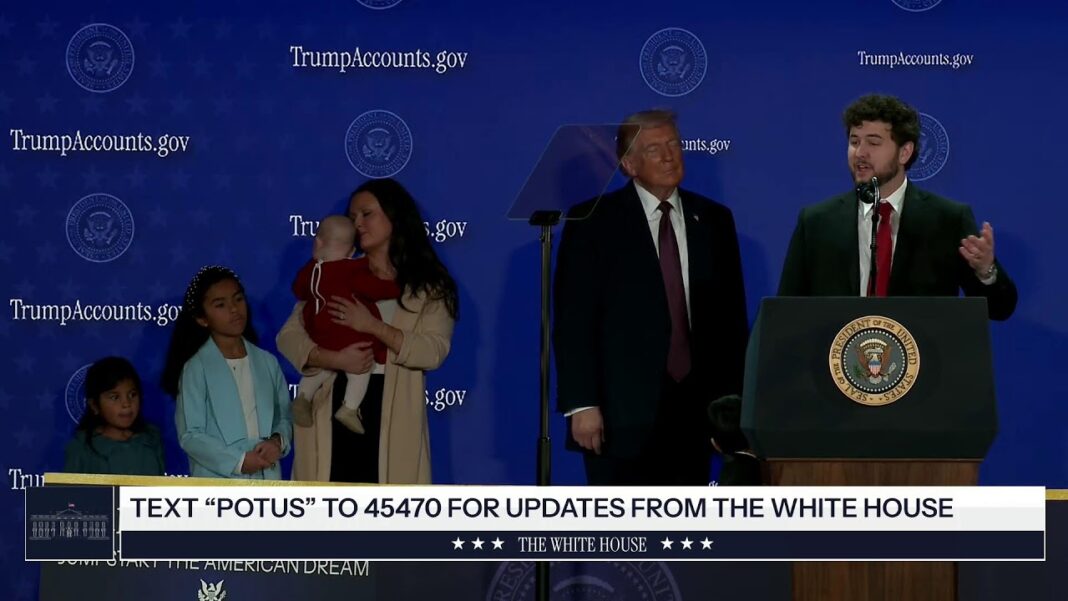

Trump’s comments came ahead of a speech focused on the economy, in which he highlighted record stock market levels, rising wages, and tariff-driven investment commitments that he said would help rebuild U.S. manufacturing capacity. He also renewed criticism of the Federal Reserve, accusing it of being too slow to cut interest rates.

The president said he would soon announce his choice for the next Fed chair, reiterating his view that borrowing costs should fall sharply.

“When we have a great Fed chairman, I think we’re going to have one. I’ll announce it pretty soon. You’ll see rates come down a lot,” Trump told the crowd in Iowa, again criticizing current Chair Jerome Powell as being “too late” to ease policy.

By Tom Ozimek