The U.S. banking industry is bracing for the long-awaited Basel III Endgame framework.

The Federal Reserve is poised to release an updated and revised Basel III Endgame framework for the banking system soon. One change could be new mortgage capital requirements for U.S. banks.

Fed Vice Chair for Supervision Michelle Bowman has said the central bank is inching closer to unveiling new mortgage-loan requirements.

Bowman, speaking at an American Bankers Association event on Feb. 16, said regulators are weighing ways to make capital requirements for residential mortgages more “risk‑sensitive.”

One option under consideration would tie a mortgage’s risk weight to its loan‑to‑value ratio, replacing the current one‑size‑fits‑all approach.

If lenders tie mortgage risks to loan-to-value ratios, they will no longer face a flat capital charge across all mortgages on the books. A lower ratio, for example, would report smaller risk weights and reduced capital requirements.

“This change could better align capital requirements with actual risk, support on-balance-sheet lending by banks, and potentially reverse the trend of migration of mortgage activity to nonbanks over the past 15 years,” Bowman stated in prepared remarks.

Another proposal under consideration is to remove the rule mandating banks to deduct mortgage‑servicing assets from regulatory capital, even as those assets continue to carry a 250 percent risk weight.

The Fed will also seek comment from the banking industry regarding possible changes.

“These potential changes would address legitimate concerns about mortgage market structure while maintaining appropriate prudential safeguards,” she said.

“By creating a resilient mortgage market that includes robust participation from all types of financial institutions, we can deliver affordable credit and high-quality servicing to borrowers regardless of economic conditions.

“Strengthening bank participation in these activities does not threaten the safety and soundness of the banking system.”

Various changes could be made across the U.S. mortgage market in the coming months.

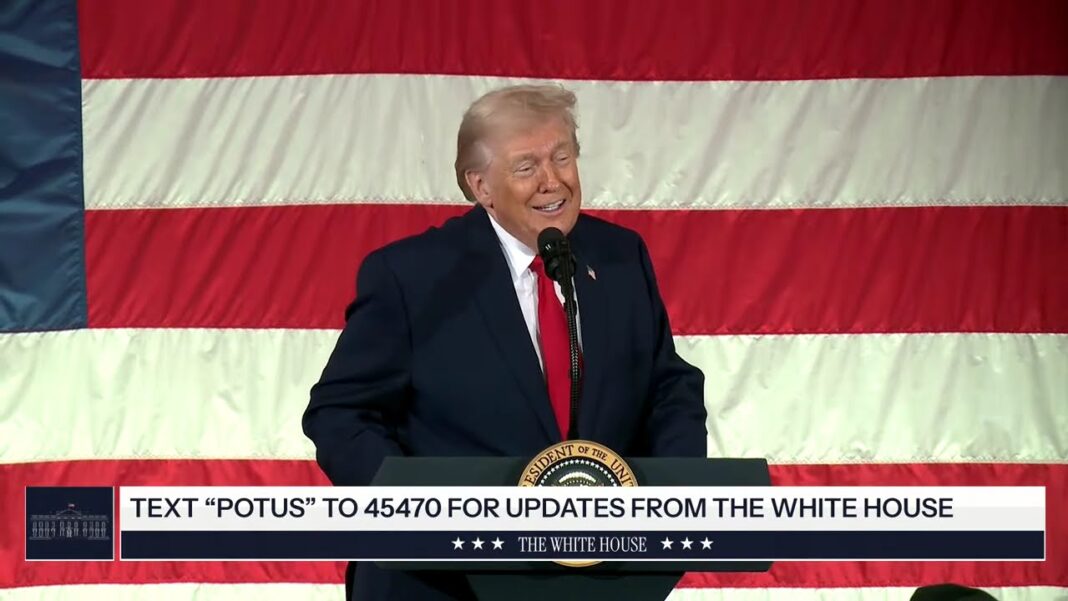

In addition to the Fed’s regulatory proposals, the White House is weighing different options to restore affordability, such as offering 50-year mortgages or purchasing mortgage-backed securities.

But the banking system could witness notable changes with the long-awaited Basel III.

By Andrew Moran