More than $175 billion in U.S. tariff revenue could be returned to importers, according to a new study.

Analysis

WASHINGTON—The Supreme Court released its long-anticipated decision on Feb. 20 over whether President Donald Trump’s tariffs exceeded the boundaries of congressional authority.

The Supreme Court finalized its decision on the legality of the president’s tariff actions after justices heard a case on Nov. 5 regarding whether Trump had violated the International Emergency Economic Powers Act.

The pivotal decision is expected to shake up the U.S. foreign and economic policies.

Although Treasury Secretary Scott Bessent had said earlier that the administration could work around a negative ruling, he said the potential fix wouldn’t be as efficient.

In November, Trump warned that the United States “could be reduced to almost Third World status” if his tariffs were shot down.

“If a president is not allowed to use Tariffs, we will be at a major disadvantage against all other Countries throughout the World, especially the ‘Majors,’” Trump said in a Nov. 2 Truth Social post.

Although recent presidents have applied pressure through trade, Trump ushered in a paradigm shift in the country’s economic policy when he announced a sweeping set of tariffs beginning in April last year.

Before the announcement, predictive markets such as Kalshi and Polymarket had shown that the odds of the high court ruling in favor of the Trump administration were about 25 percent.

The financial markets also expected the Supreme Court to invalidate the IEEPA tariffs.

U.S. stocks initially popped following the high court’s ruling, with the blue-chip Dow Jones Industrial Average rising more than 200 points. But the leading benchmark averages later pared their gains.

Fiscal worries that federal revenues will fall short of earlier projections pushed government bond yields higher.

The benchmark 10-year Treasury yield topped 4.1 percent, while the 30-year jumped above 4.75 percent.

Here are the potential impacts of today’s decision.

1. Presidential Power

The decision would limit the president’s ability to impose or increase tariffs without congressional approval.

It may also affect his future decisions to use emergency powers for many economic measures.

This decision is expected to set precedents for executive emergency powers in other policy areas.

Trump has called the decision potentially “life or death” for the United States.

2. Government Revenue

The country has seen record tariff revenues and trade renegotiations that have affected billions of dollars in commerce.

Tariffs generated record revenue of more than $215 billion in fiscal year 2025.

As of Feb. 17, the federal government had collected more than $130 billion in tariff revenue so far this fiscal year, according to the Treasury Department.

Data from the Bureau of Economic Analysis has shown the monthly trade deficit narrowing since the president’s tariffs.

But the annual deficit totaled $901 billion—a tepid decline from the previous year—making it the third-largest on record.

The decision may force the federal government to refund importers, straining the federal budget and complicating deficit-reduction efforts.

A new Penn Wharton Budget Model estimated that more than $175 billion in U.S. tariff revenue could be returned to importers in the aftermath of the Supreme Court’s decision.

3. Impact on Markets

Financial markets have been preparing for volatility.

The recent ruling against the tariffs has been good news for investors, offering some relief from higher company costs.

Still, the stock market rally may not last, as uncertainty could return.

Even if the case is lost, tariffs may remain in place for the long term.

The administration has already indicated that it could use alternatives, such as Section 232 national security tariffs or other legal options, to keep tariffs in place.

4. Importers and Businesses

More than 1,000 companies, including Costco, have sued the government over tariffs.

U.S. importers have applied for electronic refunds, pending a Supreme Court decision on the legality of Trump’s IEEPA tariffs.

The deadline for importers to register for electronic refunds through the Automated Clearing House network with Customs was Feb. 6.

5. ‘America First’ Trade Policy

In his second term, Trump has been using tariffs as leverage to reduce tariffs and nontariff barriers on U.S. goods.

Shortly after his inauguration, the 47th president described “tariff” as the most beautiful word in the dictionary.

He drew inspiration from William McKinley, the 25th president, who championed steep tariffs to protect American industries in the late 19th century.

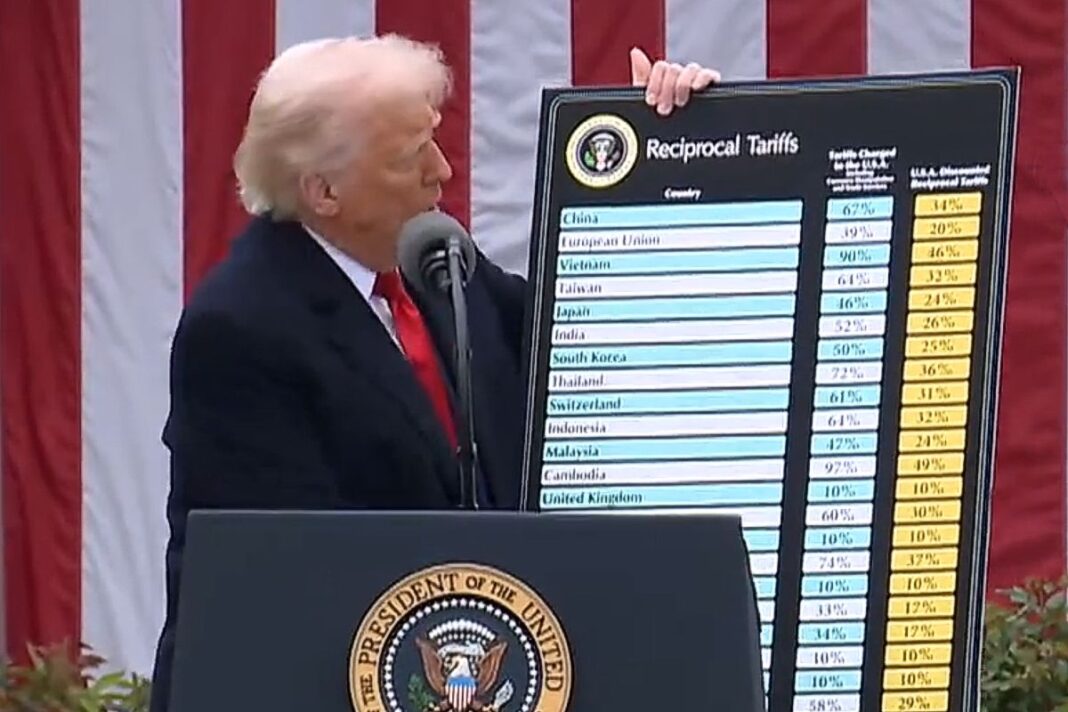

On April 2, Trump imposed levies of at least 10 percent on more than 80 countries.

This was a significant shift from the trade policy of his first term, when tariffs targeted a few specific countries, such as China.

Trump has frequently praised tariffs for attracting $18 trillion in new investment commitments this year.

He also floated the idea of sending American taxpayers $2,000 tariff rebate checks directly, using funds from the tariff revenue.

After April 2, 2025, which he dubbed “Liberation Day,” Trump launched trade talks with key trading partners to revise long-standing agreements.

He has announced new trade deals with dozens of trading partners, including Argentina, the European Union, Japan, South Korea, Switzerland, Thailand, the UK, and Vietnam.

Since taking office, Trump has also increased pressure on China by significantly raising tariff rates on Chinese goods.

Although some were reduced in a November truce, current tariffs remain high, at 47.5 percent.

This was expected to lead to long-term economic decoupling between the United States and China.

Trump’s trade agenda faced legal challenges from businesses and from states in 2025.

Although some economists warned that tariffs would increase inflation, the Bureau of Labor Statistics recently reported that inflation cooled to 2.4 percent in January, below expectations.

By Emel Akan and Andrew Moran

Read Full Article on TheEpochTimes.com