There is more than $57 billion worth of hidden tax increases in President Joe Biden’s $1.9 trillion coronavirus stimulus bill (American Rescue Plan Act of 2021 or H.R. 1319), Just the News has learned.

The final version of the legislation expands the number of employees who are covered by the $1 million limitation on the deductibility of executive compensation.

According to National Law Review, section 162(m) of the tax code “generally prohibits a public company from deducting more than $1 million in compensation paid to a current or former covered employee in a taxable year,” and under current law “the covered employees are the chief executive officer, chief financial officer, and the three other highest compensated officers for the taxable year.”

The executive compensation deduction change in the stimulus bill covers 5 more of a company’s highest paid employees.

“TCJA [Tax Cuts and Jobs Act] included such a limit, but Dems essentially doubled it to make it more draconian,” a House Ways and Means Committee minority spokesperson said. “Dems are under no illusions that their bill is about growth, so them putting a cap on executive pay is just political messaging.”

A $500,000 limit on the amount of losses that “passthrough corporations” can use to get liquidity is also tucked inside the bill, according to a Joint Committee on Taxation document obtained by Just the News.

“This was a major area of relief for American small businesses during the pandemic that allowed businesses to get fast tax refunds from the IRS,” the committee spokesperson said.

Another tax provision in the stimulus, the second largest rescue package in U.S. history, involves new limitations on the interest expenses that multinational corporations can deduct on tax returns.

Republicans argue that there is a downside to these limits that the Democrats attached to the stimulus bill.

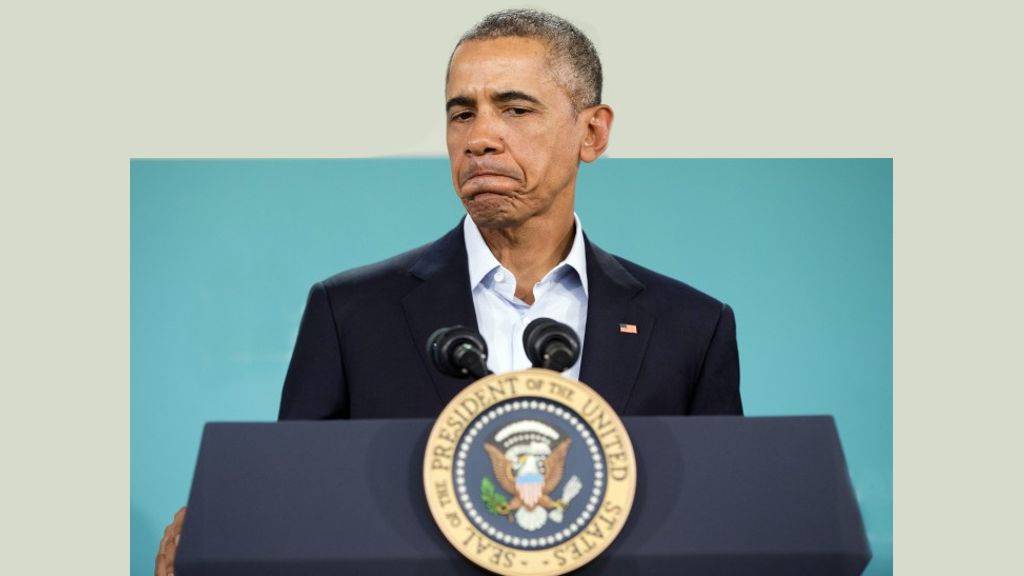

“We make it less attractive for these companies to be based in the U.S. or do business here,” the Ways and Means Committee minority spokesperson said. “TCJA was about stopping the bleeding throughout the Obama administration where jobs fled overseas — we succeeded. Now Democrats are undoing that progress.”

The Joint Committee on Taxation estimates that the tax revenue from the changes will generate an estimated $57 billion over 10 years.

Democrats used budget reconciliation to move the bill to Biden’s desk, which allowed it to pass without GOP votes. The House passed the final version on Wednesday.

Read Original Article on JustTheNews.com

Joint-Committee-on-Taxation