The United States has resumed its efforts to build its own domestic supply chain of rare earths after decades of struggles. Will it succeed this time?

At this year’s G7 summit, European Commission President Ursula von der Leyen held up a symbol of the West’s bid to gain supply chain independence from China: a rare earth magnet.

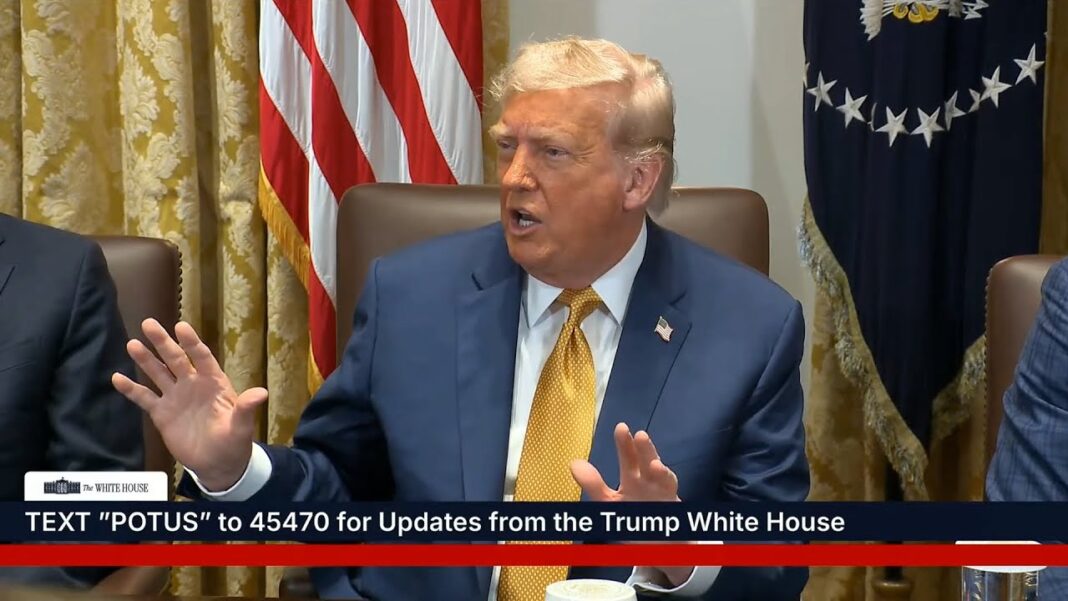

“It was manufactured in Estonia, by a Canadian company using raw materials sourced from Australia and supported by the EU’s Just Transition Fund,” the European Union chief told the other heads of state, including President Donald Trump, on June 15.

The fund provides financial support for the EU’s goal to achieve net-zero emissions of all greenhouse gases.

China accounts for 90 percent of the refining of the world’s rare earth elements, according to the International Energy Agency. A rare earth magnet produced from an alternative supply chain is noteworthy.

Heat-resistant magnets are one way these critical minerals are utilized. Rare earth elements are essential to modern manufacturing, and without them, consumers will likely face shortages of cars and electronics that rely on them for screens, batteries, and motors.

The same goes for advanced weapon systems. An F-35 fighter jet needs more than 900 pounds of rare earth elements, and a nuclear-powered attack submarine needs more than 9,000 pounds of the metals, according to the Department of Defense.

Rare earths are not named “rare” because they are scarce in the Earth’s crust but because they occur naturally at low densities and are costly to separate from other metals.

China doesn’t just dominate the mining of these elements but the entire value chain, which includes separating and refining rare earths, as well as manufacturing magnets.

Based on its near-monopoly, Beijing has weaponized rare earths in the U.S.–China trade war.

Despite agreeing in Geneva in May and in London in June to provide the United States with these metallic elements, the materials are still not flowing at the same level as before Beijing imposed export controls in April.

At the same time, the Trump administration is proceeding with deregulation and investment to nurture a domestic supply chain. The United States recognized China’s dominance in critical minerals during the Obama administration in the 2010s and, during the Biden administration, introduced manufacturing tax credits and federal loan assistance under the Inflation Reduction Act.

Experts say the West’s determination to establish an alternative rare earth supply chain has now reached a watershed moment—it will not relax its efforts, as it did in the past, even if China were to lift its export controls and again flood the market with cheap products.

By Terri Wu