‘If the Fed brings down mortgage rates, then they can end this housing recession,’ the US Treasury secretary said.

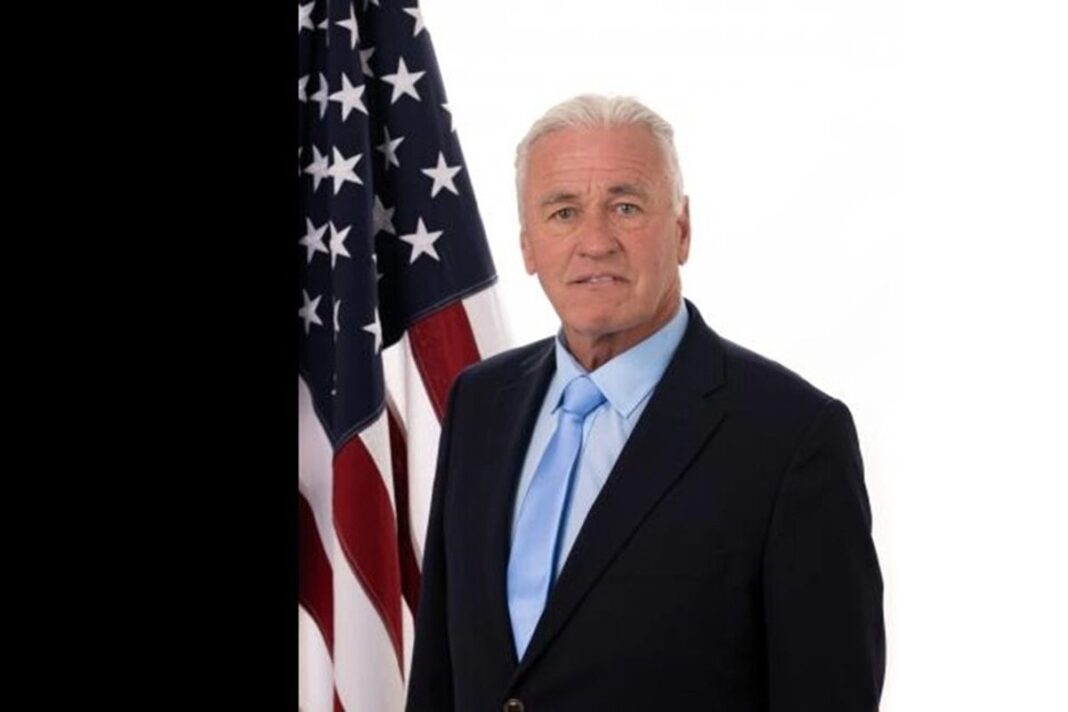

The U.S. housing market and other parts of the economy may already be in a recession due to high interest rates, Treasury Secretary Scott Bessent said Sunday, reiterating that the Federal Reserve should initiate more rate cuts.

“I think that we are in good shape, but I think that there are sectors of the economy that are in recession,” Bessent told CNN’s “State of the Union” program on Sunday, characterizing the overall economic environment as in a transition period.

Bessent said that, while the overall U.S. economy remains solid, high mortgage rates are still throttling the real estate market. Housing, he said, is effectively in a recession that is hitting low-end consumers the hardest because they have debts, not assets.

“The Fed has caused a lot of distributional problems with their policies,” he said. “We have seen the biggest hindrance for housing here that are mortgage rates. So, if the Fed brings down mortgage rates, then they can end this housing recession.”

Bessent added that low-income Americans are being harmed by high these interest rates, adding that if they’re not dealt with, “I think that there are sections of the economy that could go into recession.”

A Redfin report released in mid-October showed that new listings of homes for sale increased by 2.3 percent year-over-year for the month that ended on Oct. 5, with Redfin agents saying that potential U.S. home buyers are increasingly waiting for rates to drop.

Despite this, Federal Reserve Chair Jerome Powell signaled during last week’s policy meeting that the central bank may not cut rates further at its December meeting, prompting sharp criticism from Bessent and other Trump administration officials. At the same time, the Fed approved its second straight interest rate cut, dropping the benchmark rate to the range of 3.75 percent to 4 percent.

Days after Powell’s announcement, Fed board member Stephen Miran said in an interview with The New York Times that the Fed risked inducing a recession if it did not swiftly lower interest rates. Trump administration officials have repeatedly criticized the Fed for not doing it sooner.

“If you keep policy this tight for a long period of time, then you run the risk that monetary policy itself is inducing a recession,” he told the outlet in an interview published Saturday. “I don’t see a reason to run that risk if I’m not concerned about inflation on the upside.”