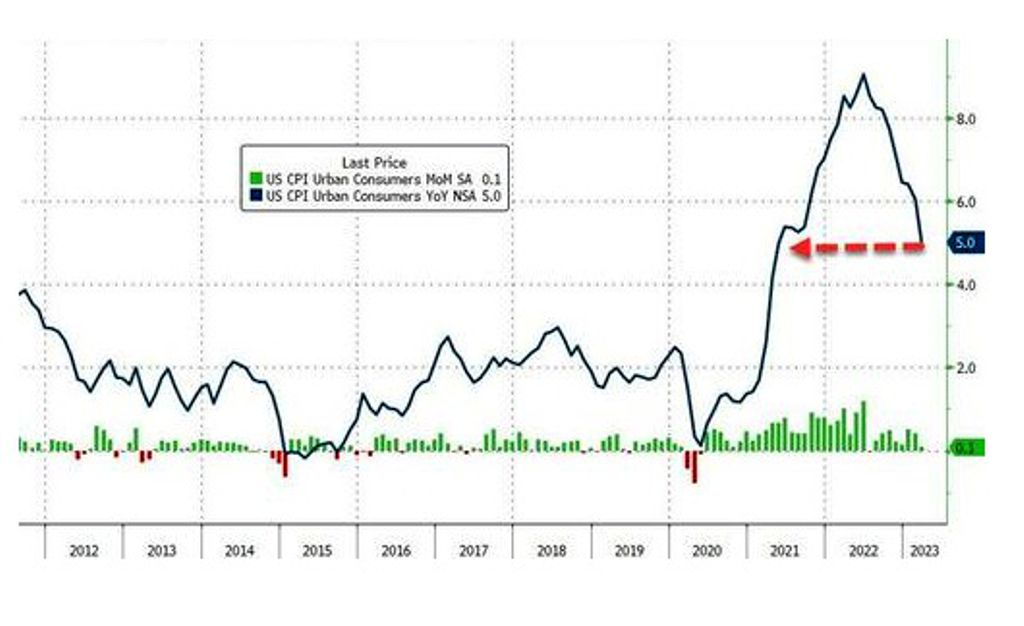

Inflation cools in the US with a notable drop in headline CPI (but a rise in core CPI), with headline CPI +0.1% MoM (+5.0% YoY vs. 5.1% exp, and down from 6.0% YoY prior). See this in the chart below and learn more here.

The Fed’s new favorite inflation indicator – so-called “Super-Core:” Core Services Ex-Shelter – slowed to 5.73% YoY, the lowest since July 2022.

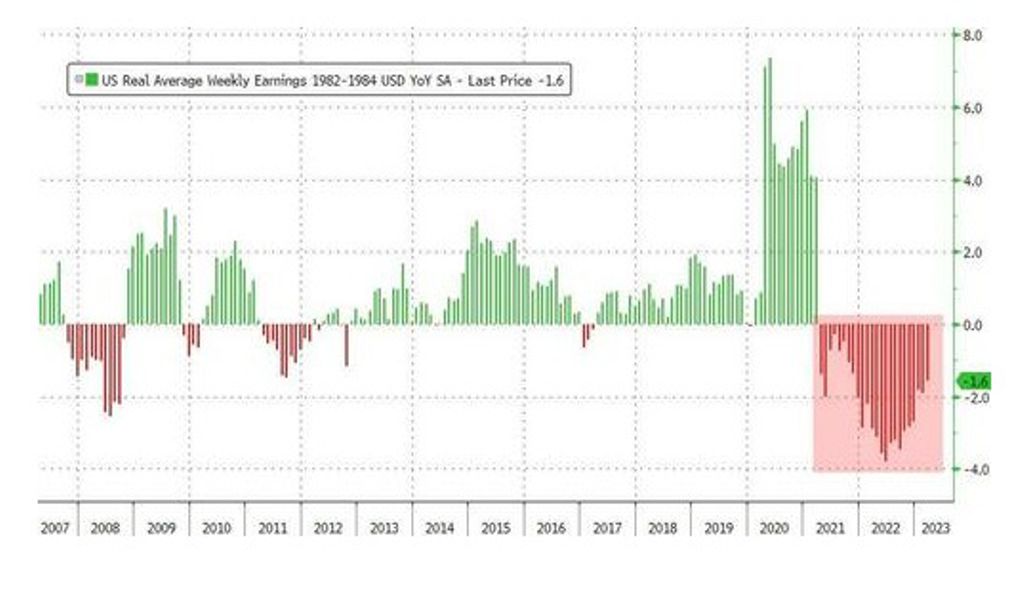

Real wages continue their declining streak – now at 24 months at -1.6%. Hence, on a YoY basis, this means a total of 6.6% decline in real terms for the average American.

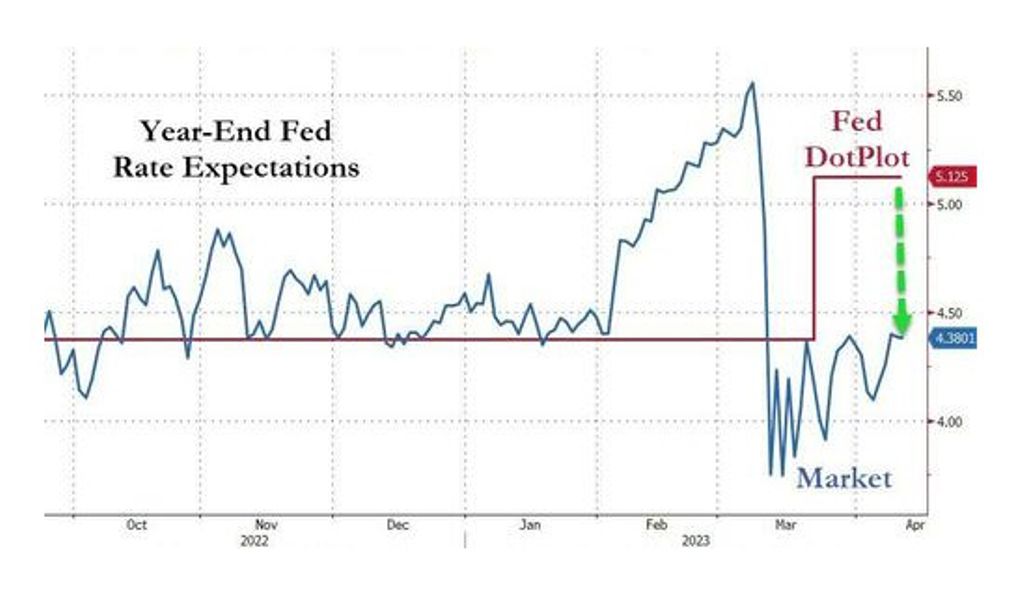

The FOMC Minutes, also recently released, did not offer too much new insight aside from admitting that staff expects a mild recession this year. After the Fed Minutes and the CPI data, the market rate expectation is still on the downside. The likelihood of a Fed pause at the next rate decision is all but in the cards. See below where the market is vs. the Fed’s thinking in terms of where interest rates are heading.

The market response was flat for stocks (for the moment), but the new dovish interest rate stance gave new life to the re-inflation trade – commodities (e.g., oil and gold) gained, and the dollar continued its losses. So where next for inflation?

What goes up must come down – but not necessarily so when it comes to inflation – see here.

We need to understand the dynamics of mathematics. A pause in the prices will make the year-on-year comparisons go lower over time – i.e., the inflation rate. So though the inflation rate is coming down, prices are not – the are plateauing. We also need to understand that no index or market goes in a straight line. Here are a few things to consider going forward.

- Though the inflation rate is cooling, growth (US and global GDP) is also cooling, and the dovish Fed stance will cause inflation to rekindle and re-challenge recent inflation highs.

- The re-inflation trade could cause assets (i.e., stocks, gold, oil, real estate, and other commodities) to begin to rise. Too many investors have been gaslighted to believe an asset crash will shortly come – they are ready to buy on any dip that may not come.

- Some believe that big job losses are in the cards. We have to remember that Gen Z is the smallest generation to come since WWII. The Boomers are all but retired. Along with a cultural decline in job participation, job openings will continue to make it difficult to find qualified workers. Hence many believe huge job losses are not in the cards, though wage growth will continue to be negative.

- As we move into the 2024 election cycle later in the year, politicians will look for artificial ways to boost growth to buy votes – which will also fuel the re-inflation story.

By Tom Williams