President Joe Biden was in North Carolina recently to kick off a national tour touting the ongoing effect of his legislative agenda that has led to massive infrastructure projects and an electric vehicle manufacturing boom across the country.

The “Investing in America” tour – which will feature appearances by first lady Jill Biden, Vice President Kamala Harris, second gentleman Douglas Emhoff, and other senior White House officials and Cabinet members — will stop in more than 20 states over three weeks as part of an effort to highlight growth and improvements that have emerged as a result of the president’s Inflation Reduction Act, CHIPS and Science Act, Bipartisan Infrastructure Law, and American Rescue Plan. See the video report below and learn more here.

Joe Biden is off on his tour that could see him announce that he is running for a second term as President, touting that the economy is in great shape – with his announcement that “America is coming back.”

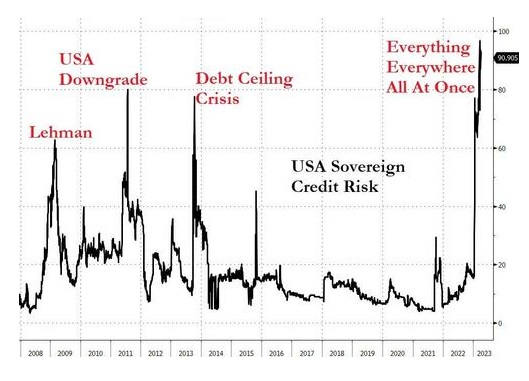

Well after, the 40-year high inflation, meager wage growth relative to inflation, a languishing stock market, spiking interest rates, and, more recently, bank runs that are spooking the markets. Spooking the markets to such a degree that US Sovereign Credit risk is now the worst in decades – even worse than in 2008. See this in the chart below and learn more here.

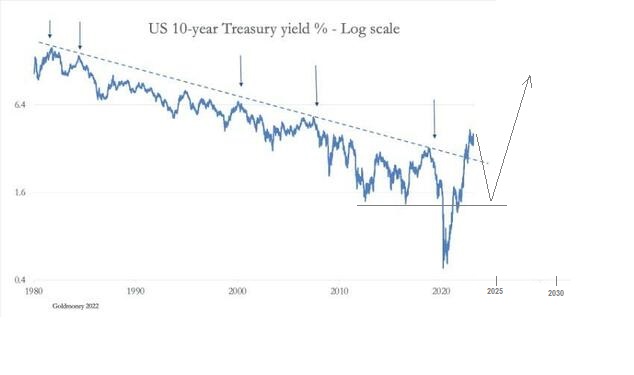

It seems as if the Biden administration keeps racking up new economic records all the time. Here is another one that we need to pay attention to. Since Paul Volcker’s attack on inflation back in the early 1980s, the US interest rate market has been on a steady march to zero. More recently, this 40-year trend has broken – and not just a transient spike. Knowledgeable traders know that anytime you break a long-term trend like this one, major changes are coming for the underlying instrument. The rule states that the longer the in-trench trend is – when the break comes – the bigger the counter move will be. See the chart of the US 10-year Treasury yield below.

One must understand that no market goes in a straight line. It often sawtooths its way in the direction of the prevailing trend. Currently, the Fed has been raising interest rates to combat 40-year high inflation. Markets are responding, and hence the recent spike in the entire credit market in terms of rates – all maturities, public and private, have similar charts.

The Fed needed to raise rates to the same level as the inflation rate as Paul Volcker and other central bankers have done in the past in similar situations – or at least until something breaks. The Fed has only done about half of what is necessary to tame the 40-year high inflation. Unfortunately, and as many have predicted, the Fed broke something, and we have massive bank runs.

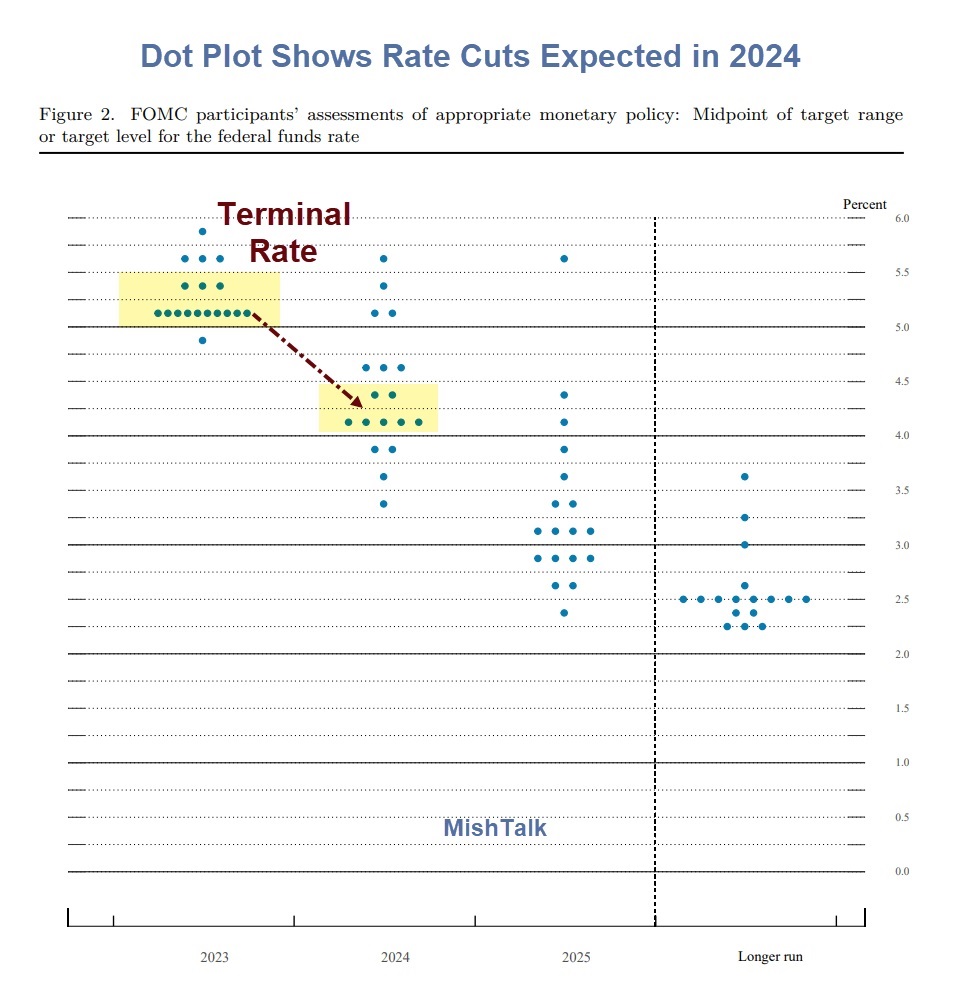

So now what? The markets and the Fed are signaling an end to the recent rate hike program in place.

Interest rate Fed projections by their “dot plot” indicates that the Fed believes that this current rate hike cycle is complete. The range of rate hike projections for 2024 and 2025 is stunning. For 2025 the top projection is 5.6 percent, with the bottom at 2.4 percent. The Median December projection for 2024 is 4.1 percent. See this below in the chart below and learn more here.

As shown in the above US 10-year Treasury chart above, we could see interest rates decline further from where they are at today – into the 2024 US presidential elections. This will boost the economy slightly (or keep it from falling off the table) but will trigger an even greater inflation cycle than we saw in 2022-2023.

The trick for the Biden administration is to thread the needle and have just enough wiggle room that the brunt of the inflation will come after the election. When we say “brunt of the inflation,” this means inflation rates could still get back to 2022 levels and higher – after the 2024 election – who cares – the inflation rate could explode along with rates to shocking new highs.

Perhaps, there will be plenty of other geopolitical issues to blame the economic problems on when the time comes. The alternative is to allow a great recession/depression to occur – which is always a possibility – it happened before. One should be careful not to put too much faith in politicians – the current situation has taken decades to build, and there will be no silver bullet.

America could face its own Zimbabwe currency collapse in the near future.

Give us your take in the comment section below on whether interest rates and inflation will move significantly higher in the coming years.

By Tom Williams