A recent economic data dump gives us an idea of where Western economies are heading. In short, they continue to sag. Many economists believe that the recent economic downturn is a central bank-induced downturn with their rate hike cycles to fight inflation.

See below where a few of the Western economies’ central banks’ interest rates are at vs. the inflation they are fighting.

- Fed discount rate of 3%-3.25%, with an inflation rate of 8.2%.

- ECB’s interest rate of 0.75%, with an inflation rate of 10.9%.

- Bank of England rates of 2.25% with an inflation rate of 10.1%.

Historically, central banks will need to raise their interest rates to the level of inflation in order to tame the inflation. As we can see, central banks have a long way to go. And if the central banks do as they have indicated, the current downturn has a long way to go as well. But first, let’s look at the current economic data dump, which was in the form of PMIs.

What are PMIs? The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision-makers, analysts, and investors. A PMI above 50 represents an expansion when compared with the previous month. A PMI reading under 50 represents a contraction.

The PMI indicators are probably one of the most looked at forward-looking fundamental indicators for market players. They tend to track and predict well eventual GDP results that tend to be lagging fundamental indicators. Let’s take a tour of the Latest PMIs from the US and the Eurozone.

With this PMI definition and understanding, let’s take a quick tour of a few Western economies (US, the EU, and the UK).

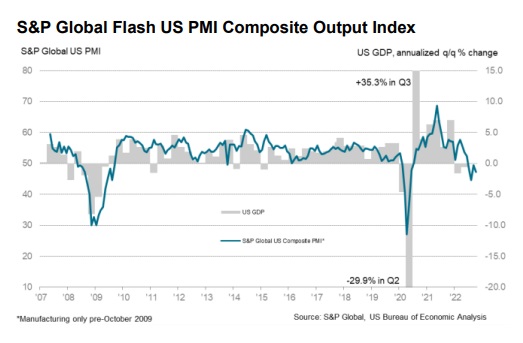

Private sector firms in the US recorded a further downturn in output at the start of the fourth quarter, according to the latest flash PMI™ data from S&P Global. The fall in business activity was solid and stronger than that seen in September, as service providers signaled a quicker

decline. Manufacturers, on the other hand, saw output rise for the second month running, albeit only marginally.

The headline Flash US PMI Composite Output Index registered 47.3 in October, down from 49.5 in September. With the exception of the initial pandemic period, the rate of decrease was the second-fastest since 2009. See this in the chart below and see the detailed report here.

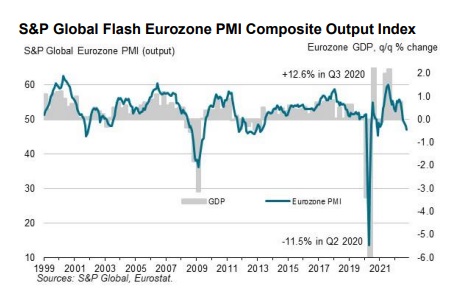

The Eurozone economy slipped into a steeper downturn at the start of the fourth quarter, the rate of decline hitting the fastest since April 2013, barring pandemic lockdowns. Manufacturing, and energy-intensive sectors, in particular, reported the steepest output loss, but services activity also continued to fall at an accelerating rate amid the ongoing cost of living crisis and broad-based economic uncertainty.

The seasonally adjusted S&P Global Eurozone PMI® Composite Output Index fell from 48.1 in September to 47.1 in October. See this in the chart below and see the detailed report here.

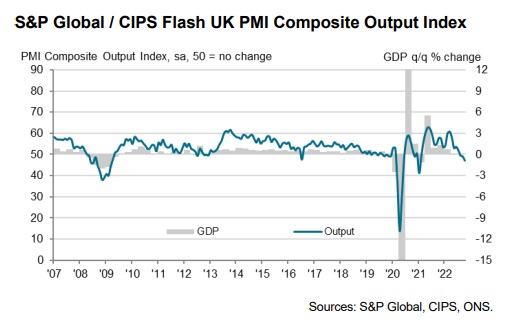

October data highlighted a reduction in UK private sector output for the third month running, according to the latest Flash UK PMI® survey compiled by S&P Global and CIPS. Adding to signs of weakening underlying demand, new orders decreased at the sharpest pace since January 2021. This was often attributed to a considerable downturn in business and consumer confidence in recent months.

The headline seasonally adjusted S&P Global / CIPS Flash UK was 47.2 in October, down from 49.1 in September. See this in the chart below and see the detailed report here.

Though this economic data dump was quite negative, they are not falling off the cliff … yet. However, remember, central banks have a long way to go in their current rate hike cycle. Unfortunately, this current economic dilemma is set in an environment where these same Western economies are beating the war drums concerning the Ukrainian conflict at a deafening pace.

Near the Ukraine-Romania border, an elite airborne division is “practicing for war” – as a CBS film crew detailed days ago – and is ready to be called up at a moment’s notice. The US Army’s 101st Airborne Division has been deployed to Europe for the first time in almost 80 years amid soaring tension between Russia and the American-led NATO military alliance. The light infantry unit, nicknamed the “Screaming Eagles,” is trained to deploy on any battlefield in the world within hours, ready to fight. See the CBS video report below.

CBS gets an exclusive sneak peak: "The US Army's 101st Airborne is practicing for war with Russia just miles from Ukraine's border"

— Michael Tracey (@mtracey) October 22, 2022

"It's not just about defending NATO territory," correspondent @charliecbs reports. "They're fully prepared to cross over into Ukrainian territory" pic.twitter.com/XE2OfHZV4o

Meanwhile, millions in Ukraine have been plunged into darkness as the Russian army is systemically destroying Ukraine. Will NATO respond? Now more recently, charges of false flags on both sides of the conflict fly. Russian authorities repeatedly have made allegations that Ukraine could detonate a dirty bomb in a false flag attack and blame it on Moscow. Ukrainian authorities, in turn, have accused the Kremlin of hatching such a plan. It’s not like these accusations have not happened before and have become a reality – remember the Nordstream pipeline sabotage attack and the Crimean bridge attack?

The Biden administration has driven America to the brink of a direct conflict on the ground with Russia. No doubt that the US Army’s 101st Airborne Division is a formidable force, and if a major incident happens in Ukraine, they will go in on the fight. The NATO army could do severe damage to the Russian military, giving them few options other than a potential nuclear response.

All the above is set in the context of the most important midterm election in recent times. A potential Red Wave is coming – see here. Leading Republicans signaled that in a future GOP-led house, there would be no “blank check” writing for Ukraine. The Biden war drums are beating so loud that even some Democrats are getting worried. 30 House Democrats urge dramatic shift in Biden’s Ukraine policy. They are saying, “Get serious about diplomacy or risk a nuclear miscalculation.” This is a backhand admission that the Biden administration, from day one, has not sought peace seriously.

Democrats are fully aware of this potential Red Wave that is coming – the economic failures of the Biden administration is one of the key issues. Aside from Nancy Pelosi’s nonsensical comments about inflation, in the following video, one thing she did get right – Democrats have to figure out a way to change the “subject” for the midterms.

NANCY PELOSI: "When I hear people talk about inflation…we have to change that subject!" pic.twitter.com/Ck1DaPVrCc

— RNC Research (@RNCResearch) October 23, 2022

With weakening economic data of Western economies sliding into recession (potentially deep recession), Pelosi’s comments should frighten you. What will Democrats be willing to do in the next two weeks to change the “subject” for the 2022 midterms? Go to war with Russia and risk nuclear war?

None of these war drums have been priced into the markets or the economy.

What could go wrong?

See more Chart of the Day posts.

By Tom Williams