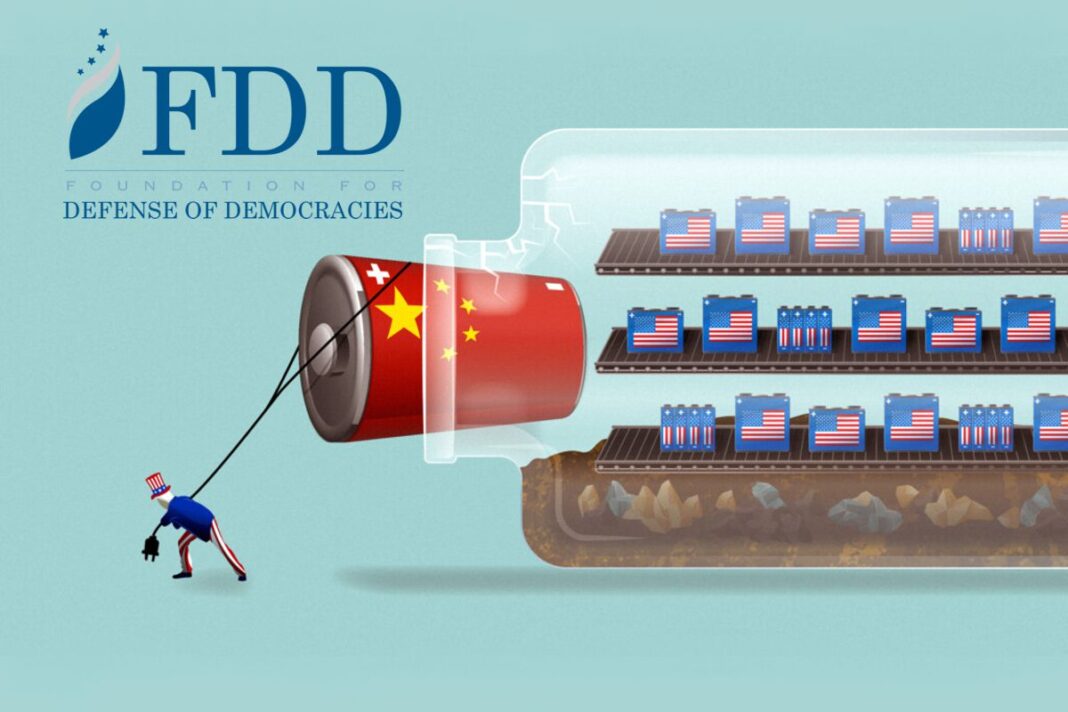

A new report finds that China controls over 80 percent of minerals essential for U.S. military batteries.

China monopolizes over 80 percent of critical raw battery minerals used in U.S. military equipment, posing a serious national security threat, new research has found.

Beijing’s “brute force economics” utilizes a bevy of non-market practices, including price manipulation, export dumping, and intellectual property theft, to build a dominant supply chain of batteries that are essential in cars, cellphones, and U.S. military drones, according to a July 21 report from Foundation for Defense of Democracies (FDD), a Washington D.C.-based think tank.

“In a hot war or even a cold one, Beijing could also weaponize the battery dependence of economic sectors ranging from cars to computers, communications, and construction,” the report said.

China’s current stranglehold requires mining a surplus of critical minerals in the upstream battery production process. As it stands, Beijing makes approximately 85 percent of anodes, 70 percent of cathodes, and a whopping 97 percent of the anode precursors, according to the report, citing data from the International Energy Agency.

Throughout the entire supply chain, bottlenecks are used to weaponize mineral exports for geopolitical leverage. However, diversifying certain minerals is proving to be complicated, especially battery-grade graphite, where China processes more than 95 percent, according to the report.

This is in part owed to China’s lax environmental standards, as the processing is “highly polluting,” and involves “discharging particulates into the air and dumping waste into local waters,” researchers said.

Another strategic hurdle is Beijing’s aggressive state subsidies that make Chinese companies temporarily immune to short-term market effects.

From 2009 to 2023, Chinese authorities spent over $230 billion on electric vehicles and the battery industry through state subsidies and tax breaks, the report said, citing an assessment by the Center for Strategic and International Studies.

That figures, according to the report, “dwarf” the 7.4 billion dollars the United States allocated for EVs through 2017.

“This difference in scale is critical,” the report said. “When subsidies, like those in China, reach the point where profitability is no longer a relevant consideration for an enterprise, companies are capable of leveraging a degree of power that can push out profit-based competitors.”

By James Xu