Critics say the bill will slash economic growth and spur further inflation

Despite Democrats’ claims that the Inflation Reduction Act will ultimately serve to reduce consumer prices and spur economic growth, experts remain divided, with some predicting that the bill will worsen inflation and lead to stagnation in growth.

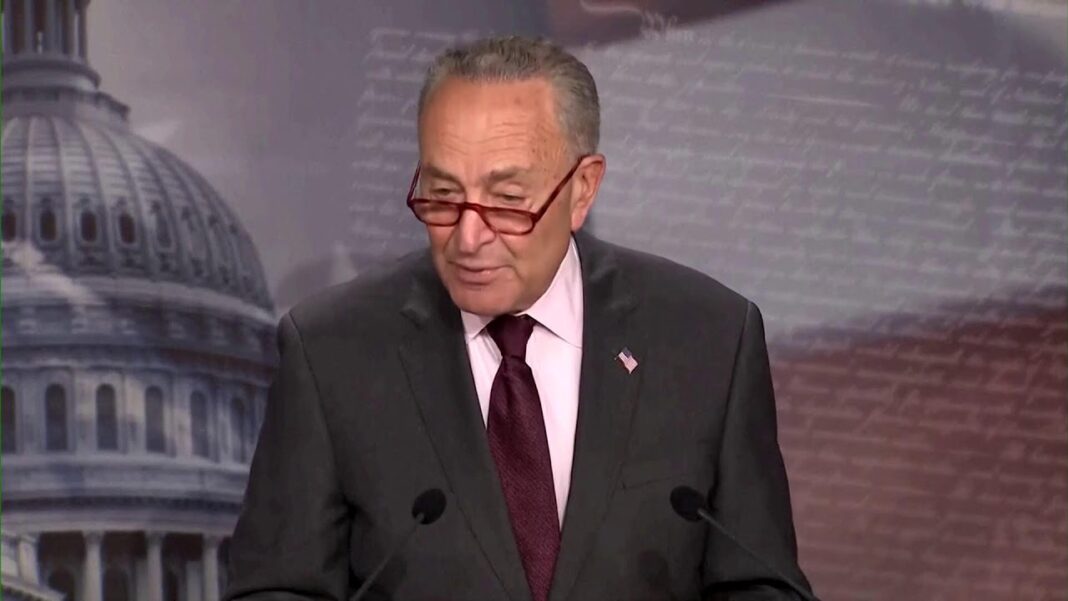

The bill, hammered out as a compromise agreement between moderate Sen. Joe Manchin (D-W.Va.) and Senate Majority Leader Chuck Schumer (D-N.Y.), serves to fulfill a series of broad Democrat aspirations: increasing federal revenue by closing so-called tax “loopholes,” climate change policies, expansion of the Affordable Care Act, commonly known as “Obamacare,” and reducing prescription drug prices.

The Inflation Reduction Act, according to its supporters, will also help to slow the growth of the ballooning U.S. national debt by decreasing the deficit.

Though it authorizes around $433 billion in new spending, Democrats’ internal estimates suggest that the bill will bring in around $725 billion in new revenue to the federal government, thus reducing the federal deficit and slowing the growth of national debt. Specifically, Democrats estimate that the bill will reduce the deficit by around $292 billion annually.

President Joe Biden issued a statement on July 27 expressing support for the new proposal, which he called “the action the American people have been waiting for.”

“This addresses the problems of today—high health-care costs and overall inflation—as well as investments in our energy security for the future,” Biden said.

IRS to Receive $80 Billion for Stricter Tax Code Enforcement

Proponents of the measure hope to offset the cost of new spending in the bill by altering the tax code, which would then be enforced by a substantially bulked-up Internal Revenue Service (IRS), which is set to gain around $80 billion through the package.

Among other provisions, the bill would impose a new 15 percent minimum tax rate on all corporations that bring in more than $1 billion per year. Though the current corporate tax rate is technically 21 percent, Democrats say that the new minimum tax rate will target large corporations who pay substantially less than 21 percent by using loopholes.

By Joseph Lord