Flash consumer sentiment also rose to its highest level in five months.

Americans are less worried about the economy and inflation as they shrug off President Donald Trump’s tariffs, according to the University of Michigan’s preliminary July survey.

The one-year inflation outlook, released on July 18, decreased to 4.4 percent from 5 percent in June, marking the second consecutive monthly decline. Likewise, the five-year forecast eased to 3.6 percent from 4 percent.

Expectations for short- and long-term inflation levels have come down from their two-decade highs and returned to pre-tariff levels.

“Both readings are the lowest since February 2025 but remain above December 2024, indicating that consumers still perceive substantial risk that inflation will increase in the future,” Joanne Hsu, the university’s director of consumer surveys, said in the report.

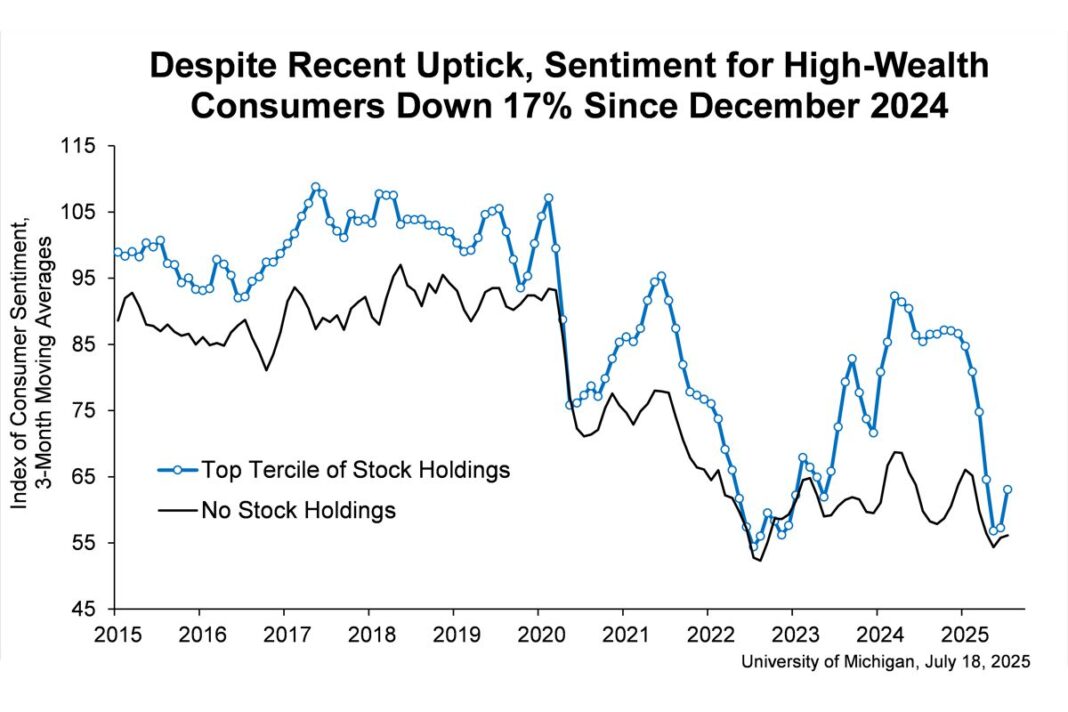

The Consumer Sentiment Index rose to its highest level since February, increasing to 61.8 from 60.7 in June. It has rebounded after cratering to near record lows in April and May, with this month’s reading topping the consensus estimate.

The flash estimate also revealed that consumers’ view of current economic conditions climbed to a higher-than-expected 66.8 from 64.8 in June. Additionally, economic expectations crept up to 58.6 from 58.1, surpassing market expectations.

However, the public’s confidence in the economy is unlikely to return to pre-tariff levels until they believe trade policy has stabilized and inflation will not worsen, Hsu noted.

“At this time, the interviews reveal little evidence that other policy developments, including the recent passage of the tax and spending bill, moved the needle much on consumer sentiment,” she said.

The next two gauges of consumer confidence—the Conference Board’s Consumer Confidence Index and the RealClearMarkets/TIPP Economic Optimism Index—could also show a bounce back following last month’s retreat.

By Andrew Moran