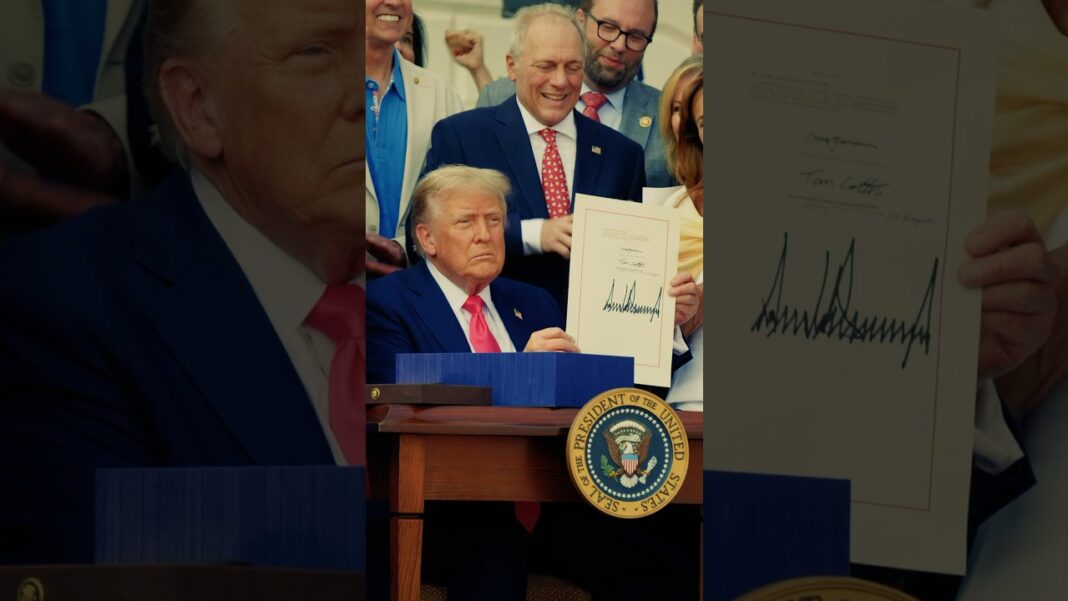

The One Big Beautiful Bill Act delivers new tax breaks, bigger deductions, and no-tax-on-tips rules.

The One Big Beautiful Bill Act (OBBB) provided many new tax provisions. Some extended the 2017 Tax Cuts and Jobs Act (TCJA) laws that were soon to sunset. But new deductions and tax cuts are also now possible because of the OBBB.

From no taxes on tips to an increased standard deduction for seniors, the OBBB provided something for every age group. Here are some of the highlights.

Increased Senior Standard Deduction

For those taxpayers 65 and older, a $6,000 additional deduction is available for singles and $12,000 for married couples filing jointly. This deduction is in addition to the current additional standard deduction for seniors, according to the IRS. The current senior deduction is $1,950 for singles.

These additional senior deductions also layer over the standard deduction. For 2025, the IRS standard deduction is $15,000 for singles and $30,000 for married couples filing jointly.

Although it will be indexed to inflation, that means that the standard deduction plus senior deductions come to approximately $22,950 for a single filer who is 65 or older.

The new senior deduction can be used whether you take the standard deduction or you itemize.

The $6,000 senior deduction is in effect until Dec. 31, 2028, unless renewed by Congress. It also phases out for taxpayers with modified adjusted gross income over $75,000 ($150,000) for joint filers.

Form 1099-K Reporting Threshold

Receiving Form 1099-K from a third-party settlement organization (TPSO) has been controversial for the past few years. A TPSO is a payment app like Venmo, Square, or PayPal. It could also be an online marketplace like eBay or Facebook Marketplace.

For tax years 2023 and prior, you would only receive a 1099-K if your payments through the app totaled more than $20,000 and you had at least 200 transactions.

But that was changed to $600. Protests from both taxpayers and TPSOs forced the IRS to implement a more gradual means to reach the $600. The agency lowered it per year.

- $5,000 in 2024

- $2,500 in 2025

- $600 in 2026 and after

The OBBB did away with this plan. The permanent threshold for receiving a 1099-K from a payment app or online marketplace is back to $20,000 and 200 transactions.

Despite not receiving a 1099-K, taxpayers are still responsible for declaring income on their tax returns.

By Anne Johnson