Commentary

Tariffs are going up, and internal taxes are coming down in the United States. That makes sense to S&P, which held the U.S. credit rating at AA+/A-1+, with a stable outlook for the coming years.

Tariffs, a stable economy, and credible and effective monetary policy were clinchers that undergird the strong U.S. rating.

“The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” according to the ratings company in its most recent report on the United States.

“This incorporates our view that changes under way in domestic and international policies won’t weigh on the resilience and diversity of the U.S. economy. And, in turn, broad revenue buoyancy, including robust tariff income, will offset any fiscal slippage from tax cuts and spending increases.”

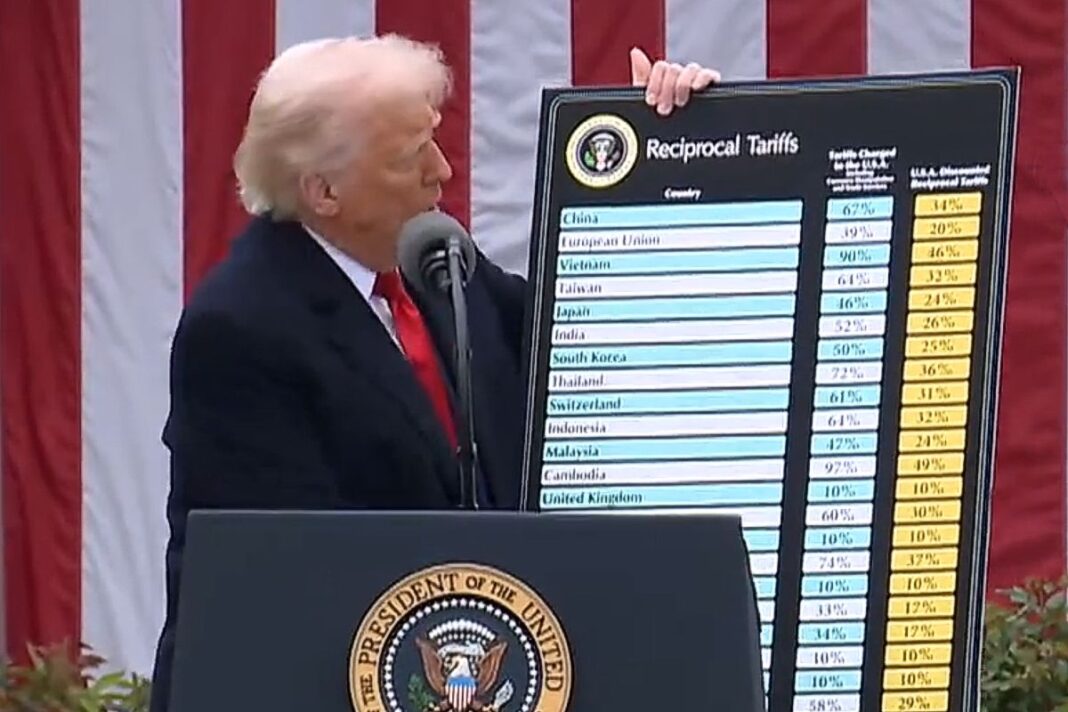

Tariffs will help hold government revenues at approximately the same level despite lower internal taxes on individuals and corporations. Tariffs, a form of external tax on imports, encourage companies to reshore at least some of the manufacturing they previously exported to other countries. Tariffs will provide approximately $300 billion annually in government revenue, arguably along with more U.S. jobs in the long run. They have not led to the massive predicted increase in inflation due to inexpensive supply chain shifts.

Tariffs give the U.S. government bargaining leverage with foreign governments on a broad range of issues, from trade and Israel to fentanyl smuggling and illegal immigration. This is a source of influence that the United States formerly denied itself due to the ideology of complete free trade that gave authoritarian countries like China and Russia a free pass to the lucrative U.S. market. As the United States is one of the world’s top importers, the U.S. government’s ability to impose tariffs can disincentivize these and other countries from adopting anti-U.S. policies, including anti-U.S. economic alliances such as BRICS (Brazil, Russia, India, China, and South Africa).

Two of the most important trade issues that the United States has used tariffs to influence are bringing rare earth element (REE) and pharmaceutical manufacturing back home to the U.S.A. Both could be used for leverage against the United States in case of war with China, as the United States is dependent on them for our economic and human health. Automobile assembly lines and patients who require antibiotics, for example, currently depend on REE and pharmaceutical imports from China.

By Anders Corr