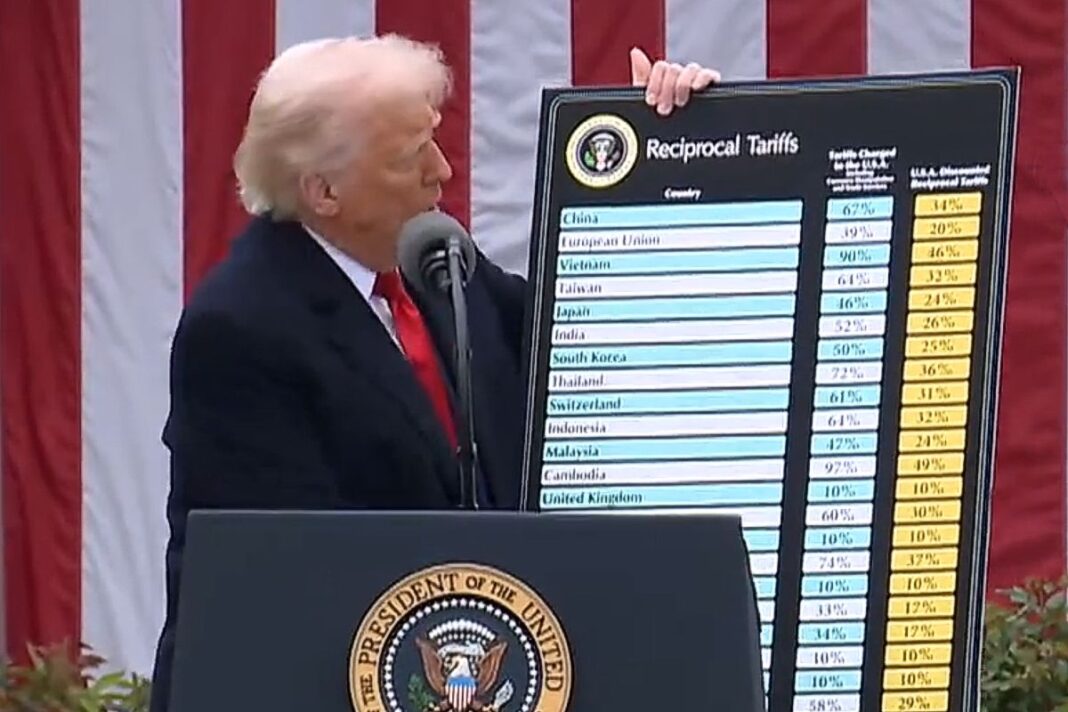

Trump has criticized India’s reliance on Russian energy and defense imports, noting that the United States has sold ’very little’ to the South Asian nation.

President Donald Trump said on Sept. 1 that India has offered to cut its tariffs on U.S. products to zero, describing the move as a long-overdue step to correct what he called decades of one-sided trade.

In a post on Truth Social, Trump said that India has long benefited from selling “massive amounts of goods” into the U.S. market while U.S. companies face barriers to entry into India.

He blamed what he said were the highest tariffs of any country for keeping American businesses out, calling the situation “a totally one-sided disaster.”

Trump also criticized India’s reliance on Russian energy and defense imports, saying the United States has sold “very little” to India by comparison.

“They have now offered to cut their tariffs to nothing, but it’s getting late,” Trump wrote, adding that the change “should have been done years ago.”

The Epoch Times has reached out to India’s Ministry of External Affairs for comment on Trump’s remarks and for more details on New Delhi’s zero-tariff offer.

Tariff Friction With Washington

Trump’s latest remarks come amid simmering trade tensions with New Delhi.

Washington initially imposed a 26 percent tariff on Indian imports in April to pressure New Delhi to lower its trade barriers. The rate was later revised to 25 percent, though Trump threatened to impose another 25 percent levy over India’s continued purchases of Russian oil and weapons. This additional levy recently went into effect—with current U.S. tariffs on Indian goods standing at 50 percent.

India’s tariffs against the United States have been a long-running irritant for Washington.

A U.S. Trade Representative report said average duties on U.S. products exceed 113 percent and can reach 300 percent on sensitive farm goods. Applied agricultural rates average about 39 percent, while U.S. exporters also face non-tariff barriers such as strict dairy certifications, non-GMO rules, and complex customs procedures.

By Tom Ozimek