Collections top $151 billion for the fiscal year to date as Trump’s trade policy enters a critical phase ahead of the Aug. 1 reciprocal tariff deadline.

Tariff revenues hit a new monthly record in July, topping $28 billion and lifting collections for the fiscal year to date to more than $151 billion, according to Treasury data.

The latest Daily Treasury Statement, released on July 29, shows July’s haul surpassing the previous record of $27 billion set in June.

President Donald Trump has said the higher duties will substantially boost government revenue.

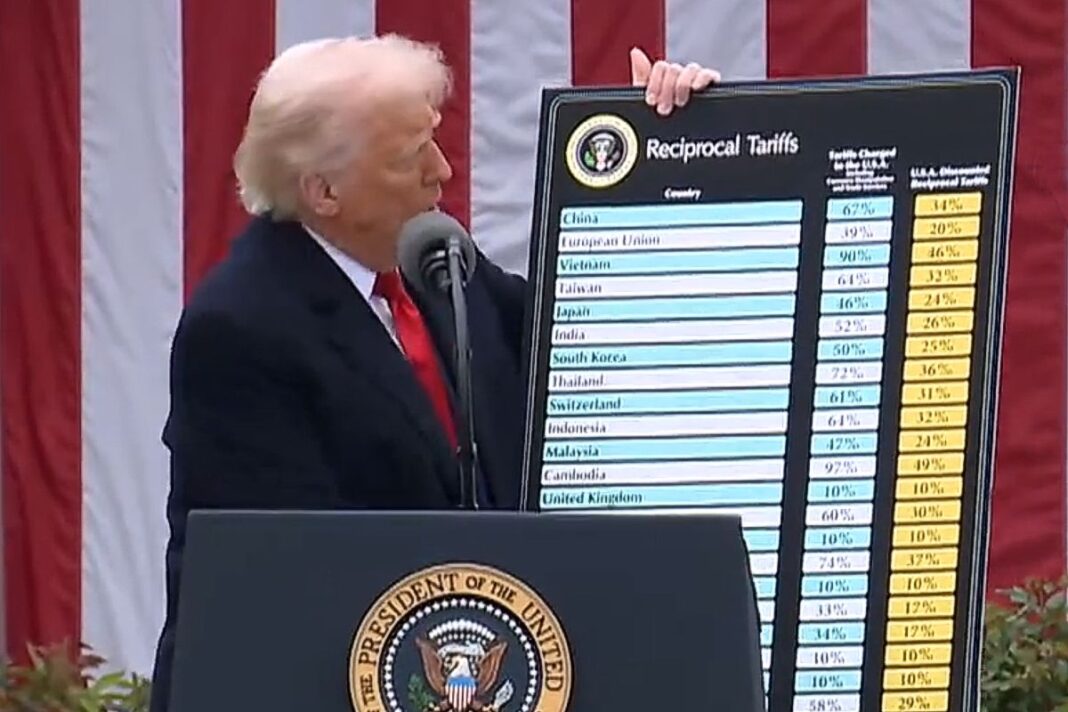

“The big money will start coming in on Aug. 1,” he said during a July 8 Cabinet meeting, referring to reciprocal tariffs scheduled to take effect against dozens of trading partners unless they strike last-minute deals with Washington.

In the days leading up to the Aug. 1 deadline, Trump announced a 25 percent levy on India—citing its purchases of Russian energy and weapons—and a 15 percent duty on South Korea, aligning it with Japan’s rate.

Despite Trump’s insistence that the Aug. 1 deadline is fixed, aides have hinted at potential flexibility once the new tariffs take effect. Commerce Secretary Howard Lutnick told reporters this week that the president is “always willing to listen” to countries seeking adjustments after Aug. 1, signaling that tariff rates could be modified later in response to trade negotiations or concessions.

In light of soaring tariff revenues, Trump has floated the idea of sending rebate checks to taxpayers, telling reporters on July 25, “We have so much money coming in, we’re thinking about a little rebate.”

Treasury Secretary Scott Bessent has projected that tariff collections could reach $300 billion by year’s end, roughly double current levels.

When asked whether he believes Bessent’s projections to be realistic, Sergio Altomare, cofounder of Hearthfire Holdings, called the estimate “aggressive” and said that “the trajectory certainly makes sense.”

“More importantly, though, the focus shouldn’t be on the number itself, but on the underlying trend,” Altomare told The Epoch Times in an emailed statement, while framing the tariffs in broader, structural terms.

“What we’re seeing is not just a trade tweak—it’s a structural shift in capacity, resilience, and dignity in work.”

He described Trump’s trade policies as “the beginning of a structural shift” to revive industrial jobs such as line technicians, machinists, and skilled trades, which were gutted in globalization’s offshoring push.

By Tom Ozimek