Spanning nearly 1,000 pages, the measure includes permanent tax changes and provisions affecting families, seniors, and businesses.

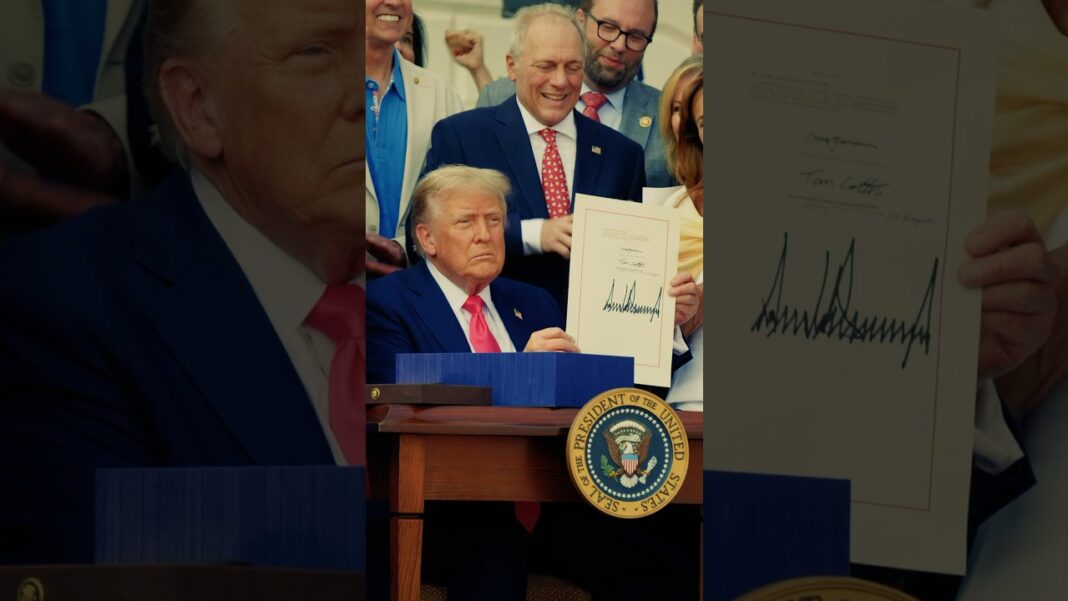

The One Big Beautiful Bill Act, which President Donald Trump signed on Independence Day, ushers in significant changes to Americans’ personal finances.

Spanning nearly 1,000 pages, the legislation locks in Trump’s 2017 tax cuts and introduces new tax breaks—including deductions for tips, overtime pay, and auto loan interest—while also offering a special $6,000 deduction for seniors who receive Social Security.

At the same time, the Republican-backed bill enacts significant cuts to social programs such as Medicaid and food assistance, eliminates tax incentives for clean energy, and overhauls the federal student loan system.

Speaking ahead of the final vote, House Speaker Mike Johnson (R-La.) said, “For everyday Americans, this means real, positive change that they can feel.”

Here is what the measure could mean for your wallet.

Tax Cuts

At the heart of the legislation is the permanent extension of the tax cuts first enacted under the Tax Cuts and Jobs Act of 2017 during Trump’s first term. That law reduced marginal tax rates across the board, with most brackets seeing cuts of roughly 2 percent to 4 percent.

Those tax cuts were set to expire after 2025 without congressional action, which could have resulted in higher taxes for more than 60 percent of taxpayers by 2026, according to a 2024 Tax Foundation report. The One Big Beautiful Bill Act not only preserves those tax reductions, but also enhances several key provisions.

The standard deduction will increase to $15,750 for single filers and $31,500 for married couples filing jointly. The estate and gift tax exemption rises to $15 million for individuals and $30 million for couples. The child tax credit grows to $2,200 per child starting in 2025, with up to $1,700 refundable and future increases indexed to inflation.

New Parents

One of the bill’s novel features is the creation of new “Trump Accounts” for children born between 2025 and 2028.

Under the provision, the federal government will make a one-time $1,000 deposit for every eligible child who is a U.S. citizen. Parents can contribute up to $5,000 annually, with investments growing tax-deferred in a fund that tracks a U.S. stock index. Employers can also chip in up to $2,500, contributions that will not count as taxable income for the employee.

Withdrawals from the accounts will be taxed as long-term capital gains if used for qualified purposes.

By Tom Ozimek