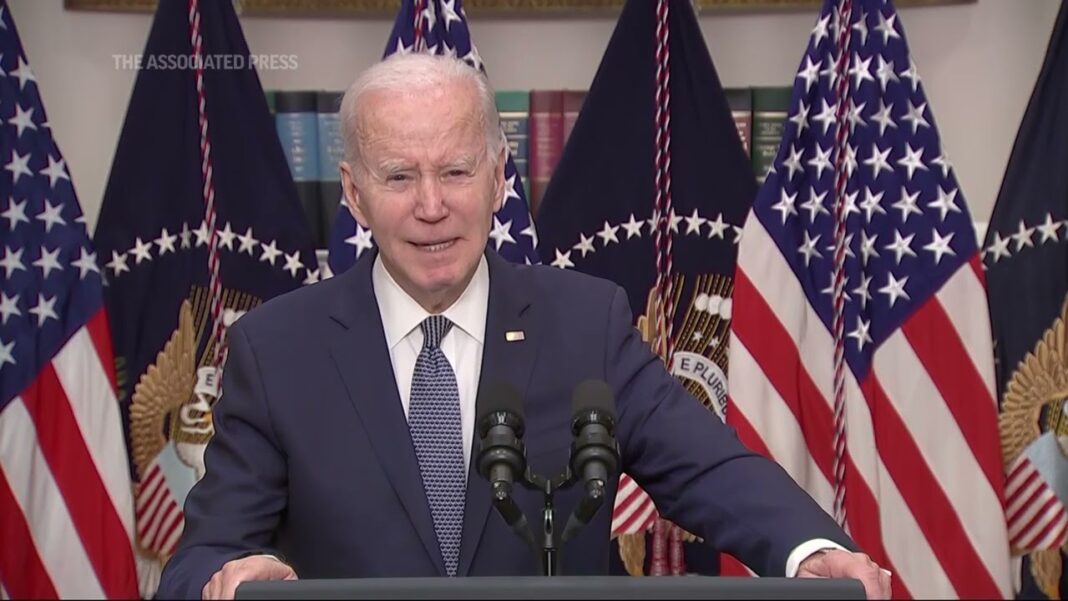

President Joe Biden on Sunday issued a statement on the failures of Silicon Valley Bank (SVB) and Signature Bank, insisting that the U.S. financial system is “safe” after the Federal Reserve rolled out an emergency lending program to stabilize the banking system.

It comes after the Federal Deposit Insurance Corporation (FDIC) expanded its deposit insurance coverage at the two failed banks so depositors won’t lose any money.

Biden said in a statement on Sunday that Treasury Secretary Janet Yellen and his top economic adviser Lael Brainard worked with banking regulators to mitigate any potential financial fallout from the failures of SVB and Signature Bank.

“I am pleased that they reached a prompt solution that protects American workers and small businesses, and keeps our financial system safe. The solution also ensures that taxpayer dollars are not put at risk,” Biden said.

“The American people and American businesses can have confidence that their bank deposits will be there when they need them,” Biden added, while pledging to hold those “responsible for this mess” fully accountable.

U.S. financial authorities worked on several fronts to stem any potential fallout from the twin failures, which sparked fears of bank runs and contagion that could threaten broader financial system stability.

‘Systemic Risk Exception’

The FDIC said it will carry out the orderly wind-down of SVB—in a process known as resolution—in a way that “fully protects all depositors” on the basis of a special “systemic risk exception” that lets the FDIC temporarily expand its deposit insurance coverage over and above what’s normally a $250,000 per account cap.

“Depositors will have access to all of their money starting Monday, March 13,” the FDIC said in a joint statement with the Fed and Treasury.

This means that all depositors are set to receive all their money back, rather than facing the prospect of having to take losses on the uninsured portions of their deposits, normally anything above the $250,000 limit.

The same “systemic risk exception” has been adopted for Signature Bank, which was closed Sunday by New York state chartering authorities.

By Tom Ozimek