KEY TAKEAWAYS

- The bipartisan group of senators that just passed a $1.1 trillion federal infrastructure bill is attempting to sell it as a reasonable, centrist compromise.

- If approved by the House, the bill would immensely expand the size and power of the federal government, among other issues.

- Besides all the abominable policies, the trillions in new taxes necessary to fund both bills would cripple the American economy.

The bipartisan group of senators that just passed a $1.1 trillion federal infrastructure bill is attempting to sell it as a reasonable, centrist compromise. Yet it is neither reasonable nor centrist.

If approved by the House, the bill would immensely expand the size and power of the federal government, waste hundreds of billions of taxpayer dollars on things that aren’t federal responsibilities, and promote expensive, far-left causes like climate change and taxpayer subsidies for green energy companies.

But that’s not all.

Take that $1.1 trillion infrastructure bill and add to it a second bill that’s more than triple the cost, waste, and government expansion—a $3.5 trillion budget bill (the largest in history) that “has to” be passed along with the infrastructure bill.

9 Things You Need to Know About the Budget Resolution’s Reckless Tax and Spending Spree

Improving America’s infrastructure is certainly a worthwhile goal. But this infrastructure bill won’t deliver on its promises because of its failure to properly prioritize projects. For example, things like mass transit and Amtrak would get about the same amount that’s allocated for highways, even though buses and rail account for only a tiny fraction of Americans’ travel.

The bill also includes exorbitant amounts of taxpayer-funded corporate welfare for the energy sector, including grants and loan guarantees for politically favored companies and technologies.

And the bill spends nearly $65 billion to expand broadband internet service. While improving broadband may be worthwhile, it’s not public infrastructure the way roads and bridges are. Additionally, nearly $3 billion of that would go toward “achieving digital equity,” which includes ensuring that prisoners have high-speed internet. Is providing prisoners premium broadband a higher priority than directing those billions to fix crumbling bridges?

Lawmakers want to pay for the bill’s spending in ways that are inappropriate or will never raise the amount of money needed to cover its costs.

One of the worst pay-for gimmicks is known as “pension smoothing,” and it puts the costs on the backs of millions of the nation’s employees. The bill will allow corporations to reduce the amount they are required to contribute to their employees’ pension funds and instead use that money to increase their profit margins.

Why would politicians promote such behavior? Because while it shortchanges pension funds by about $9 billion, the federal government gets to tax the resulting corporate revenue.

But as bad as the infrastructure bill is, the really egregious part is that those controlling Congress have said that they won’t allow the bill to reach the president’s desk unless a $3.5 trillion budget package is passed along with it.

The budget package would be the largest tax-and-spend bill in history, and they propose paying for it by dramatically increasing taxes on businesses and investments—at the same time we are trying to spur a post-pandemic economic recovery.

You may remember that the tax cuts on businesses in 2017 led in part to the lowest unemployment rates in 50 years and higher wages for even the lowest income earners. This bill will reverse much of that.

Additional harmful elements of the $3.5 trillion plan (and there are many more than I have the space to mention here) include the largest expansion of welfare benefits since the 1960s. As the former Virginia Secretary of Health and Human Resources who successfully reformed the state’s welfare program in the 1990s, I can say without hesitation that the policies created by this welfare expansion will harm both recipients and society. They discourage recipients from looking for work, promote even more dependency on government, and create generational poverty.

The budget agreement would also make much of the Green New Deal climate change agenda a reality, providing huge amounts of taxpayer-funded corporate welfare to favored green industries, even though the science shows that such initiatives actually generate few environmental benefits.

The bill would also expand government subsidies for the Affordable Care Act and expand control over existing health programs, moving America that much closer to government-run health care and reducing consumer choices.

6 Troubling Leftist Wins in $1.1 Trillion Infrastructure Bill

Moreover, it would give amnesty to illegal immigrants. Apparently, in Washington’s upside-down world, amnesty is now considered a budget item.

Besides all the abominable policies, the trillions in new taxes necessary to fund both bills would cripple the American economy.

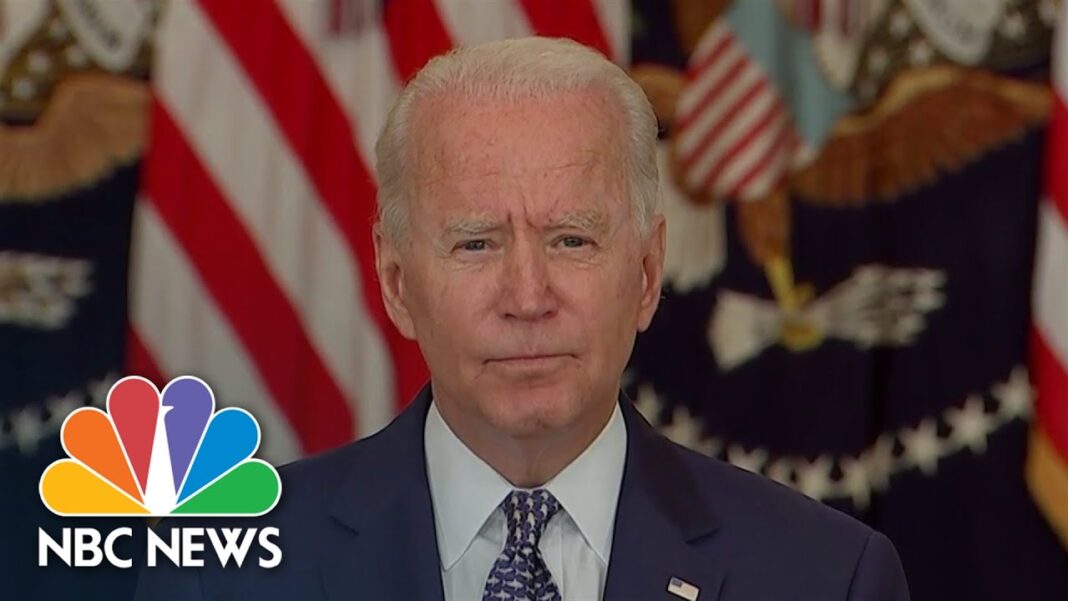

President Biden says the tax increases would be borne by businesses and the rich, but raising taxes on businesses hurts all Americans, especially poor and working families. The simple fact is that companies have to pay for higher taxes somehow, and they usually do it by charging higher prices, lowering wages, or investing in operations and jobs overseas where taxes are cheaper.

In the end, this massive two-bill package would increase costs for American families, chase jobs out of the country, add trillions to the debt, and concentrate more power in the federal government. It’s filled with false promises of new “free” benefits that are only possible through higher costs and less liberty for every American.

By Kay C. James

President of The Heritage Foundation

Read Original Article on Heritage.org