President Emmanuel Macron upped the retirement age from 62 to 64 and placed further restrictions on collecting a full pension. He did this unilaterally, by decree.

Under the French constitution, the president can enact laws without a vote in Parliament if he can survive a vote of no confidence. Macron barely survived a vote of no-confidence by just nine votes. 278 voted in favor, with 287 needed.

Macron’s move has sparked nationwide protests, not just for raising the retirement age but the perceived un-democratic process Macron followed. See a couple of Tweets showing some of the protests in France.

Protests continue across France against President Macron's bill to increase the retirement age from 62 to 64. @carolineconnan explains what's at stake pic.twitter.com/gEjnKpS5Vv

— Bloomberg Politics (@bpolitics) March 25, 2023

Millions of people on the streets in Paris. They want Dictator Emmanuel Macron to resign. 🇫🇷

— Dr. Anastasia Maria Loupis (@DrLoupis) March 24, 2023

This will be happening worldwide when people understand what evil the WEF is. 🔥🔥🔥pic.twitter.com/oH8Q4JW5T6

This is not just a French issue. Recently in the US, President Joe Biden has been gaslighting Americans, telling them that they can have it all – to buy votes, of course. Biden has attacked Republicans in recent months for positions the president himself once held on Social Security and entitlement programs, including sunset bills and raising the retirement age. Though today Biden is playing politics, saying he won’t touch Social Security, the reality is that he will have no choice. See Biden from the past in the video below.

BIDEN on SOCIAL SECURITY:

— RNC Research (@RNCResearch) March 29, 2023

“Raising the cap, raising the retirement age for people who are now 30 years old, raising the tax on Social Security, cutting benefits — they're all things that have to be discussed, quite frankly.” pic.twitter.com/HHQwrBngQc

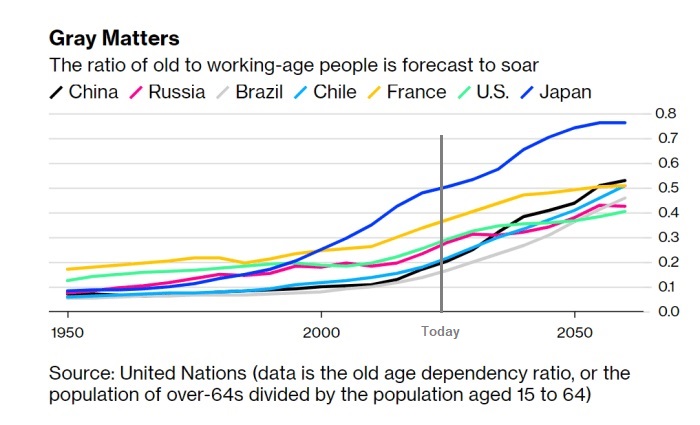

The world’s population of people aged 60 years and older is expected to double by 2050, according to the World Health Organization, while fertility rates are in long-term decline. The financial strain is challenging old-age support systems and leaving many countries facing tough choices about raising the age of retirement, cutting benefits, or lifting taxes.

Pension shortfalls will be the equivalent of about 23% of world output by 2050, the Group of 30 consultancy estimated. One key measure is the old-age dependency ratio – the number of older people compared to the population that is working age.

In Europe and North America, that ratio will be about 50 per 100 by 2050, according to UN forecasts, a rise from 30 per 100 in 2019. In short, we’re on a trajectory toward a smaller share of people paying taxes and a higher proportion drawing pensions. By 2035, the basic US system known as Social Security will no longer be able to cover payments, forcing a 20% reduction in benefits, according to its trustees.

See the old-age dependency ratio in the US and selected countries in the chart below and learn more here. Take particular notice that the slope of this curve has just started to accelerate and will only get worse in the years to come.

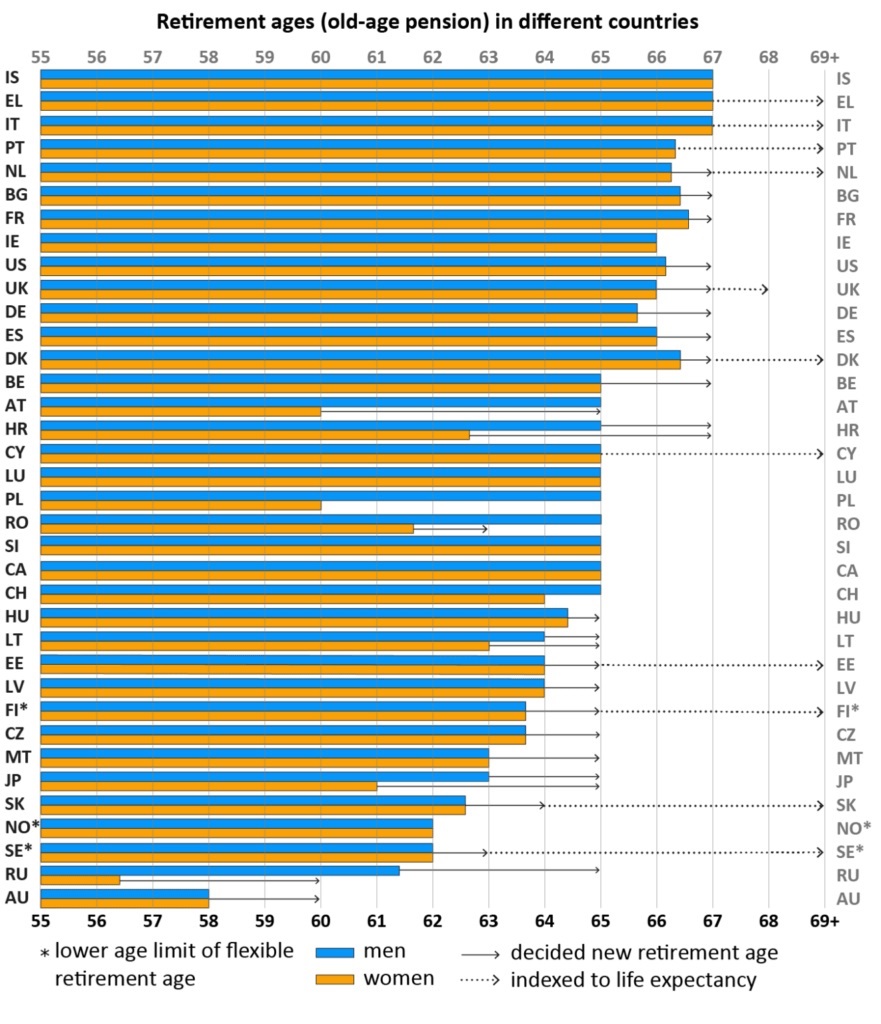

France is not alone, but certainly late to the global movement to raise retirement ages to meet the challenge. In the chart below, see where the US sits along with other countries in terms of current retirement ages and where the retirement age potential could arrive – learn more here.

Can you imagine a bricklayer retiring at 70? Or a brain surgeon working on you at that same age. The unfortunate reality is that demographics will drive the need to either raise retirement ages or require more taxes/funding of public and private pension plans in order to keep them solvent to pay benefits relative to what has been paid in the past.

Protest or not, this issue is not going away.

See more Chart of the Day posts.

By Tom Williams