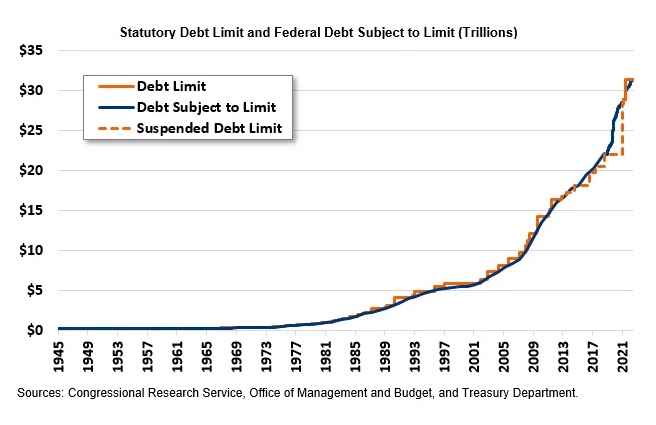

The federal debt ceiling was raised in December of 2021 by $2.5 trillion to $31.381 trillion, which is expected to last until January 19, 2023, according to a letter from Treasury Secretary Janet Yellen to Congressional leaders.

At that point, the Treasury Department will begin using accounting tools at its disposal, called “extraordinary measures,” to avoid defaulting on the government’s obligations, which Secretary Yellen indicates should allow for continued borrowing until at least early June. At the point of exhaustion of those measures, absent a new agreement to either raise or suspend the debt ceiling, the Treasury will be unable to continue paying the nation’s bills, and the U.S. will default. See below the history of the debt ceiling over the past decades and learn more here.

House Speaker Kevin McCarthy has laid out an opening gambit in what is likely to be a lengthy battle over the debt ceiling, suggesting that Republicans are open to a deal – but at a very high price.

On April 17, 2023, McCarthy told a gathering at the New York Stock Exchange that the Republican-controlled House would vote “in the coming weeks” on a bill to “lift the debt ceiling into the next year.” The catch? The Democrats would have to agree to freeze spending at 2022 levels and roll back regulations, among other conditions.

See the below video of House Speaker Kevin McCarthy, R-Calif., delivering a floor speech to unveil the Limit, Save, Grow Act, Republicans’ proposed plan to raise the debt limit into the next year.

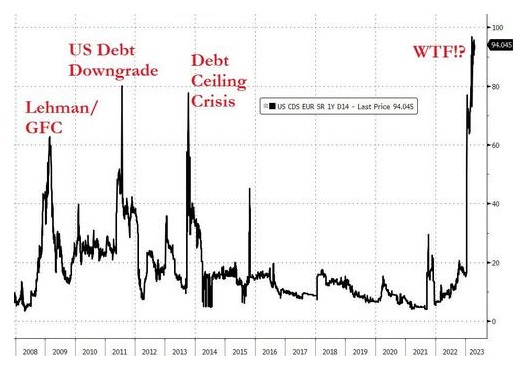

Meanwhile, markets are getting nervous. The US Sovereign credit risk spread is hovering right at record highs – see this in the chart below and learn more here.

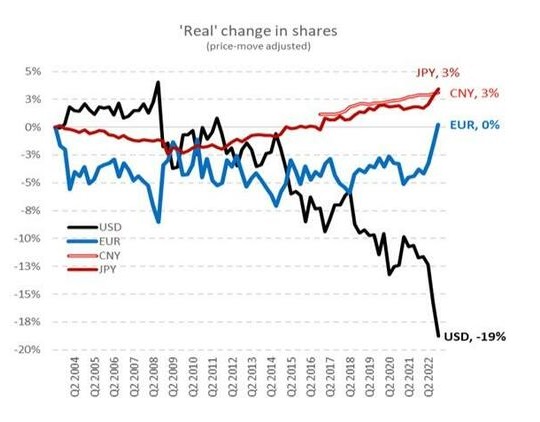

Longer term, our politicians seem to be doing everything in their power to sink the dollar as the world’s reserve currency. The dollar is losing its reserve status at a faster pace than generally accepted, as many analysts have failed to account for last year’s frantic swings in exchange rates. The dollar’s share of official global reserve currencies has gone from about 73% in 2001 to around 55% in 2021. See this in the chart below and learn more here.

Notice in the above chart since Obama – the dollar has been losing its standing as the world’s reserve currency on a slow trendline downward. Since the Biden administration has come onto the scene, the dollar’s standing has accelerated further downward. It is almost as if it is by design.

Can our politicians ever get a handle on the US debt? The answer is NO if we keep listening to silly advice from the likes of Joe Biden. Biden recently said, “I’m sick of this stuff … the American people think the reason for inflation is government spending more money. Simply not true!” See his ludicrous comment in the video below.

Biden: "I'm sick of this stuff … the American people think the reason for inflation is government spending more money. Simply not true!"

— RNC Research (@RNCResearch) March 11, 2022

🤔 pic.twitter.com/Xak7CKTjFs

Obviously, Biden is oblivious to data and what the markets are saying. So what are the Republicans doing – masterful negotiations or a giveaway to Democrats? Give us your take in the comment section below.

See more Chart of the Day posts.

By Tom Williams