The US banking system is suffering its worst banking crisis since 2020. Silicon Valley Bank, aka SVB, about a month ago was the initial trigger point. Some believed that the contagion would drive an even bigger bank crisis. So far, it has not. Or so it seems.

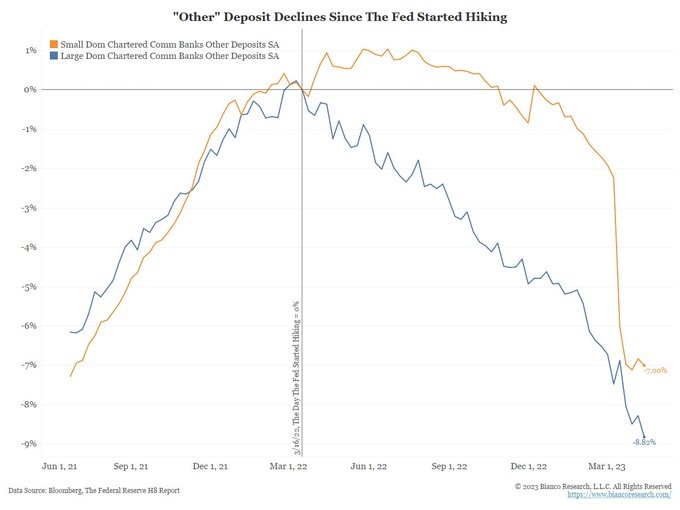

The reality is the “bank runs” continue, though they are more like “bank walks.” What we have been seeing is a mass exodus of deposits at banks for Money Market mutual funds. See this in the series of charts below and learn more here.

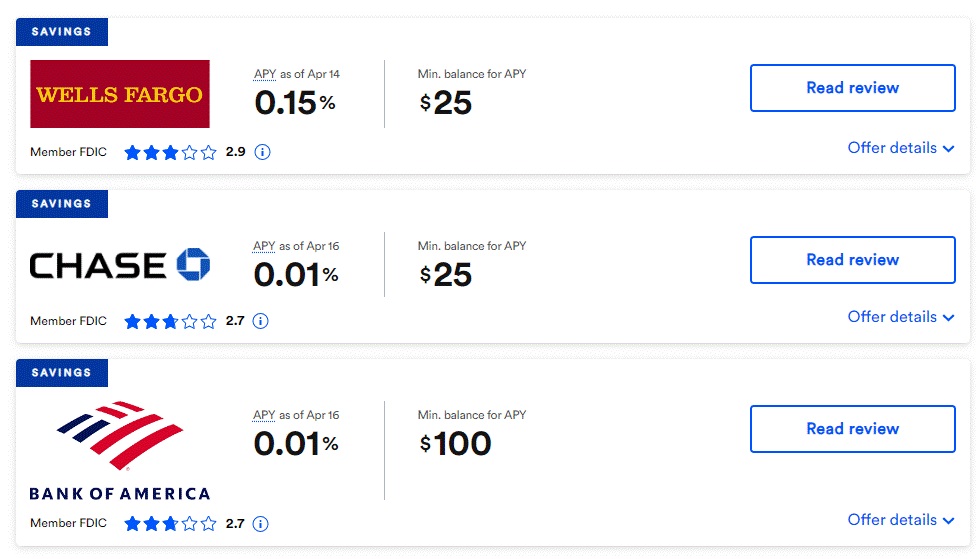

So why the exit of bank deposits to Money Market funds? One can only look at what banks are offering to their saving depositors. The rates being offered by banks are a mere pittance of what can be obtained in the Money Markets. See recent rates being offered to savers at banks in the infographic below.

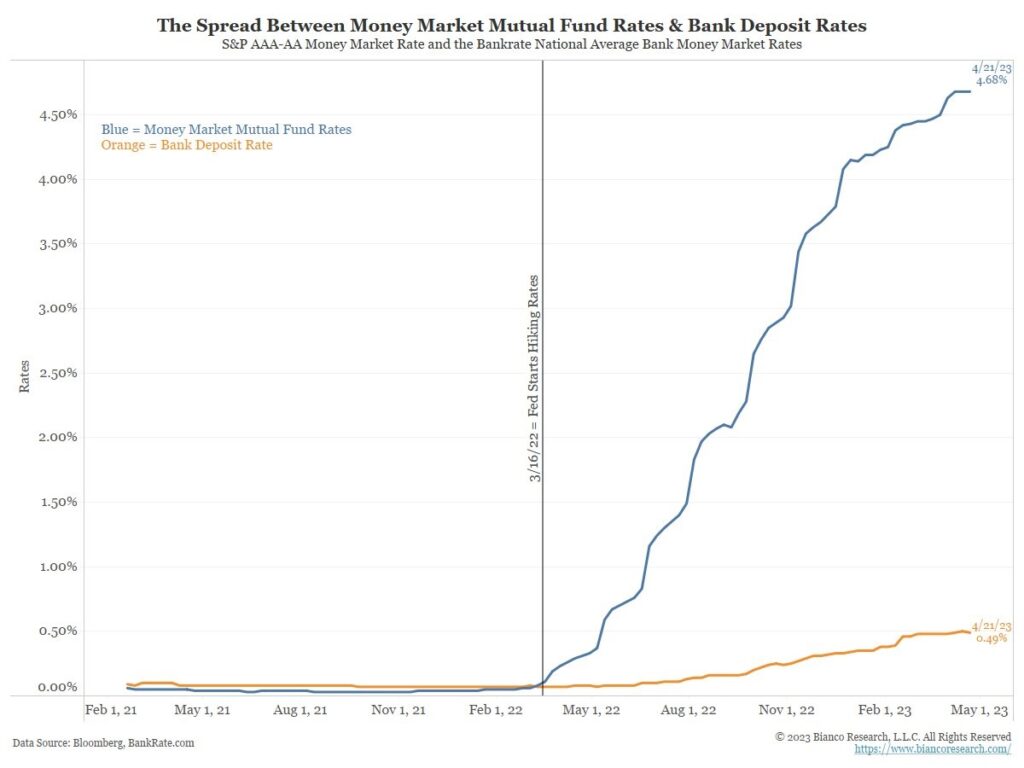

Below is a chart that shows the growing spread between Money Market funds and savings deposit rates. There is about a 4% difference – so why deposit money in a bank savings account instead of parking your money in Money Market funds?

So what is the effect of this wide variance between bank savings rates and Money Market rates? Unfortunately, due to the speed of the Fed-induced interest rate rises, banks are caught in longer-dated assets and can not offer their savers the better Money Market rates – at least until their assets mature, which could take years.

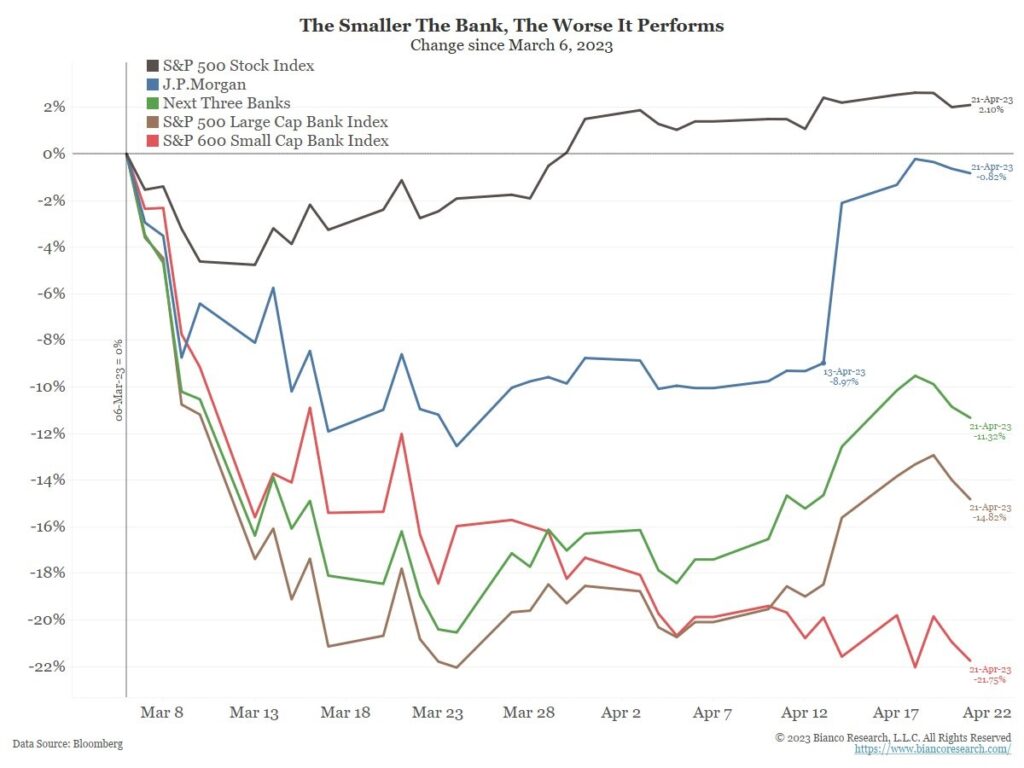

The net effect on banks is that they will not be able to have better profitable outcomes and will seek other measures to boost their earnings. In the chart below, one can see the poor performance of the bank stock sector – bigger banks are doing better than the smaller ones.

Not many will be crying for the sufferings of the banking industry – but does it have any effect on the rest of the people? Unfortunately, it will have negative effects on the rest of us. Not only will savers receive suboptimal savings rates, but the banks will also seek additional revenues with higher banking fees.

With poorer performing banks, especially at the local smaller community banks, they will be less eager to loan money, as much of the money has left for Money Market funds and not left at the bank. Less loan origination means slower growth for the economy – as bank lending is the engine of growth, especially at the local level.

The pressure of slower economic growth may cause the Fed to pause its current rate hike cycle, though on the other side of the coin of this effect, will be a less inflation-fighting Fed. One doesn’t have to tell the American people the drastic effects inflation has already had on their pocketbooks over the last several years.

This could be a virtuous negative cycle that feeds on itself, resulting in grinding stagflation – or worse. Add in a debt ceiling debate from Congress, could government inflation-creating stimulus be close behind?

What could go wrong?

By Tom Williams