There is an observed a phenomena of our time that is most perplexing and frustrating. From Google AI:

“The Dunning-Kruger effect is a cognitive bias where people with low ability at a task overestimate their competence, while those with high ability underestimate their competence. Essentially, those who know the least tend to think they know the most, while experts often underestimate how much they know.”

“Why Stupid People Think They’re Smart – The Dunning-Kruger Effect” – Philosophy Coded

Essentially we have some of the dumbest people on the planet lecturing and preaching to us about right over wrong while those who truly know right from wrong remain relatively silent and/or go unreported. Put another way, the liars are yelling the loudest while those who speak the truth remain either silent or go unheard.

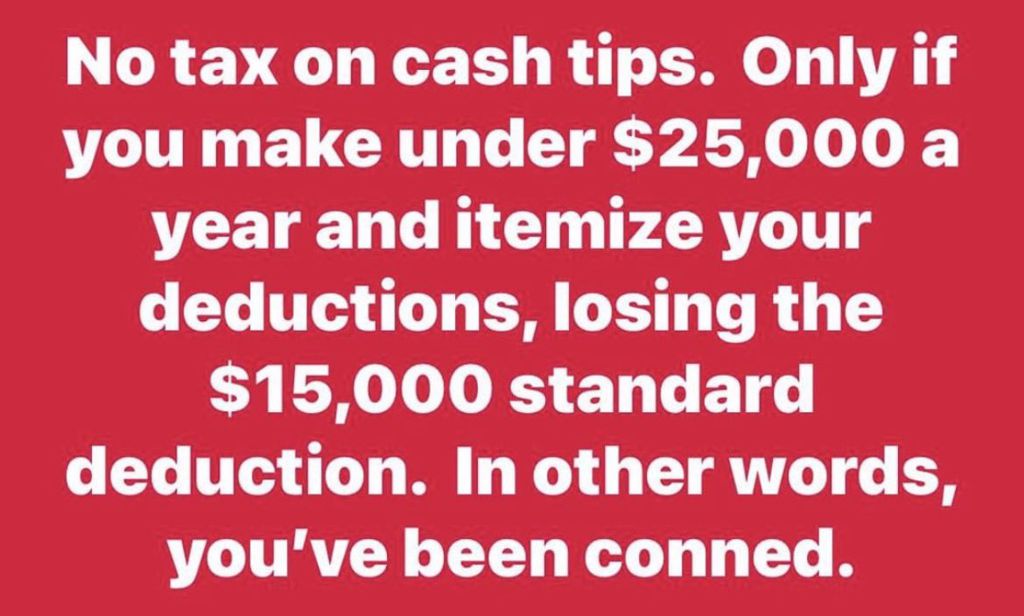

Here is one recent and very good example. A meme came up on social media that offered this:

Of course the intent of this post is to spread misinformation on President Donald Trump and his just signed “One Big Beautiful Bill”. The intent is to portray Donald Trump as some form of a conman or con artist. Of course all of it is untrue and if Joe Biden is serious about wanting to get engaged with the Trump Administration as foreign leaders are telling him to do, he should insist this fellow liberal Democrat be sent to prison for the crime of misinformation, also known as outright lying.

So here is the truth in this matter found here:

“No Tax on Tips Act

This bill establishes a new tax deduction of up to $25,000 for tips, subject to limitations. The bill also expands the business tax credit for the portion of payroll taxes an employer pays on certain tips to include payroll taxes paid on tips received in connection with certain beauty services.

Under the bill, the new tax deduction for tips is limited to cash tips (1) received by an employee during the course of employment in an occupation that customarily receives tips, and (2) reported by the employee to the employer for purposes of withholding payroll taxes. (Under current law, an employee is required to report tips exceeding $20 per month to their employer.)

Further, an employee with compensation exceeding a specified threshold ($160,000 in 2025 and adjusted annually for inflation) in the prior tax year may not claim the new tax deduction for tips.

Finally, the bill expands the business tax credit for the portion of payroll taxes that an employer pays on certain tips to include payroll taxes paid on tips received in connection with barbering and hair care, nail care, esthetics, and body and spa treatments. (Under current law, an employer is allowed a business tax credit for the amount of payroll taxes paid on certain tips received by an employee in connection with providing, delivering, or serving food or beverages.)”

Source: https://www.congress.gov/bill/119th-congress/senate-bill/129

What this means in plain English is this:

The new law allows many workers to deduct up to $25,000 in tips and $12,500 in overtime (or $25,000 for joint filers) on their taxes starting with income earned January 1, 2025. This means you’ll see this change when one files their 2025 tax return in 2026. The new law means the amounts must be reported on a W-2 or 1099, only if one works in industries that the Treasury Department officially recognizes as “customarily tipped.”

These new deductions are not applicable if one’s income is $150,000 ($300,000 for couples), or more and they only apply to “qualified” tips and overtime as defined by the Treasury Department.

CONCLUSION:

Democrats have two things going for their party:

- They are extremely well organized.

- They are extremely united and seemingly indivisible.

In one of my latest articles I concluded with:

“In April of this year it was widely reported AOC was a leading candidate to run for the presidency in 2028 raising almost $10 million in 3 months. That should scare every single American.

Whatever happened to us running our ‘best and brightest for our highest office’”?

“AOC – Acting On Cue” – The Thinking Conservative

What they have going against their party are these two things:

- People with low abilities are being consistently overestimated as competent.

- The lowest IQ individuals (President Trump term) are some of the largest fundraisers.

I recently got my first anonymous hate mail from a presumed liberal Democrat after writing the truth about where the Democrat’s party is at today. It read like this:

“You are a stupid, blind Mother F**king idiot. You are so full of s**t its covering your eye balls. How can you support Diaper Don, a felon, a rapist? If you had a daughter and he grabbed her p***y, what would you do about it? If he did that to our daughter, he would be sitting down to pee or worse! You are a case of the pot calling the kettle black. Why don’t you go rot in h**l and take your d**n popcorn with you!!!”

Now, the interesting things observed about this little hate mail relative to my local letter to the editor were as follows:

- Spelling and grammar errors.

- Abundant use of profanity.

- Lack of defense of Democrats to points made in my editorial.

- Deflection from topic by attacking Donald Trump.

- The guy sent it by snail mail anonymously.

Here is my letter here that triggered this opposing side member:

“The Ogle County Life” June 30,2025– Page 6

© 2025 by Mark S. Schwendau