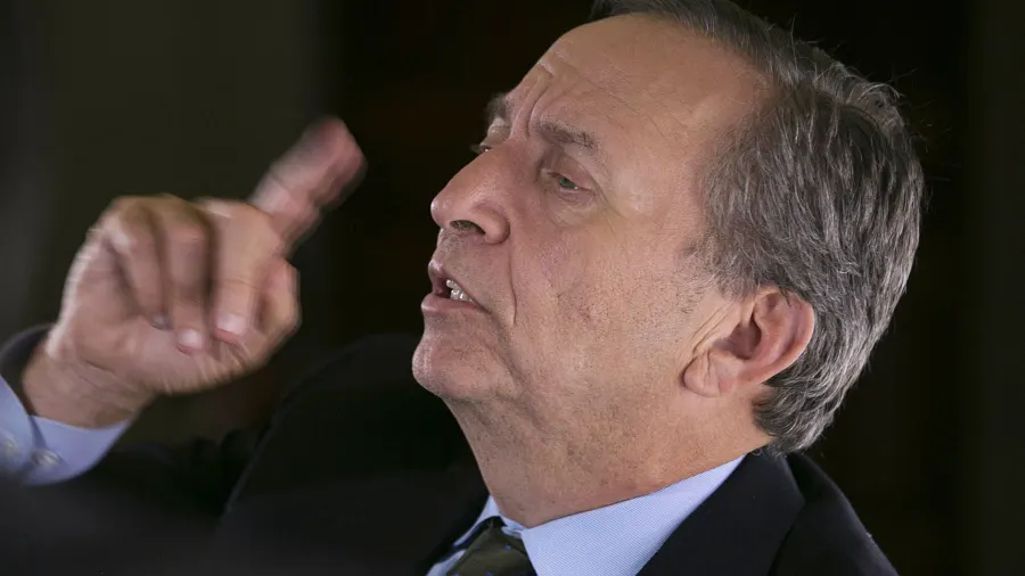

Former U.S. Treasury Secretary Lawrence Summers severely condemned the Fed’s loose monetary policy, accused the central bank of creating “dangerous complacency” in financial markets, and misunderstood the Fed. economic.

Summers’ speech at a conference hosted by the Federal Reserve Bank of Atlanta marked a significant escalation in his attack on the U.S. Central Bank. Harvard University economists and former Democratic presidential advisers have criticized Joe Biden’s views. Fiscal stimulus As a result of the excessive excess earlier this year.

Summers said that monetary and fiscal policymakers “significantly underestimated financial stability and traditional risks. inflation Long-term extremely low interest rates”.

The Federal Reserve has vowed to keep U.S. interest rates close to zero until the economic recovery reaches certain milestones, including full employment, and the peak inflation rate is expected to be temporary. The latest median forecast by central bank officials shows that the lowest interest rate will be maintained until at least 2024.

Policy forecasts indicate that interest rates may not increase. . . Summers said that nearly three years can create dangerous complacency. He added that the Fed may be forced to tighten monetary policy, which will frighten the market and even harm the real economy.

“These adjustments are surprising when I think it is very likely that policy adjustments will be needed.” Summers warned that such “shocks” would “cause real damage to financial stability and may cause real damage to the economy.”

The main risks today include overheating, rising asset prices and subsequent financial over-leverage and subsequent financial instability

This Federal Reserve There was a view that, compared with the level before the pandemic, the slowdown in economic recovery and the risk of job shortages still require strong monetary support for the economy. It also does not believe that the current surge in consumer prices will continue, on the grounds that the bottleneck in the supply chain and the reopening of the economy have exacerbated the rise in consumer prices.

Summers warned that the notion of maintaining a balance between inflation and deflation risks, and between financial bubbles and credit problems, is “a long way from a correct understanding of economic conditions.”

“The main risks today include overheating, rising asset prices, subsequent financial over-leveraging and subsequent financial instability. There will be no economic recession, excessive unemployment and excessive sluggishness.” Summers said.

He added: “The assertion that a weak labor market is a major problem in today’s American economy is untenable.” “Go outside: Labor shortage It is a common phenomenon. ”

Summers’ attack on American economic policymakers this year was particularly painful because he was a Democrat, which led to him becoming harsh criticism Within the party. Liberals in particular said he was out of touch with the struggle of low- and middle-income families.

Respected

By Agnes Zang