Crashing Real Wages and persistent Inflation squeeze Americans in a financial vise.

Retirees who live in the bucolic Paradise Village retirement community outside of San Diego, CA recently received shocking news. Their recurring bills for rent and other fees will reportedly vault higher by an astounding $1,000 or more per month. Prior to the increase, total costs per apartment started around $3,000 per month.

The local Fox affiliate interviewed a daughter of elderly residents who reacted with indignation: “I’m livid. I cannot believe someone would do this. My mom and her husband are 85 years old, on a fixed income.” The management company responded that the huge increases were compelled to “offset the rising cost of food, labor, and supplies.”

Unfortunately, this Paradise Valley story is hardly isolated. In fact, prepare for evictions and foreclosures to explode in America in the coming months as a toxic financial one-two punch of crashing real wages combines with sky-high inflation to force millions of Americans out of their homes.

A July survey from the Census Bureau, reported by Bloomberg News, found that a staggering “5.4 million households, or 40% of households that are not current on their rent or mortgage payments, said they were likely to be evicted or foreclosed on in the next two months.”

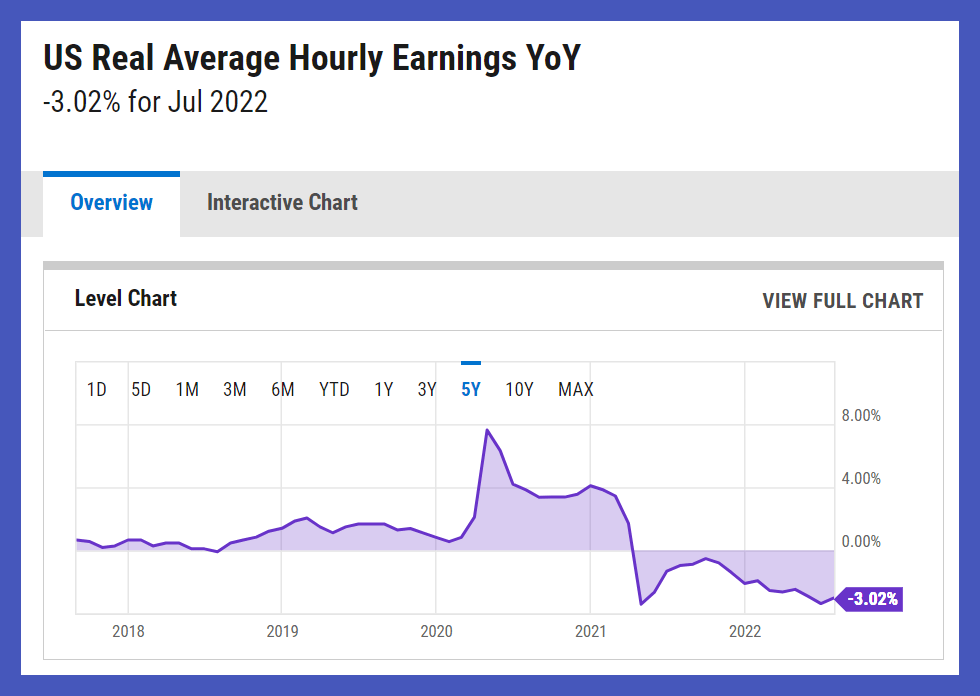

The confluence of severe economic pressures increasingly put vulnerable citizens into a financial vise. On the income side of the ledger, Americans now endure 16 straight months of falling Real Wages, meaning pay adjusted for inflation. Even if paychecks tick higher, the added earnings cannot keep pace with prices for consumer staples galloping at 40 year record pace.

For example, the latest CPI report — which the White House actually bragged about — showed a blistering hot overall Consumer Price Index increase of 8.5%. Within that report, details showed food prices soaring at the hottest velocity since 1979.

Here is the chart depicting the plunge in Real Wages under Biden, reaching -3.02% in July:

Such a precipitous and sustained loss of real income crushes the actual buying power of all Americans, and especially working-class citizens who see their lifestyles decline measurably every single month. The weight of this destruction of prosperity compelled millions of workers to turn to the dangerous practice of loading up on high interest credit cards to cope with the inflation explosion. Total credit card debt in the Second Quarter of this year jumped $46 billion, the highest clip in 20 years.

That credit card debt becomes far more untenable with interest rates rising materially because of the Biden inflation surge. Concurrently, that massive ascent in interest rates also forces mortgage rates far higher than just months ago.

Here is a chart on 30-year mortgage rates going back 5 years, contrasting the President Trump years vs. the present Biden spike in rates:

By Steve Cortes

Read Full Article on SteveCortes.Substack.com

JPMorgan Chase CEO Jamie Dimon sees up to 30% chance of ‘harder recession’: Report

JPMorgan Chase & Co. JPM, -0.64% CEO Jamie Dimon said recently he sees a 20% to 30% chance of a “harder recession” and a 10% chance of a soft landing in the economy as the U.S. Federal Reserve hikes interest rates, according to a Saturday report from Yahoo Finance. Dimon reiterated his view that “storm clouds” remain on the economic horizon. He said he sees a 20% to 30% chance of “something worse” than a harder recession, but added it would be a mistake to pinpoint the exact probability. He expects the Fed’s interest rate to rise to 4% by the end of the year from 2.4% now. The biggest complaint he hears from company leaders is they can’t hire enough people. While company leaders say the prospects for their company are good, they also add that their confidence is low, “because of inflation, because of partisan politics and a lot of leftover anger from COVID-19,” Dimon said. Dimon’s comments to wealthy clients in recent conversations were shared with the news service, which published a collection of his remarks. Shares of JPMorgan Chase are down 22.9% in 2022, compared to a 7.1% loss by the Dow Jones Industrial Average DJIA, -0.07%