All accounts are professionally managed and invested in diversified index funds designed to grow over time.

Billionaires Michael and Susan Dell have pledged $6.25 billion to help 25 million American children open newly created investment accounts under President Donald Trump’s Invest America initiative.

The Dells gift, announced on Dec. 2, will fund $250 deposits for children aged 10 and under who were born prior to the Jan. 1, 2025, qualifying date to receive the federal government’s $1,000 newborn contribution to their tax-advantaged Invest America accounts, commonly known as “Trump Accounts.”

“TWO GREAT PEOPLE,” Trump wrote in a Truth Social post, reacting to the Dells’ announcement. “I LOVE DELL!!!”

The $6.25 billion donation, which is intended to encourage families to activate the new child investment accounts authorized under Trump’s signature One Big Beautiful Bill Act, is expected to reach nearly 80 percent of American children aged 10 and under across 75 percent of zip codes.

“Children older than 10 may benefit, too, if funds remain available after initial sign-ups,” the Dells said in a statement.

“It is an incredibly practical and direct step to help families begin saving today.”

The Invest America program gives every child under 18 with a Social Security number access to a federally overseen savings and investment account that families can activate beginning July 4, 2026.

According to program materials, all accounts are professionally managed and invested in diversified index funds designed to grow over time.

Children born on or after Jan. 1, 2025, will automatically receive a $1,000 Treasury deposit at birth, while families and community members may contribute up to $5,000 total per year. Employers may contribute up to $2,500 annually to an employee’s child, and philanthropic or government contributions are uncapped.

When the children turn 18, they can withdraw the funds for “qualified purposes,” such as paying tuition, buying a home, or starting a business. The money will be taxed as ordinary income if used for non-qualified expenditures. The accounts automatically convert to traditional Individual Retirement Accounts at age 18, allowing any unused funds to keep growing over time.

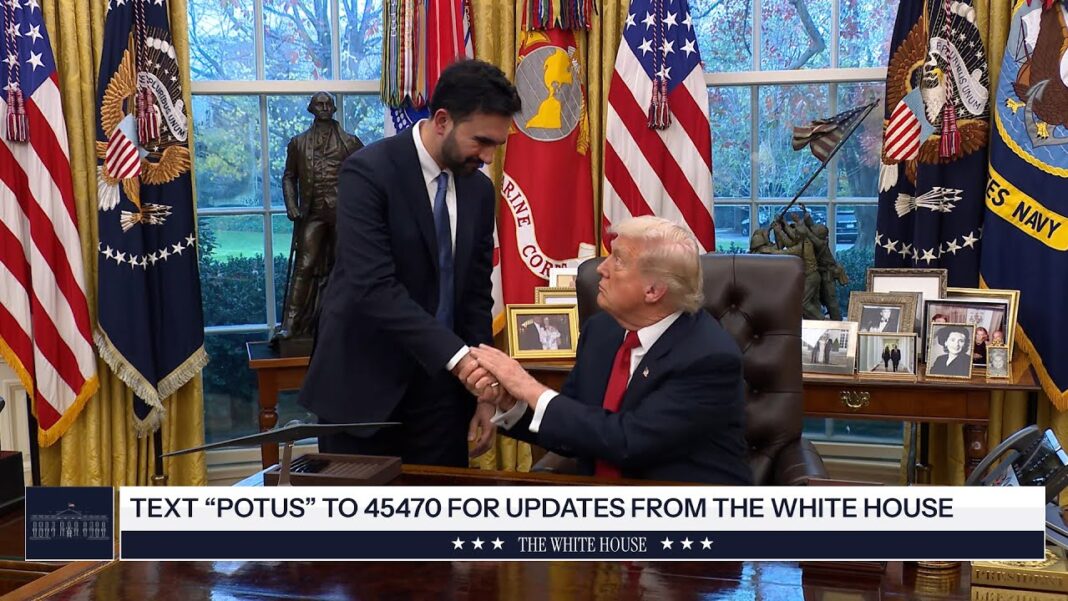

“It’s a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation, and they’ll really be getting a big jump on life,” Trump said at a June 9 White House event.

By Tom Ozimek