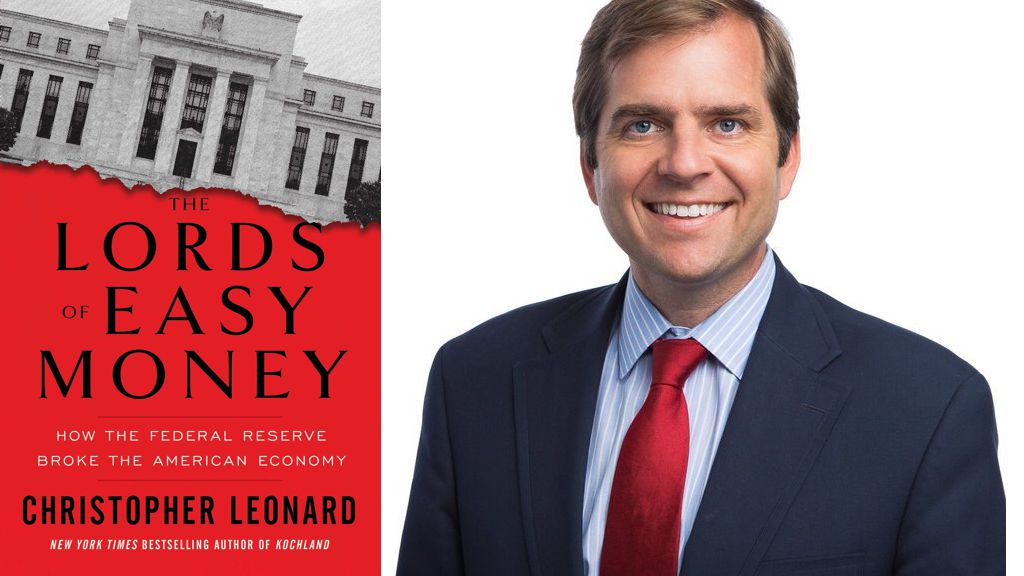

The New York Times bestselling business journalist Christopher Leonard infiltrates one of America’s most mysterious institutions—the Federal Reserve—to show how its policies over the past ten years have accelerated income inequality and put our country’s economic stability at risk.

If you asked most people what forces led to today’s unprecedented income inequality and financial crashes, no one would say the Federal Reserve. For most of its history, the Fed has enjoyed the fawning adoration of the press. When the economy grew, it was credited to the Fed. When the economy imploded in 2008, the Fed got credit for rescuing us.

But the Fed also has a unique power to reshape the American economy for the worse, which it did, fatefully, on November 4, 2010 through a radical intervention called quantitative easing. In just a few short years, the Fed more than quadrupled the money supply with one goal: to encourage banks and other investors to extend more risky debt. Leaders at the Fed knew that they were undertaking a bold experiment that would produce few real jobs, with long-term risks that were hard to measure. But the Fed proceeded anyway…and then found itself trapped. Once it printed all that money, there was no way to withdraw it from circulation. The Fed tried several times, only to see market start to crash, at which point the Fed turned the money spigot back on. That’s what it did when COVID hit, printing 300 years’ worth of money in two short months.

Which brings us to now: Ten years on, the gap between the rich and poor has grown dramatically, stock prices are trading far above what’s justified by actual corporate profits, corporate debt in America is at an all-time high, and this debt is being traded by big banks on Wall Street, leaving them vulnerable—just as they were during the mortgage boom. Middle-class wages have barely budged in a decade, and consumers are buried under credit card debt, car loan debt, and student debt.

The Lords of Easy Money tells the shocking, riveting tale of how quantitative easing is imperiling the American economy through the story of the one man who tried to warn us. This will be the first inside story of how we really got here—and why we face a frightening future.

Due out January 11, 2022

Editorial Reviews

Review

“Leonard’s wonderfully readable new book is about one of the most important, yet least covered and least understood, changes in American life. That’s the effect of the dramatically increased role in financial markets played by the Federal Reserve. As Leonard convincingly argues, it might be nothing short of catastrophic.” — Bethany McLean, New York Times bestselling co-author of The Smartest Guys in the Room

“An essential, engrossing and, above all, human tale featuring the central banker who dared to dissent from the party line and a factory worker whose sufferings are traceable to that dissident’s failure to carry his case. A monetary page-turner? Christopher Leonard has actually produced one.” — James Grant, founder and editor of Interest Rate Observer

“Thanks to Leonard’s gripping narrative, I now have a new monetary hero: former Fed governor Tom Hoenig. If, like me, you are desperate to understand how we got into this predicament, The Lords of Easy Money is required reading.” — William D. Cohan, New York Times bestselling author of House of Cards

“Leonard’s richly reported and provocative exploration will have you reassessing whether the Fed built on a solid foundation or on air.”— Jesse Eisinger, Pulitzer Prize winning author of The Chickenshit Club

“An eye-opener. Well-researched and engaging, it brings to life consequential issues that influence the current and future wellbeing of most Americans… How this journey ends has important implications not just for the United States but also globally.” — Mohamed A. El-Erian, New York Times bestselling author of The Only Game in Town and president of Queens’ College, Cambridge University.

“A timely and persuasive challenge to the Fed’s new economic orthodoxy…. Leonard shrewdly dissects the policy wrangles roiling the Fed behind its facade of technocratic consensus—he presents a sharp riposte to glowing accounts of former Fed chairman Ben Bernanke’s leadership—while offering a trenchant analysis of how the Fed controls and misshapes the economy….[a] probing history.”— Publishers Weekly (starred review)

“The federal banking system has built a house of cards, Leonard cogently warns. Expect it to fall any minute now.” — Kirkus Reviews

“Leonard strives to present the issues clearly but without oversimplification….the patient reader comes away with a greater understanding of economic issues that are affecting everyone’s lives.” — Booklist

About the Author

Christopher Leonard is a business reporter whose work has appeared in The New York Times, The Wall Street Journal, Fortune, and Bloomberg Businessweek. He is the New York Times bestselling author of The Meat Racket and Kochland, which won the J. Anthony Lukas Work-in-Progress Award.