Natural gas and nuclear power will be the big winners in the energy sector over the next 20 years. They have a competitive advantage over solar, wind, hydro, geothermal, coal, and oil. That advantage, combined with market factors, sets up rare investment opportunities to hold high-quality energy companies and buy natural gas and uranium futures.

People in different parts of the world—from Sacramento to Frankfurt to Beijing—are currently experiencing higher energy prices and shortages. Three main factors are at work here:

- Increased demand,

- Policies aimed at reducing climate risk,

- Current market incentives.

Global demand for energy is increasing. Energy fuels all the benefits of modern life: healthcare, education, transportation, communication, and economic growth. Developed countries don’t want to give up those benefits, and developing countries want more of them. As a result, the demand for energy will continue to increase over the next 20 years.

But supply isn’t currently increasing to meet that demand. Concerns about climate risk have led to corporate and government incentives that channel money away from oil and gas production toward solar and wind power, and environmental activists in Europe and the U.S. have successfully slowed the development of nuclear power. Investors lost money betting on the energy sector over the last decade, so the stock market has been rewarding energy companies for strengthening their balance sheets and returning cash to shareholders instead of investing in new long-term projects.

But things are poised to change. Energy runs on a predictable cycle like other commodities. As demand for energy increases, the price of energy also increases because supply is limited. Higher prices attract producers to invest in new production. New production kicks into overdrive because companies start competing to produce more. This competition leads in turn to oversupply: prices crash, and producers stop investing. Supply then gets tight; prices start rising again, and the boom-bust cycle continues.

We are at the beginning of a new cycle. The supply shortage we’re currently experiencing will likely last the remainder of this decade. Investors will find rare opportunities to capitalize on growth.

Global demand for energy is increasing

Energy is the lifeblood of modern civilization, the driving factor behind human progress and human flourishing. Our food, water, housing, transportation, communication, healthcare, and economic development all depend on harnessing energy.

Energy isn’t limited to generating electricity. It is needed for transportation, heating, and producing most of the materials and products we rely on: plastics, fertilizer, computers, medical equipment, mobile phones, cars, and airplanes–all currently made from oil and natural gas.

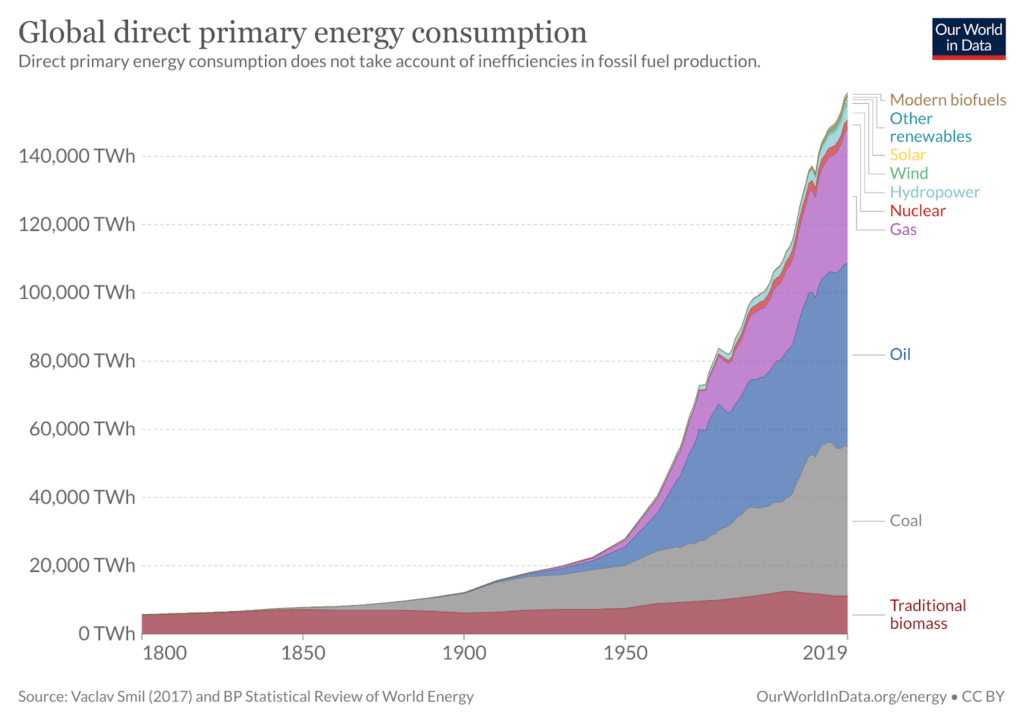

The world is hungry for energy. Global energy consumption more than doubled between 1971 and 2020,[1] and it’s projected to increase nearly 50% by 2050.[2] It’s clear that we’re going to need a lot more energy than we’re generating now. Some people believe that when we learn to harness new sources of energy, we will stop using our current sources. But that has never been true. Historically, whenever we learned to harness a new energy source, we did not stop using the sources we previously relied on (Figure 1).

Figure 1: Harnessing new energy sources did not replace energy sources we used before.

Future demand for energy isn’t going to be evenly distributed around the globe. Over 3 billion people—40% of the Earth’s population—currently live in energy poverty.[3] Most of the increased future demand for energy is going to come from providing these people with the energy they need and deserve. This is especially true in Asia where standards of living are rapidly increasing.

By Brian Gitt