Democrats claimed the Inflation Reduction Act would help ordinary Americans, but a new analysis suggests people making less than $400,000 a year could end up paying $20 billion of the new tax revenue it brings in.

President Joe Biden signed the act into law in August, injecting $473 billion of new spending on climate and healthcare, yet there are strong concerns it will do little to reduce inflation. In fact, middle-class Americans will pay new taxes – directly contradicting Biden’s promise not to raise penalties on people earning under $400,000.

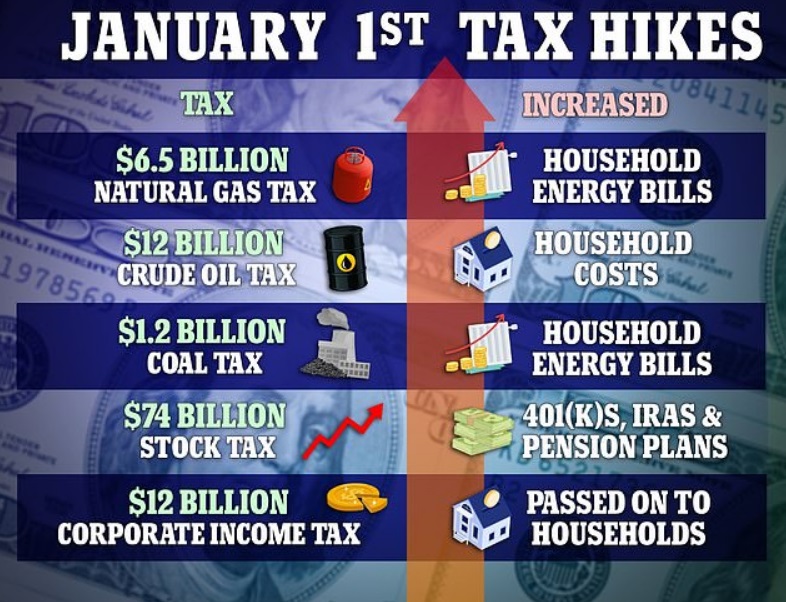

The bill includes $430 billion in spending, raises $737 billion over a decade in revenue, and is projected to shave about $300 billion off the deficit. The House passed the bill 220-207 on a party-line vote after it squeaked through the Senate 51-50, with all Democrats and Vice President Kamala Harris voting for it. See these new taxes starting in 2023 in the infographic below and learn more here.

But the above are merely some headline grabbers. The Internal Revenue Service announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2022-38 provides details about these annual adjustments – learn more in summary form here. Below are some highlights of these changes.

- The standard deduction for married couples filing jointly for tax year 2023 rises to $27,700 up $1,800 from the prior year. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

- Marginal Rates: For tax year 2023, the top tax rate remains 37% for individual single taxpayers with incomes greater than $578,125 ($693,750 for married couples filing jointly).

- The Alternative Minimum Tax exemption amount for tax year 2023 is $81,300 and begins to phase out at $578,150 ($126,500 for married couples filing jointly for whom the exemption begins to phase out at $1,156,300). The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption began to phase out at $1,079,800).

- The tax year 2023 maximum Earned Income Tax Credit amount is $7,430 for qualifying taxpayers who have three or more qualifying children, up from $6,935 for tax year 2022. The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs.

- For tax year 2023, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $300, up $20 from the limit for 2022.

- For the taxable years beginning in 2023, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $3,050. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $610, an increase of $40 from taxable years beginning in 2022.

- For tax year 2023, participants who have self-only coverage in a Medical Savings Account, the plan must have an annual deductible that is not less than $2,650, up $200 from tax year 2022; but not more than $3,950, an increase of $250 from tax year 2022. For self-only coverage, the maximum out-of-pocket expense amount is $5,300, up $350 from 2022. For tax year 2023, for family coverage, the annual deductible is not less than $5,300, up from $4,950 for 2022; however, the deductible cannot be more than $7,900, up $500 from the limit for tax year 2022. For family coverage, the out-of-pocket expense limit is $9,650 for tax year 2023, an increase of $600 from tax year 2022.

- For tax year 2023, the foreign earned income exclusion is $120,000 up from $112,000 for tax year 2022.

- Estates of decedents who die during 2023 have a basic exclusion amount of $12,920,000, up from a total of $12,060,000 for estates of decedents who died in 2022.

- The annual exclusion for gifts increases to $17,000 for calendar year 2023, up from $16,000 for calendar year 2022.

- The maximum credit allowed for adoptions for tax year 2023 is the amount of qualified adoption expenses up to $15,950, up from $14,890 for 2022.

And taxes at the Federal level may not be the only concern you might have – some positive and others negative. On January 1, 2023, thirty-eight states have noteworthy tax changes taking effect. Most of these changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

See here for specifics concerning your specific state tax concerns.

Meanwhile, supposedly the GOP’s first bill would be to repeal these 87,000 IRS agents we have heard about. The potential new GOP Speaker, Kevin McCarthy, at least, has seemingly promised to do this – we shall see if this happens, though others claim this is not true.

Do you make $75,000 or less?

— Kevin McCarthy (@GOPLeader) August 9, 2022

Democrats' new army of 87,000 IRS agents will be coming for you—with 710,000 new audits for Americans who earn less than $75k.

They say nothing is sure in life except for death and taxes. It looks like the 2023 tax laws will continue to make this a true statement.