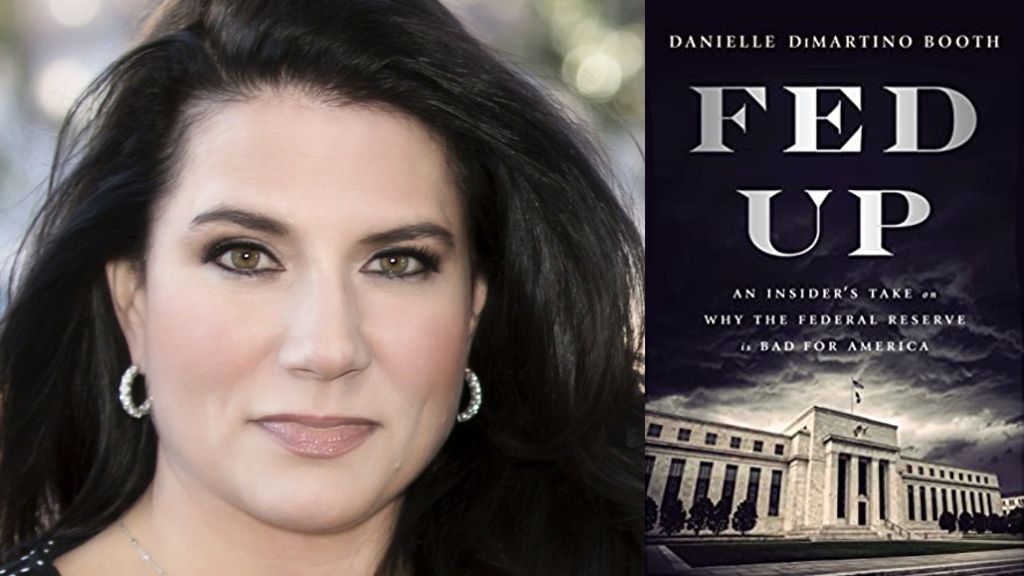

Above Video: Economist Danielle DiMartino Booth spoke about why printing more money doesn’t work in a sit-down with Patrick Bet-David.

An insider’s unflinching exposé of the toxic culture within the Federal Reserve.

In the early 2000s, as a Wall Street escapee writing a financial column for the Dallas Morning News, Booth attracted attention for her bold criticism of the Fed’s low interest rate policies and her cautionary warnings about the bubbly housing market. Nobody was more surprised than she when the folks at the Dallas Federal Reserve invited her aboard. Figuring she could have more of an impact on Fed policies from the inside, she accepted the call to duty and rose to be one of Dallas Fed president Richard Fisher’s closest advisors.

To her dismay, the culture at the Fed – and its leadership – were not just ignorant of the brewing financial crisis but indifferent to its very possibility. They interpreted their job of keeping the economy going to mean keeping Wall Street afloat at the expense of the American taxpayer. But bad Fed policy created unaffordable housing, skewed incentives, rampant corporate financial engineering, stagnant wages, an exodus from the labor force, and skyrocketing student debt. Booth observed firsthand how the Fed abdicated its responsibility to the American people both before and after the financial crisis – and how nobody within the Fed seems to have learned or changed from the experience.

Today the Federal Reserve is still controlled by 1,000 PhD economists and run by an unelected West Coast radical with no direct business experience. The Fed continues to enable Congress to grow our nation’s ballooning debt and avoid making hard choices, despite the high psychological and monetary costs. And our addiction to the “heroin” of low interest rates is pushing our economy toward yet another collapse.

The Fed Up book is Danielle DiMartino Booth’s clarion call for a change in the way America’s most powerful financial institution is run – before it’s too late.

Published on February 14, 2017

Editorial Reviews

Review

“This view from the inside is not to be missed.”

—A. GARY SHILLING, president of A. Gary Shilling & Co., Inc.

“Danielle DiMartino Booth has written an informed, thoughtful, eye-opening—and justifiably angry—memoir of her days at the Federal Reserve. A monetary broadside for our populist world.”

—JAMES GRANT, publisher of Grant’s Interest Rate Observer

“An outsider-turned-insider gives a gripping account of how false, but stubbornly held beliefs at the Fed helped create the global economic crisis as well as contribute to rising inequality in the United States. Brutally honest and engagingly written . . . A mustread.”

—WILLIAM R. WHITE, former economic adviser and head of the monetary and economic department at the Bank for International Settlements

“Penned with bold prose and laced with compelling arguments, Booth delineates the exact reasons that the Fed has failed America and why America should abandon the Fed. Fed Up is a must-read tale of the over-reaching power, unfettered egos and clueless bravado that struck at the core of American stability, and must do so no longer.”

—NOMI PRINS, author of All the Presidents’ Bankers

“The road to hell is paved with good intentions. [Booth] personalizes and clearly explains the influence, the danger, and the consequences of monetary activism gone wild.”

—PETER BOOCKVAR, chief market analyst at The Lindsey Group

“This book is a must read for every American who wants to stay informed and educated about our financial future.”

—ALLEN WEST, member of the 112th US Congress

“If you want to read a strong counterpoint—from the perspective of a lonely non-Keynesian within the Fed—to the ‘we saved the world’ narratives of those who led us to zero yields, asset bubbles, and a fast-shrinking middle class, this is it.“

—ROB ARNOTT, chairman of Research Affiliates

“Danielle DiMartino Booth proves that insightful technical analysis and hilarious anecdotes can exist between the covers of the same book.”

—JAMES RICKARDS, author of The Road to Ruin

“Booth’s insider status, captivating personality, mellifluous writing style, and keen sense of observation are wrapped up into a thoughtful analysis of our country’s dependency on the Fed and the worrisome consequences of that addiction.”

—DOUGLAS A. KASS, founder and president of Seabreeze Partners Management Inc.

“DiMartino Booth combines a lively writing style with careful research, quotes and annotations. Her first-hand account, which juxtaposes the complacency inside the Fed with the unfolding crisis outside, should appeal to a wide range of readers, from critics of the Fed and market participants to the average person eager to learn how monetary policy is conceived and executed.”

–CAROLINE BAUM, MarketWatch

About Danielle DiMartino Booth

Danielle DiMartino Booth is a Founder & CEO of Quill Intelligence, DiMartino Booth set out to launch a #ResearchRevolution, redefining how markets intelligence is conceived and delivered. To build QI, she brought together a core team of investing veterans to analyze the trends and provide critical analysis on what is driving the markets – both in the United States and globally. A global thought leader on monetary policy, economics and finance, DiMartino Booth founded Quill Intelligence in 2018. She is the author of FED UP: An Insider’s Take on Why the Federal Reserve is Bad for America (Portfolio, Feb 2017), has a column on Bloomberg View, is a business speaker, and a commentator frequently featured on CNBC, Bloomberg, Fox News, Fox Business News, BNN Bloomberg, Yahoo Finance and other major media outlets.

Excerpt. © Reprinted by permission. All rights reserved.

Chapter 1

“Groupstink”

Never in the field of monetary policy was so much gained by so few at the expense of so many.

-Michael Hartnett, Bank of America Merrill Lynch chief investment strategist, November 1, 2015

Early morning, December 16, 2008, with a drizzle of freezing rain falling, few would even glance at the line of inconspicuous Mercury Marquis sedans pulling up to Washington, DC’s Fairmont Hotel. Emerging from the luxurious four-star establishment, their Foggy Bottom home eight times a year, are eleven little-known bureaucrats with their contingent of requisite subordinates.

There is no fanfare to mark the coming momentous decision they are to take on as they comfortably settle in for the ten-minute caravan to the neoclassical white marble edifice known as the Marriner S. Eccles Federal Reserve Board Building, located at Twentieth Street and Constitution Avenue NW.

Another half dozen of their peers had already left their homes in nearby Georgetown or some other Washington suburb and they too are making their way to the same address for the all-important 9 a.m. meeting.

Only one of these bureaucrats-the chairman, a mild-mannered former professor-might have been recognized in an American airport. The rest-unelected, immune to political pressure, mostly academics, and save one, inexperienced in the intricacies of running a major corporation, or even a small business-were virtually invisible outside the narrow world they inhabited despite the enormous power they wielded.

As these seventeen people arrived, they stowed their coats and umbrellas, grabbed a cup of coffee or tea, and mingled, the low hum of their conversation perhaps more subdued than on similar occasions. The day before, the first of the two-day affair, had been extraordinary in both the dire picture it painted of the American economy and the realization that they would have to take bold and unprecedented action.

That next sleety morning, they met again, determined to take action to prop up a faltering Wall Street, hopelessly mired in the greatest financial crisis since the Great Depression. Even as they convened, the wreckage of the previous three months still burned around them. Credit markets had seized up and fears for the fate of the economy were mounting.

With a few exceptions, virtually all of those at the meeting were PhD economists who had earned doctorates at MIT, Yale, Harvard, Princeton, and other top American universities. They met under the auspices of the Federal Open Market Committee (FOMC), the decision-making body of the Federal Reserve System. They believed a lifetime of study in economic theory and monetary policy had given them unique insight to steer policy for the most powerful central bank in the world, the lender of last resort for failing Wall Street banks, and the U.S. government’s last line of defense against utter financial chaos.

Created in 1913 after the Panic of 1907, the Federal Reserve was founded to keep the public’s faith in the buying power of the U.S. dollar. After failing miserably in the 1930s, the Fed aimed to be more responsive. This led the institution to find discipline in the rising macroeconomic models championed by top monetary theorists. During the ensuing “Quiet Period” in American banking, deposit insurance prevented panics, the Fed controlled interest rates and manipulated the money supply, and though occasional disruptions flared, like the failure of Continental Illinois National Bank and Trust Company in 1984, no systemic risk erupted for seventy years. The Fed had tamed the volatile U.S. economy.

Until September 2008, when all hell broke loose in a worldwide panic that completely blindsided and, embarrassed the Federal Reserve. The Fed had used billions of dollars in taxpayer funds to bail out Wall Street fat cats. Everyone blamed the Fed.

Just before 9 a.m., the door to the chairman’s office opened. Federal Reserve Chairman Ben Bernanke took his place in an armchair at the center of a massive oval table. The members of the FOMC found their designated places around the table; aides sat in chairs or couches against the wall. With staff, the room contained fifty or sixty people, far more than normal for this momentous occasion.

In front of each FOMC member was a microphone to record their words for posterity. To a casual observer, the content of their conversation would be obscured by economic jargon.

This day, their essential task was to vote on whether to take the “fed funds” rate-the interest rate at which banks lent money to each other in the overnight market-to the zero bound. The history-making low rate would ripple throughout the economy, affecting the price to borrow for businesses and consumers alike.

Bernanke was calm but insistent. His lifetime of study of the Great Depression indicated this was the only way. His sheer depth of knowledge about the Fed’s mishandling of that tragic period was undoubtedly intimidating.

By the end of the meeting, the vote was unanimous. The FOMC officially adopted a zero-interest-rate policy in the hopes that companies teetering on the brink of insolvency would keep the lights on, keep employees on their payrolls, and keep consumers spending. It would even pay banks interest on deposits.

Free cash. We’ll even pay you to take it!

As they gathered their belongings, everyone shook hands, all very collegial despite the sometimes vigorous discussion. They journeyed back to their nice homes in the toniest neighborhoods of America’s richest cities: New York, Boston, Philadelphia, Chicago, Dallas, San Francisco, Washington, DC.

They returned to their lofty perches, some at the Eccles Building, others to the executive floors of Federal Reserve District Bank buildings, safely cushioned from the decision they had just made. Most of them were wealthy or had hefty defined benefit pensions. Their investments were socked away in blind trusts. They would feel no pain in their ivory towers.

It took a few months, but the Fed’s mouth-to-mouth resuscitation brought gasping investment banks and hedge funds and giant corporations back to life. Wall Street rejoiced.

But the Fed’s academic models never addressed one basic question: What happens to everyone else?

In the decade following that fateful day, everyday Americans began to suffer the aftereffects of the Fed’s decision. By 2016, the interest rate still sat at the zero bound and the Fed’s balance sheet had ballooned to $4.5 trillion, thanks to the Fed’s “quantitative easing” (QE), the label given its continuing purchases of Treasuries and mortgage-backed securities.

To what end? All around are signs of an economy frozen in motion thanks to the Fed’s bizarre manipulations of monetary policy, all intended to keep the economy afloat.

The direct damage inflicted on our citizenry begins with our youngest minds and scales up to every living generation in our country’s midst.

The journey could begin anywhere, but let’s start in Erie, Pennsylvania, an area of the country that was struggling even before 2008. The Fed’s high interest rates in the 1980s killed its steel and auto industries. The zero bound has dealt the region another devastarting blow. Now, in an Erie elementary school students are given stapled copies of “Everyday Mathematics” instead of an actual textbook. After a snowstorm, twenty-one buckets were deployed to catch leaks because there was no money to repair the roof. In the last five years, the Erie school district has laid off one fifth of its employees and closed three schools to cut costs. School officials are being forced to divert budgets earmarked for kids and facilities to cover the shortfall in its teacher pension fund, starved for yield in a zero-interest-rate environment where bonds return only 1 to 2 percent.

This is not limited to Erie. By mid-2016, long-term returns for U.S. public pensions have dropped to the lowest levels ever recorded-a $1.25 trillion funding gap-forcing pension fund managers from New York to California to resort to ever-riskier investments to meet their legal obligations-and to cut services to make up the shortfall.

Ruining Americans’ pension systems? The professor and the FOMC had not anticipated that particular side effect.

And then there are the millennials, the 77 million young people born between 1980 and 1995. As private equity surged into real estate, purchasing homes to be used as rentals in search of higher yields, house prices have soared and the market share of first-time home buyers has dropped to its lowest level in almost thirty years. Nearly half of males and 36 percent of females age eighteen to thirty-four live with their parents, the highest level since the 1940s.

Delaying household formation and all the consumer spending that goes with that? Not on the FOMC’s radar.

Even with mortgage rates at record lows, stagnant wages have made it difficult for millennials to amass down payments. Builders anxious to maximize returns now focus on constructing expensive houses, leaving fewer starter homes for sale in urban areas favored by today’s young adults. It is an ominous trend for baby boomers. For many, home equity makes up the bulk of their retirement savings.

Killing the move-up housing market? Nope, the FOMC didn’t foresee that either.

Chances are pretty good that most boomers didn’t get the gist of the statement released by the Fed on that December day in 2008. A certificate of deposit (CD) now pays a hair above nothing. Those boomers-my mom among them-have taken a long hard look at their retirement accounts and realized with a sense of dread that a lifetime of scrimping and risk-averse investing has left their nest eggs vulnerable to serious erosion.

With interest rates on CDs near zero, the average boomer household would need $10.6 million in principal to safely earn $15,930 in interest, the annual income at the federal poverty-line level for a family of two.

Do your folks have $10 million in savings? Mine don’t.

Of course, with $10 million, CDs might not be on the table, but that’s the point. Several hundred thousand dollars won’t do the trick without undue risk for aging boomers.

The members of the FOMC knew their decision would screw savers and the risk-averse elderly. They didn’t care. They couldn’t afford to. Even when well-intentioned smart people save the world, there are always a few, or in this case, millions of inevitable casualties. C’est la vie!

Sadly, there were no angry protests, no million-man marches on Washington that sent shock waves through our country after the FOMC issued its press release. Only the quiet, unheralded loss of some fundamental freedoms: the freedom to save for our retirements risk free, the freedom to sleep in peace knowing our pensions are safe, and the freedom for U.S. companies to invest in our nation’s future.

The FOMC’s vote during its final meeting of 2008 didn’t come from nowhere. It was part of a long tradition of economic interference by well-meaning bureaucrats, going back to the 1930s and accelerating with Federal Reserve Chairman Alan Greenspan in the 1980s.

Greenspan championed the era of financial deregulation that drove Wall Street to levels of greed that surprised even the most hardened investment banking veterans.

His pragmatic response to every crisis on Wall Street? Lower interest rates, which Greenspan did again and again and again. Blow bubbles and pray they don’t pop.

But they always do.

In the late 1990s, dot-com companies soared far beyond true valuations; reality pricked that balloon in 2001.

In response, Greenspan again aggressively lowered interest rates and blew another bubble, this time in housing, with catastrophic results that led to the worldwide meltdown in 2008.

In response, his successor, Ben Bernanke, followed suit, pushing through a massive monetary policy experiment by lowering interest rates to zero and using QE to flood America with easy money.

He based his policies on a lifetime of academic study. His theoretical models relied on the idea of the “wealth effect,” first articulated by British economist John Maynard Keynes. The concept assumed that free money would induce businesses to borrow, invest, and hire more employees. They in turn would buy homes, consume, and put savings into the stock market instead of CDs, where they would earn little to no interest. As their assets rose in value, people would spend more.

The resulting wealth-effect tide would lift all boats. Hailed as a genius by other academics, Bernanke had every confidence his theories would work.

When they didn’t, when the American economy continued to stagger, Bernanke doubled down. His models couldn’t be wrong; something else must be holding back the economy.

Janet Yellen, who followed Bernanke as Fed chair, maintained his radical policies with gusto, determined that households and businesses would invest, buy, consume, damn it! Though many on the FOMC sought an exit plan, Yellen was even more married to the Keynesian model of economic growth than Bernanke. She continued to advocate for more QE, and has even raised the specter of negative interest rates.

But real people haven’t responded the way academics anticipated in their wealth-effect models. Individuals, small businesses, and corporations alike have been flummoxed by Fed policy and made their own rational choices unforeseen by the FOMC.

Cheap money, combined with uncertainty about the regulatory and tax landscape, has encouraged corporations to buy back their shares rather than invest in their future. Companies in the S&P 500 Index-the benchmark for America’s top five hundred publically listed companies-dispersed more than $600 billion to buy back their stock in 2014, and more than $500 billion in 2015.

This strategy has been employed by companies as diverse as Apple, Bank of America, and ExxonMobil, which lost its prized AAA credit rating after one hundred years, based partially on the record amount of debt it incurred to buy back shares. Since 2005, U.S. corporations have disbursed an estimated $296,000 on share buybacks for every single new employee who has been hired.

Because that’s the way the world works.

“No wonder share buybacks and corporate investment into research and development have moved inversely in recent years,” wrote Rana Foroohar in an op-ed in the Financial Times on May 15, 2016. “It is easier for chief executives with a shelf life of three years to try to please investors by jacking up short-term share prices than to invest in things that will grow a company over the long haul.”

Compared to the immediate post-World War II period, some American corporations now earn about five times more revenue from purely financial activities such as trading, hedging, tax optimization, and selling financial services, as compared to their core businesses.

As a result, the labor market has atrophied. Though lots of so-called eat, drink, and get sick jobs-for waiters, bartenders, and health care workers-have been created, Fed policy effectively pulled the plug on long-term investment and compromised high-paying job growth.

By mid-2015, only 62.6 percent of adult workers were employed or actively looking for a job, the lowest in nearly four decades. The so-called shadow unemployment rate is estimated to be as high as 23 percent. Many of these people will never come back into the workforce.