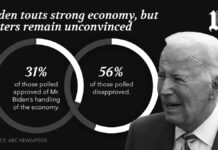

For months and even years, the mainstream news has sought to spin terrible inflation news. It’s not so bad, it’s just transitional, it’s getting better, it’s not really a problem, and all your gloom about the value of the dollar is in your head. Truly, in the past fortnight, we have been inundated with articles suggesting that the public is dumb as rocks for thinking that inflation is still a problem.

This morning: boom! The upward trend for the entire first quarter was solidly confirmed. We could be entering a second wave. It was so bad that not even the two most influential venues could deny it. The New York Times reported, “Inflation Stronger Than Expected.” The Wall Street Journal reported, “Hot Inflation Report Weakens Case for Fed’s June Rate Cut.” The accompanying editorial is even better: “The Inflation Thief Rises Again.”

Truly, I’m stunned by the highly unusual and rather brazen truthfulness of these headlines. I don’t think we’ve seen that in three years. Which makes me wonder: Maybe the problem is even worse!

Here is a look at the inflation data as we see it now. The upward trajectory even from last summer is becoming apparent. The total loss of purchasing power in three years is easily 20 percent, but probably closer to 30 percent or more.

And that’s just from the official data, which is highly manipulated by messing up the pricing of housing and health insurance while excluding the cost of borrowing entirely. Adding those easily gets us back to double digits and perhaps exceeding what we experienced in 1979–1980, especially once you consider the sheer longevity of this mess.

In the 1970s, the devastation occurred in three distinct waves. Each time the trend improved, elites declared victory and the Federal Reserve moved in with rate cuts, thereby causing yet another round. Absolutely no one in charge anticipated the next wave. It came anyway.

Are we about to repeat this pattern?

It’s extremely spooky that the Fed has been angling for a rate cut for the past six months, just waiting for the chance. It’s bizarre. The whole idea of cutting rates comes from the notion of “countercyclical monetary policy.” You do it to stop a recession or dig out of one when it is happening.

Why would they talk about cutting rates now? Officially, we are doing well, in an upswing. To be sure, I don’t believe a word of it. The jobs data is a joke, and so is the output data. This is not recovery. It is possible to reconstruct the numbers in a way to show that we never left the recession of March 2020 and never recovered from lockdowns.