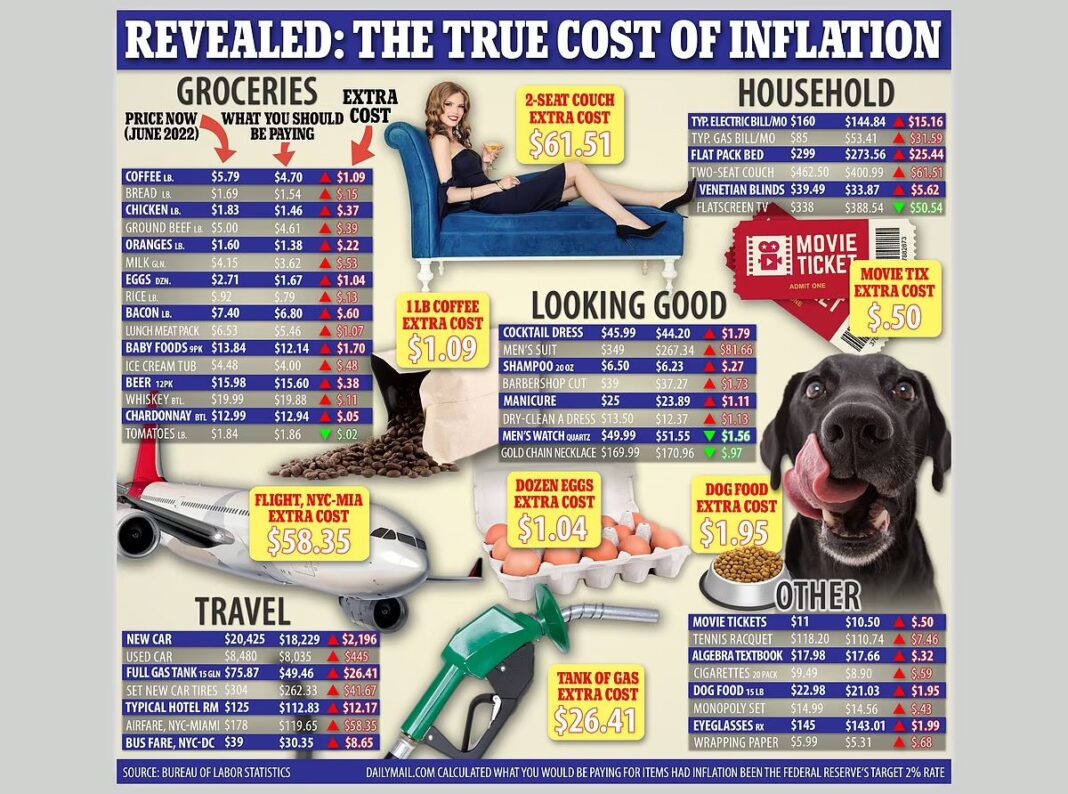

- Item by item, we reveal what consumers are paying right now, and what they SHOULD be paying were it not for 12 months of runaway 9.1% inflation

- Comprehensive analysis by DailyMail.com found the 45 products that were most frequently burning a hole in the pockets of the average urban shopper

- Price rises for gasoline (59.9%) are well known, but many everyday items have jumped: Among them, eggs are up 33.1%, chicken up 18.6% and men’s suits are up 24.9%

- The typical U.S. household $5,915 cost spike is a hefty rise for households on the median income of $67,521

- Families have cut back on everything from Friday-night treats to groceries and travel to make ends meet

- Analysts blame everything from Biden’s spending spree and supply chain snarl-ups to the war in Ukraine and sanctions on Russia roiling global food and energy markets

- Is inflation hurting your family? Write to James.Reinl@mailonline.com

The typical American household will spend $5,915 more on everyday items this year than in 2021, with inflation running at a 40-year high and stinging prices at gas pumps and grocery store checkouts, DailyMail.com can reveal.

Householders are spending nearly $493 more each month to buy the same items they were buying a year ago, said Moody’s Analytics economist Mark Zandi, who studied the latest U.S. government price data.

He called this a ‘big deal for a household making about $60,000 per year’. The median household income in the U.S. is $67,521.

Consumers across the U.S. told DailyMail.com how they have struggled to put food on the table after inflation reached 9.1 percent — its highest rate since the 1980s — meaning cutbacks on basics such as butter and beefsteaks.

In another sign of economic strain, the U.S. slipped into a recession after Thursday’s announcement of a second straight quarterly decline in economic turnover.

The Federal Reserve raised its key interest rate by 0.75 percent on Wednesday to battle high inflation, putting the brakes on the economy and making it harder to repay mortgages, credit cards and other debt.

Experts blame everything from President Joe Biden’s spending spree and supply chain snarl-ups to the war in Ukraine and sanctions on Russia roiling global food and energy markets.

Against this gloomy economic backdrop, DailyMail.com examined the latest data from the government’s Bureau of Labor Statistics (BLS) and found the 45 items that were most frequently burning a hole in American pockets.

We then calculated how much the same items would cost had inflation stayed at the Federal Reserve’s target 2 percent rate — not the runaway hikes we’ve seen this past year — to indicate ‘normal’ prices for the same items.

Our table shows how consumers are spending additional hard-earned dollars on everything from pantry staples like eggs, bread and baby food to used cars, furniture and board games. (See Image at Top of Page)

By James Reinl