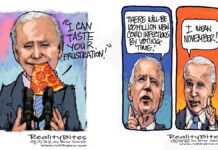

The U.S. economy created 209,000 new jobs in June, down from a downwardly revised 306,000 in May, according to the Bureau of Labor Statistics (BLS). This also came in below the consensus estimate of 225,000 and represented the lowest level of job creation of President Joe Biden’s time in the White House.

Employment growth has averaged 278,000 per month in the first six months of 2023, lower than the 399,000 average in the same span a year ago.

The unemployment rate slipped to 3.6 percent, down from 3.7 percent, and matched economists’ expectations.

BLS noted that the change in total non-farm payroll employment levels for April and May were revised down by 77,000 and 33,000, respectively.

Average hourly earnings remained unchanged at a higher-than-expected 4.4 percent year-over-year. On a month-over-month basis, average hourly earnings rose 0.4 percent to $33.58. Average weekly hours inched higher from 34.3 to 34.4.

Job gains were led by government (60,000), health care (41,000), social assistance (24,000), construction (23,000), and professional and business services (21,000). Retail trade lost 11,000 workers, while transportation and warehousing shed 7,000 employees. Manufacturing payrolls increased by 7,000.

The number of people working two or more jobs rose to 7.995 million, up from 7.762 million in the previous month. The number of people working part-time for economic reasons surged by 452,000 to 4.2 million. The number of long-term employed was flat at 1.1 million and represented 18.5 percent of the total unemployed.

“On the heels of May’s blockbuster gains, today’s jobs report finally reflects the slower growth forecasted since early 2023 and a general return to market norms,” said Cody Harker, the head of data and insights of recruitment marketing firm Bayard Advertising.

Stocks were flat in pre-market trading following the June jobs report.

The U.S. Treasury market was mixed. After topping 5 percent for the first time since the global financial crisis on July 6, the 2-year yield tumbled more than 3 basis points to around 4.97 percent. The benchmark 10-year yield picked up a little more than 1 basis point to nearly 4.06 percent.

“With everything that’s been thrown at the economy, it is remarkable that jobs creation has been as solid as it has been, and that the nation’s unemployment rate remains so low. But it has not been without pain, given surging job cuts,” said Mark Hamrick, the senior economic analyst at Bankrate, in a note.

By Andrew Moran