JPMorgan Chase CEO Jamie Dimon has warned that a confluence of factors—including the Israel-Hamas war—has ushered in the “most dangerous time” in decades.

JPMorgan Chase CEO Jamie Dimon has sounded the alarm that U.S. consumers are running down their excess cash buffers and that inflation could stay stuck in high gear due in part to high government spending, while issuing an ominous warning that the “most dangerous time” that the world has seen in decades has arrived.

Mr. Dimon made the remarks while reporting JPMorgan’s third-quarter results, which showed America’s biggest bank by assets generating net income of $13.2 billion.

After boasting that his bank had $3.2 trillion in assets and a return on average tangible common shareholders’ equity (ROTCE) of 22 percent in the third quarter, Mr. Dimon turned his attention to the broader economy—and the headwinds it faces.

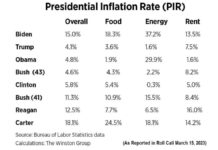

While warning of clouds on the horizon of consumer spending, “extremely” high government debt levels, and the largest peacetime fiscal deficits in U.S. history, Mr. Dimon said he sees a growing risk that inflation stays high and that the Fed will raise interest rates even higher.

He then mentioned the disruptive impact of the war in Ukraine and the recent terror attacks in Israel, warning of “far-reaching impacts on energy and food markets, global trade, and geopolitical relationships.”

“This may be the most dangerous time the world has seen in decades,” he cautioned.

Economic Headwinds

One area Mr. Dimon focused on was the waning strength of American consumers and their key contribution their spending makes to the U.S. economy.

“Currently, U.S. consumers and businesses generally remain healthy, although, consumers are spending down their excess cash buffers,” he said.

Consumer spending is a key barometer of economic health in the United States as it accounts for roughly two-thirds of gross domestic product (GDP). This means that if the all-mighty U.S. consumer taps out, the economy is likely not far behind.

His warning about excess savings being depleted comes as the Federal Reserve Bank of New York revealed on Oct. 11 that Americans’ disposable income has fallen and consumers are increasingly dipping into the savings to prop up consumption.

By Tom Ozimek